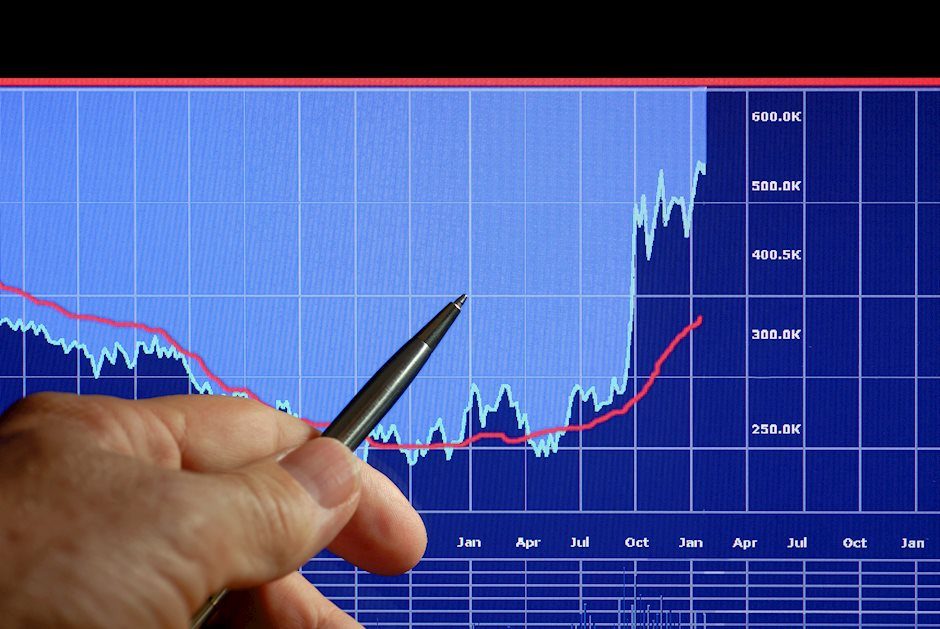

EuroStoxx: 2610 level remains key

Eurostoxx

EuroStoxx 50 JUNE Futures

EuroStoxx we wrote: 23.6% Fibonacci level around 2610/30 should be key. Holding above here re-targets 2646/50 with a break above yesterday’s high at 2671 to target 2695/2700. A break above 2720 look for 2750/60 & 2780/85.

We had several opportunities to buy at around 2610/30 & longs worked perfectly each time offering up to 150 ticks on 2 trades.

Daily Analysis

EuroStoxx 23.6% Fibonacci level at 2610/30 remains key. Holding above here re-targets 2650/2670 & 2695/2700. A break above 2720 look for 2750/60 & 2780/85. Above 2800 try shorts at 2850/60 with stops above 2890.

Holding below 2600 risks a slide to 2575/70, 2550/45 & minor support at 2525/05. Stop below 2385.

Trends

Weekly outlook is negative

Daily outlook is negative

Short Term outlook is neutral

Author

Jason Sen

DayTradeIdeas.co.uk