EUR/USD Weekly Forecast: US authorities in denial, but what do the market think?

- The US economy contracted for a second consecutive quarter, indicating a technical recession.

- Inflation at both shores of the Atlantic reached fresh multi-decade highs in July.

- EUR/USD's long-term bearish stance remains intact, with fresh multi-year lows in sight.

The EUR/USD pair finished the last week of July unchanged, ending it in the 1.0190 price zone. At the same time, it is finishing a second consecutive month with sharp losses, although away from a multi-decade low of 0.9951.

The pair was driven by the usual recession fears and the US Federal Reserve, which announced its latest decision on monetary policy. European data released these days showed that the economic slowdown keeps steepening at the beginning of the third quarter and took its toll on the shared currency throughout the first half of the week.

Markets changed course on Wednesday, as the Federal Reserve came with some novelties. As expected, the central bank hiked the funds rate by 75 bps to 2.25%/50%. Chairman Jerome Powell noted that at this level, rates have reached neutrality and hinted at a tightening slowdown. Chances of another 75 bps hike have decreased to roughly 20% in September, an unexpected dovish surprise. According to Powell & co, upcoming rate hikes will be a meeting-by-meeting decision.

Furthermore, the central bank reaffirmed its commitment to “expeditiously bring inflation down” while noting that the economy remains resilient. Finally, Powell said that “nothing works without price stability,” indicating that policymakers are more concerned about overheated inflation than slowing economic progress.

Nonetheless, US inflation continues to soar. The Personal Consumption Expenditures Price Index climbed to 6.8% YoY in June from 6.3% in May, while the core reading jumped by 4.8% in the same period. The Fed is trapped between a rock and a hard place, as tightening further to tame inflation will add a burden on economic growth. Policymakers may have offered a confident image, but that’s not what lies behind it.

A recession that is not a recession

Wall Street rallied after the announcement, also helped by solid earnings reports. Fears remain, but the dollar fell and its attempt to recover was smashed on Thursday by the preliminary estimate of the US Q2 Gross Domestic Product. According to the official figures, the economy contracted at an annualized pace of 0.9%, a second consecutive contraction and the birth of a technical recession.

Following the release, several US authorities diminished the relevance of the negative figure. Federal Reserve chief Jerome Powell anticipated it on Wednesday, saying that a disappointing GDP figure should be taken with a pinch of salt. US Treasury Secretary Janet Yellen said on Thursday that the Q2 contraction demonstrates the economy's move to more sustainable growth. Finally, President Joe Biden noted that not only Chair Powell but also several other high-level banking executives claim that we are not in a recession.

European crisis steepening

Things are no better in the EU, which is keeping EUR/USD at the lower end of its yearly range, alongside the disbelief of a resilient US economy. The preliminary estimate of the German July Consumer Price Index showed that it rose by 8.5% YoY from 8.2% in June, while the Q2 GDP showed no growth in the three months to June. For the whole EU, the Consumer Price Index soared to a multi-decade high of 8.9% in July, according to preliminary estimates. However, the Union grew by 0.7% in the second quarter, according to the preliminary GDP estimate.

At the same time, Russia has cut further its natural gas provision to the region after reopening the Nord Stream 1 pipeline. The European energy crisis worsens by the day, pushing inflation up and cutting economic progress.

The latest optimism in financial markets seems temporary, and the dollar is fighting its way back against its high-yielding rivals. The fact that safe havens are ending the week up vs the greenback somehow reflects how the market feels regardless of the positive tone of equities.

Coming up next

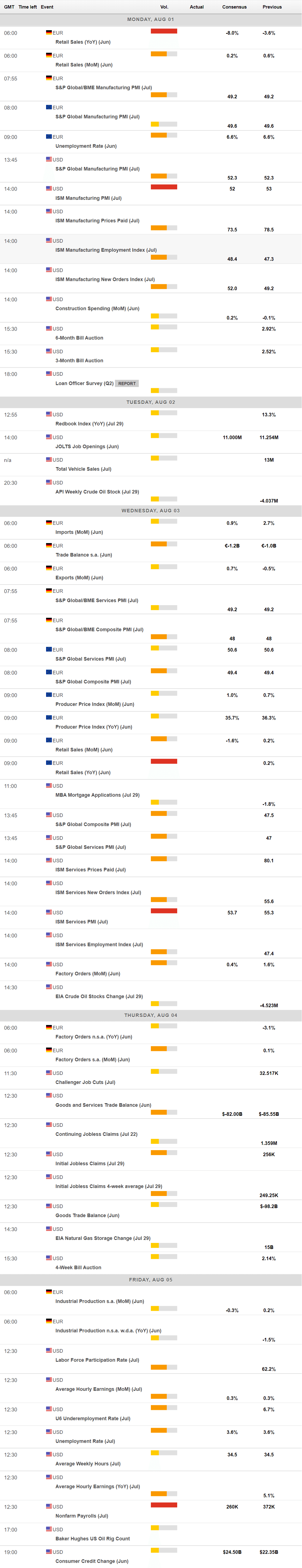

The macroeconomic calendar will be lighter next week, but it will include some key figures that will give further clues on how major economies are doing. Germany and the EU will release June Retail Sales, while S&P Global will publish the final July PMIs for all major economies. The US will unveil the official ISM Manufacturing PMI for the same month, foreseen at 52, down from 53 in June, and the ISM Services PMI, expected at 53.7 from 55.3 in June.

