EUR/USD Weekly Forecast: Inflation to confirm or deny an interim bottom

- United States employment-related data came as a red flag for speculative interest.

- Inflation data could start losing relevance as soon as next week.

- EUR/USD bounced ahead of the weekly close, but additional gains are still doubtful.

The US Dollar retained its leadership for a third consecutive week, resulting in EUR/USD falling to 1.0911, its lowest in roughly a month. The Greenback benefited from a souring market mood linked to tepid growth-related figures and signs of a tight United States (US) labor market. EUR/USD currently trades at around 1.1020, having trimmed losses after the mixed US employment data release.

Financial markets kick-started the week with optimism amid signs of easing global inflation. Following news that the US Personal Consumption Expenditures (PCE) Price index, excluding food and energy, increased by 4.1% YoY in June, the Euro Zone reported that the July Harmonized Index of Consumer Prices (HICP) declined by 0.1% in the month, while the June Producer Price Index (PPI) contracted by 3.4% from a year earlier.

Economic growth under scrutiny

However, economic progress continues to lag. Indeed, the EU grew by 0.3% in the second quarter, according to the Gross Domestic Product (GDP) preliminary estimate, yet S&P Global PMIs came as a red flag. EU manufacturing output was confirmed at 42.7, while the Services PMI was downwardly revised to 50.9, barely holding within expansion levels. Furthermore, June Retail Sales fell 0.3% MoM in June,

Across the pond, the picture was quite alike. The US ISM Manufacturing PMI printed at 46.4 in July, while the services index came in at 52.7, both missing the market expectations.

Tight US labor market

Nonetheless, US employment data was the game changer. JOLTS Job Opening remained pretty much steady at roughly 9.6 million in June, while the ADP survey showed that the private sector added 324K new jobs in July. Challenger Job Cuts in the same month declined to 23.7K, while Initial Jobless Claims stood at 227K in the week ended July 28. Additionally, according to preliminary estimates, Q2 Nonfarm Productivity rose 3.7%, while Unit Labor Costs in the same quarter were up 1.6%.

Finally, on Friday, the country published the July Nonfarm Payrolls (NFP) report, bringing more bad news. The Unemployment Rate slid to 3.5%, while the Participation Rate remained at 62.6%. Also, the US added 187K new jobs in the month. Average hourly Earnings rose 4.4% YoY, higher than anticipated. The US Dollar ticked lower with the news, but the decline lacked momentum. Little jobs added mean the sector cooled down a bit, yet a shrinking unemployment rate indicates it remains tight. Hence, the Federal Reserve (Fed) could maintain the monetary tightening policy in place.

The US Dollar lost ground anyway, which could partially be explained by profit-taking ahead of the weekend.

Does inflation really matter now?

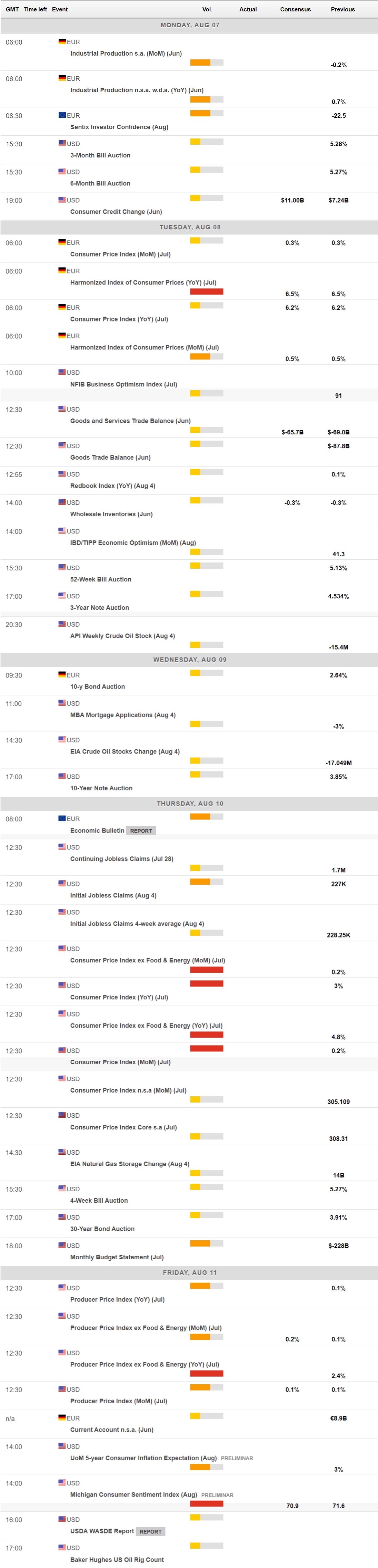

Next week, investors will be looking at inflation updates. Germany will publish the final version of the July HICP, while the US will release the July Consumer Price Index (CPI) on Thursday and the Producer Price Index (PPI) for the same month on Friday.

Financial markets anticipate monthly inflation will be up by 0.2% while foreseeing a 3.3% YoY gain. Finally, annual core CPI is foreseen steady at 4.8%.

The country will end the week unveiling the preliminary estimate of the August Michigan Consumer Sentiment Index.

While inflationary levels around the world remain above central banks’ comfort levels, they are far from the records seen in mid-2022 and, more importantly, on a downward path. Unless price pressures pick up and for more than two-month in a row, CPIs are no longer a huge concern. Employment, however, is becoming more of an issue. The Fed is looking for a more balanced labor market, and we are not seeing it.

