EUR/USD Weekly Forecasts: US Dollar fighting a losing battle

- US Federal Reserve Chair Jerome Powell announced its time to ease the pace of tightening.

- S&P Global downwardly revised the pace of growth in the European Union.

- EUR/USD retains its bullish strength despite retreating from a fresh multi-month high.

The EUR/USD pair started December on a strong footing, reaching a fresh six-month high of 1.0544. The US Dollar attempted to recover some ground at the beginning of the week but came under strong selling pressure following a speech from US Federal Reserve (Fed) Chair Jerome Powell in a private event organized by the Brookings Institution.

Mixed signals from the United States

Chief Powell spoke on Wednesday and said that the central bank could start slowing the pace of quantitative tightening as soon as December, although he added that restrictive rates should stay for some time, as the fight against inflation is far from over.

"It makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down. The time for moderating the pace of rate increases may come as soon as the December meeting," Powell noted.

EUR/USD retreated towards 1.0427 on Friday following the release of the Nonfarm Payrolls report. The United States Labour Department reported the country added 263,000 new jobs in November, and it upwardly revised the October figure to 284,000. The Unemployment Rate held steady at 3.7% as expected, although it is worth noting the Participation Rate contracted to 62.1% from 62.2%.

The job sector grew at a stronger-than-anticipated pace despite the US Federal Reserve´s aggressive approach. Slowing the labor market is part of the job of tackling inflation, and a blooming sector clearly means the US central bank could maintain the current pace of quantitative tightening.

Regardless of the US Dollar's sharp appreciation post-NFP, it seems unlikely Fed officials will change their minds and pull the trigger for another 75 bps in December. EUR/USD bounced back, aiming to close the week with substantial gains. It seems the market overreacted while profit-taking ahead of the weekend exacerbated the move.

Macroeconomic data still far from optimal

Generally speaking, news from both shores of the Atlantic were far from encouraging. The US published Personal Consumption Expenditures (PCE) Price Index, which rose by 6% YoY in October, easing from 6.3%. Core PCE inflation came in at 5% in the same period, down from 5.2% in September. Also, the ISM Manufacturing PMI fell to 49 in November, down from the previous 50.2, being the first time the indicator signals contraction since May 2020. Easing inflation coupled with easing growth fueled speculation the Fed will hike by 50 bps in December.

At the same time, S&P Global downwardly revised its European Manufacturing PMIs, reflecting a steeper contraction in November. Also, the German Harmonized Index of Consumer Prices (HICP) rose by 10% YoY in November, according to preliminary estimates, easing from 10.4% in the previous month. The Euro Area HICP in the same period also printed 10%, down from 10.6% in October. Easing inflation is good news, but up at an annual pace of 10% is still too high to be positive. Finally, Germany Retail Sales were down a whopping 2.8% MoM in October, while other minor figures also missed expectations while indicating slowing economic activity.

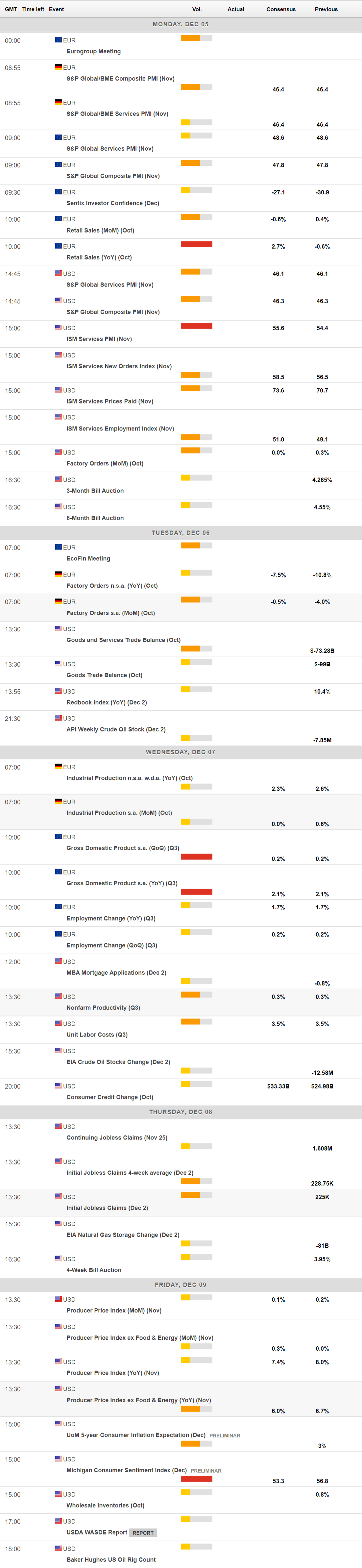

The upcoming week will bring some interesting figures. S&P Global will release the final November Services PMIs for the US and the EU, while the latter will unveil October Retail Sales and the final estimate of the Q3 Gross Domestic Product.

The US will publish the official November ISM Services PMI, foreseen at 55.6, up from 54.4 in October, the November Producer Price Index, and the preliminary estimate of the December Michigan Consumer Sentiment Index.