At the end of the week, the US will publish the July Nonfarm Payroll report. The country is expected to have added 260K new jobs in the month, while the Unemployment rate is foreseen steady at 3.6%. A dismal outcome of the NFP report will once again raise the alarms and take its toll on markets’ confidence.

EUR/USD technical outlook

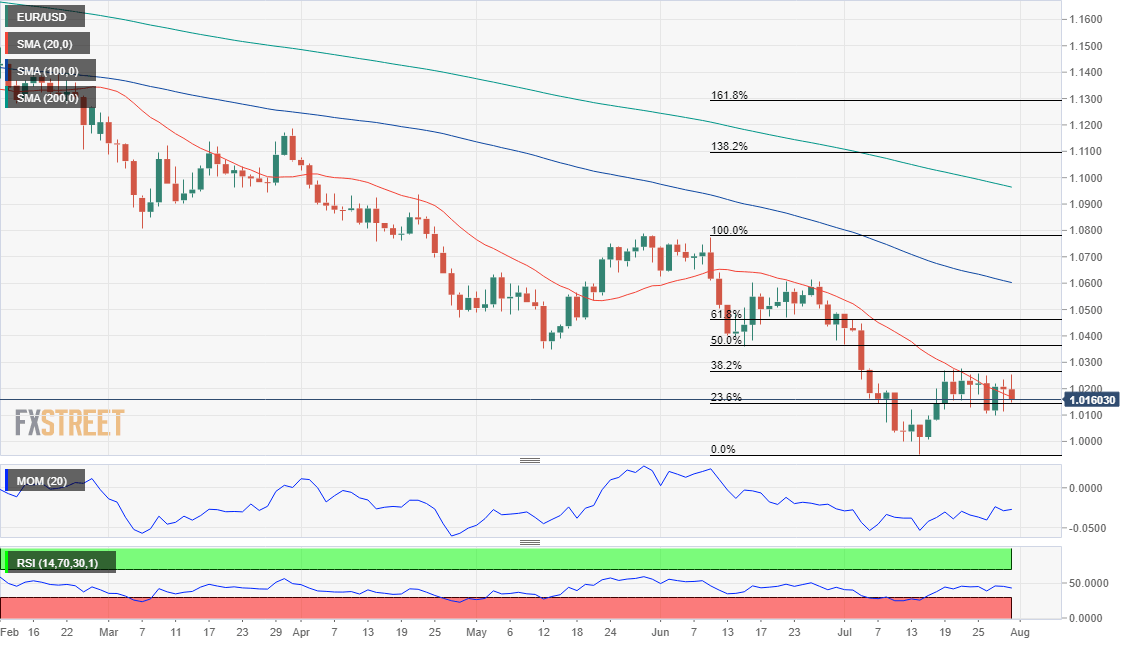

The EUR/USD pair maintains its long-term bearish stance. The pair has retreated for a second consecutive week from around the 50% retracement of its latest daily decline between 1.0614 and 0.9951 at 1.0280 and settled below the 38.2% retracement of the same slide at 1.0205. Support lies at 1.0150, the immediate Fibonacci level.

Technically, the weekly chart favors a downward extension. EUR/USD continues to develop far below bearish moving averages, with the 20 SMA heading firmly south at around 1.0600. Technical indicators, in the meantime, have turned marginally lower within negative levels, reflecting prevalent selling interest.

In the daily chart, the pair has been struggling around a bearish 20 SMA for a second consecutive week, unable to hold above it. The Momentum indicator advances within positive levels, but the RSI indicator has already resumed its decline and is currently at 41. Finally, the 100 SMA keeps heading lower, far above the current level, converging with the upper end of the aforementioned range.

A break below 1.0105 will open doors for a retest of parity, while below the latter, fresh multi-decade lows could be expected, with the main bearish target at 0.9880. The pair needs to accelerate through 1.0280 to shrug off the negative stance and extend its recovery towards 1.0360 and en route to 1.0440.

EUR/USD sentiment poll

The FXStreet Forecast Poll shows that sentiment around EUR/USD is slowly changing. The pair is expected to remain neutral on a weekly basis, and regain the upside afterwards. On average, the pair is seen at 1.0187 next week while reaching the 1.0300 threshold in the monthly and quarterly views. The number of those betting for a downward move decreases as time goes by, down to 22% in the wider perspective.

The Overview chart shows that the weekly and monthly moving averages have turned marginally higher but also that the longer one maintains a mildly bearish slope. Most targets remain below 1.1000, while the number of bets sub-parity has decreased sharply when compared to the previous weeks, somehow suggesting the formation of an interim bottom is underway.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.