EUR/USD technical outlook

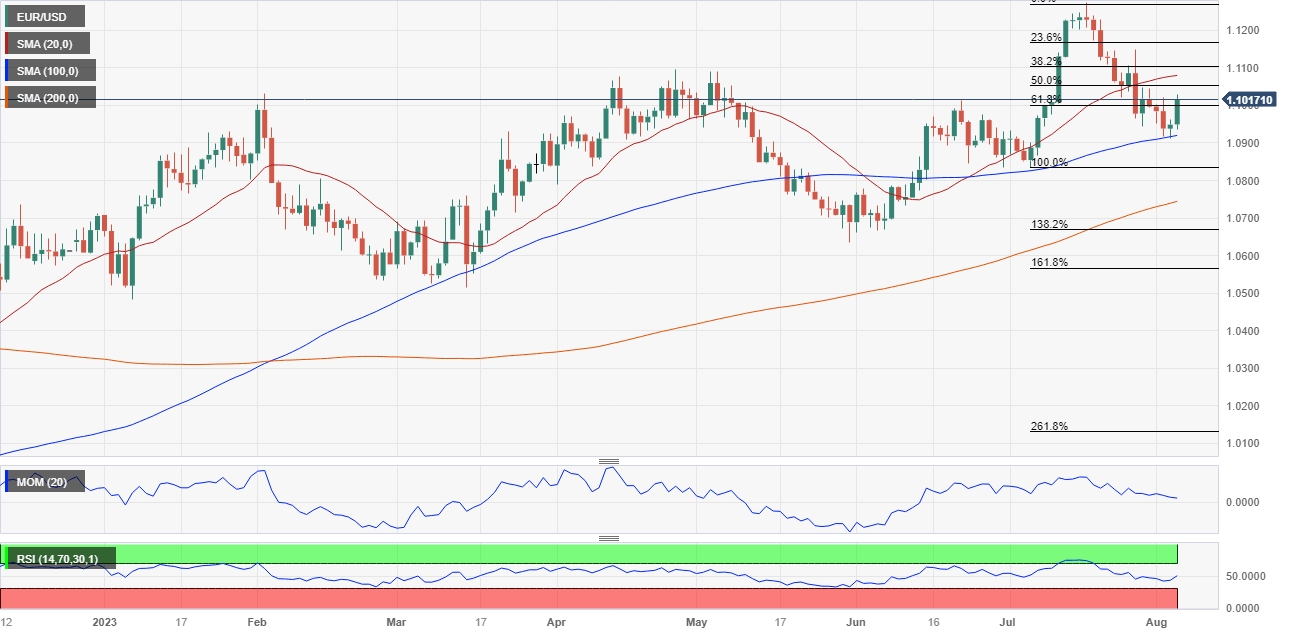

The weekly chart for the EUR/USD pair shows that it hovers just above a critical Fibonacci level, the 61.8% retracement of the 1.0833/1.0975 rally at 1.1002. At the same time, the pair is bouncing sharply from a bullish 20 Simple Moving Average (SMA), which extends its advance above the 100 SMA. Furthermore, technical indicators have lost their bearish slopes and turned flat around their midlines, suggesting easing selling interest, although not enough to confirm an interim bottom.

For the upcoming days, the daily chart indicates that an upward extension is likely. The pair bounced from a bullish 100 SMA, while the 200 SMA keeps advancing below the shorter one. Technical indicators, in the meantime, have turned higher, with the Relative Strength Index (RSI) indicator crossing its midline into positive territory, while the Momentum indicator remains far below its 100 line.

An immediate resistance level comes at 1.1050, while a more relevant one is located at 1.1104, the 38.2% retracement of the aforementioned rally. A recovery beyond the latter should put EUR/USD back on the bullish track. On the contrary, a slide through 1.1000 could see the pair falling back towards the 1.0910 area en route to the 1.0830 price zone.

EUR/USD sentiment poll

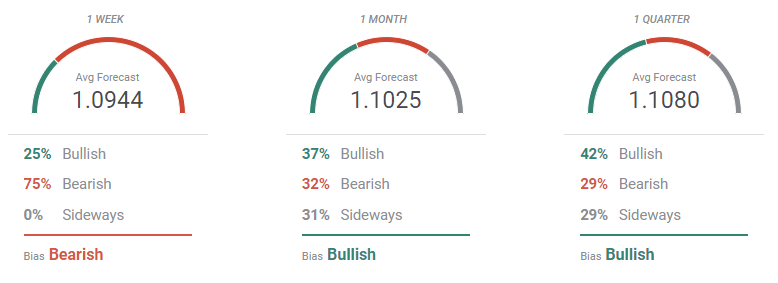

The FXStreet Forecast Poll shows that bears could retain control near term, as 75% of the polled experts are bearish in the weekly perspective, with an average target of 1.0944. Bulls, on the other hand, dominate the monthly and quarterly views, although barely above those betting for a continued decline. Buyers are at 37% in the 1-month view and at 42% in the three-month one. However, the average targets fall in the 1.10 price zone, suggesting bulls remain unconvinced.

EUR/USD turned neutral according to the Overview chart as the moving averages on the three time frames under study lack directional strength. The near-term one offers a modest downward slope, as most targets accumulate around the 1.0950 level, while the monthly one ticks modestly higher. The pair is seen for the most holding above the 1.0800 level, with some experts betting for a slide below it in the quarterly view. The top of the crowded range is the 1.1300 area, which means a break through the level may help convince speculative interest of a long-term bullish stance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.