EUR/USD technical outlook

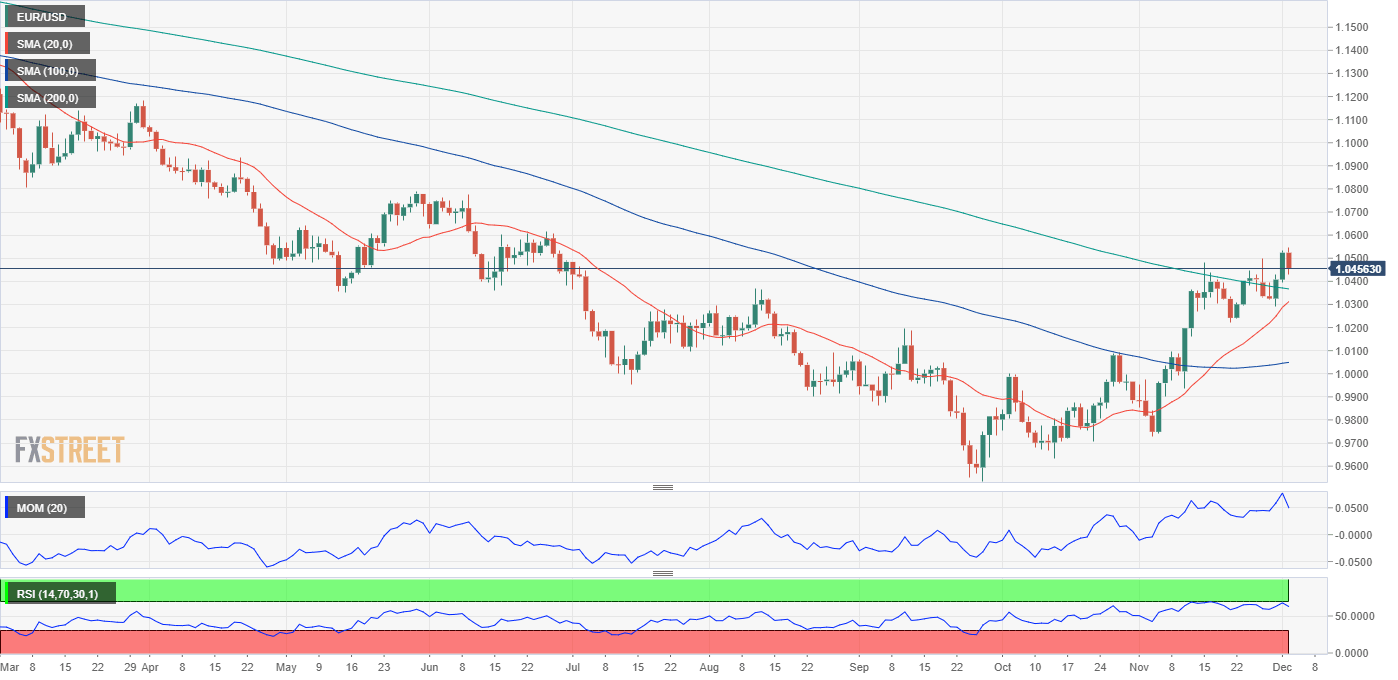

The EUR/USD pair weekly chart favors a continued advance. The pair posted a higher high and a higher low while developing above the 20 Simple Moving Average (SMA), which slowly gains upward traction. The 100 SMA crossed below the 200 SMA, both maintaining their bearish slopes above 1.1100, not significant for the time being. At the same time, technical indicators resumed their advances while maintaining their bullish slopes near overbought readings, reflecting buyers’ dominance.

The daily chart for EUR/USD provides some interesting bullish clues. The pair has broken above its 200 SMA and settled above it. Despite several attempts, the pair has not cleared it since June 2021. At the same time, the 20 SMA heads firmly higher below it and well above a flat 100 SMA. The Momentum indicator, in the meantime, has partially lost its downward momentum but remains above its 100 level, while the RSI indicator barely retreated from overbought readings, now at around 64.

The weekly high, at 1.0544, is the level to beat to resume the advance. The next relevant resistance level to overcome is the 1.0620 price zone, en route to 1.0700. Support comes at 1.0420, with a break below the level, and 1.0300 comes as the next potential bearish target.

EUR/USD sentiment poll

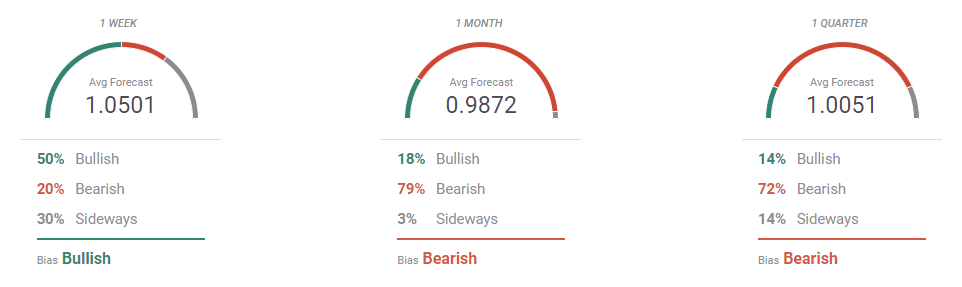

According to the FXStreet Forecast Poll, bulls are in control of the pair, at least in the near term. In the weekly perspective, most polled experts are bullish, with an average target of 1.0500. The bearish mid-term stance of banks still weighs on the monthly and quarterly perspectives, although fresh highs beyond 1.0500 have appeared, with the pair seen as high as 1.1000 in the three-month perspective. At the same time, the number of bets below parity has begun decreasing.

The Overview chart shows that the near-term moving average picked up momentum as most potential targets accumulate in the 1.0500/600 price zone. The monthly one is directionless, but the quarterly one also shows an increased bullish potential, advancing for a third consecutive week.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.