EUR/USD Weekly Forecast: Gear up for a too conservative ECB meeting

- US inflation soared to a fresh multi-decade high, but the Fed will not do much more.

- The European Central Bank will announce its monetary policy decision on Thursday.

- EUR/USD is hinting at a possible near-term corrective advance but bears retain control.

The EUR/USD plummeted for a third straight week to reach a fresh 20-year low of 0.9951, bouncing modestly afterward to settle in the 1.0080 price zone. The global economic situation continues to deteriorate, and speculative interest rushes into safety, ultimately benefiting the greenback.

EU heading into the abyss

Fears of a US recession have dominated the headlines in the last few months. Still, the focus is slowly shifting to Europe, as the situation in the Union is even more worrisome than that in America.

The Ukraine war results in global food and energy shortages, with the EU suffering the most from the latter, as it depends on Russia for oil and gas provision. On Monday, July 11, Russian energy giant Gazprom closed the Nord Stream1 pipeline for maintenance, shutting down gas provision to Germany. Mid-week, the company announced it could not guarantee to resume the functioning of the pipeline. German Economy Minister Robert Habeck said that the uncertainty around gas deliveries “is clouding the economic outlook considerably heading into the second half of the year.”

Italian Prime Minister Mario Draghi announced he was resigning after coalition partner Five Star withdrew its support in a confidence vote, adding further trouble on the euro side. The coalition fell apart when Five Star leader Giuseppe Conte accused Draghi of not doing enough to tackle the economic crisis. Italian President Sergio Mattarella rejected the resignation offer from the former ECB chief and still Italian PM and urged him not to quit.

Supply-chain issues alongside a rapid economic comeback after the initial pandemic-related lockdowns sent inflation to levels not seen in decades across the globe. Politicians and central bank officials have been caught off-guard, with the latter shifting to tight monetary policies at a quite uneven pace across major economies.

Central banks under scrutiny

The US Federal Reserve leads the list of aggressiveness. The central bank has pushed rates higher to a floating range of 1.50%-1.75%. The European Central Bank, on the other hand, lags behind as it plans to hike rates by 25 bps for the first time in years on its meeting next Thursday. The imbalance between central banks partially explains EUR/USD weakness, alongside the fact that the crisis in the Union is deepening.

The greenback got an additional risk-averse boost on Wednesday, following the release of the June Consumer Price Index, which jumped by 9.1% YoY, more than anticipated. The news was even more discouraging amid hopes of softer oil prices through June would translate into CPI contraction.

Upbeat inflation figures spurred speculation that the Fed could hike rates by 100 bps, although such speculation was cooled down by comments from FOMC member Christopher Waller, who noted that markets may have gotten ahead of themselves by pricing a 100 basis points rate hike in July, adding that a 75 bps hike will bring them to neutral.

ECB and businesses grow in the docket

Generally speaking, macroeconomic data confirmed the gloomy scenario. The German ZEW survey showed that Economic Sentiment collapsed in the country and the EU in July. Also, German inflation was confirmed at 7.6% YoY in June, although US Retail Sales were up by 1% in June, boosting optimism and putting near-term pressure on the US dollar.

The upcoming week will bring the final estimate of the EU June Consumer Price Index, expected to be confirmed at 8.6%. On Thursday, the European Central Bank will announce its monetary policy decision. European policymakers have widely anticipated a first 25 bps rate hike for this particular meeting, already priced in by market participants. President Christine Lagarde’s speech following the announcement will be critical, as speculative interest will scrutinize it for any clue on what’s coming up next.

Finally, on Friday, S&P Global will publish the preliminary estimates of its July PMIs for the EU and the US. Businesses activity is expected to have shrunk further at the beginning of the third quarter and to barely hold in expansionary levels.

EUR/USD technical outlook

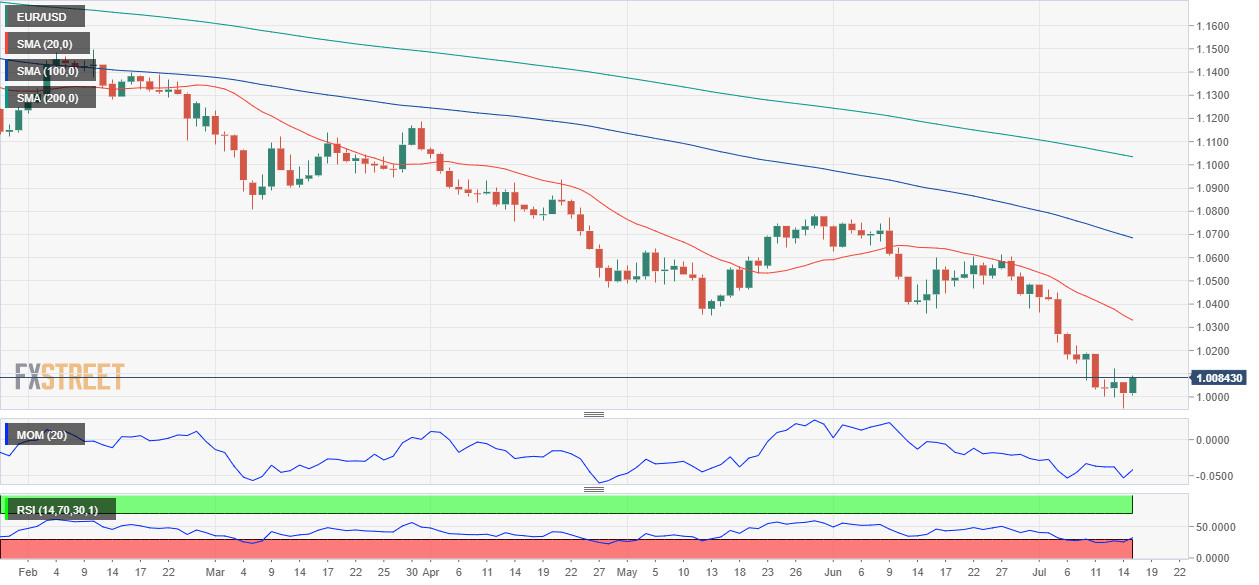

The EUR/USD pair trimmed half of its weekly gains, showing some modest signs of bearish exhaustion in the weekly chart, not enough to confirm a potential bottom. Nevertheless, technical indicators have lost their bearish momentum, although the RSI maintains a modest downward slope at around 26. At the same time, the 20 SMA heads south almost vertically, currently in the 1.0650 price zone and far below the longer ones.

The daily chart shows that technical indicators have turned marginally higher, while holding around oversold readings, hinting at a possible bullish corrective advance coming up next. Still, the pair keeps developing well below bearish moving averages, which reflect sellers’ strength.

The level to watch on the upside is 1.0120, as gains beyond it could trigger additional gains towards the 1.0200 area first and later towards the 1.0340 price zone. On the other hand, immediate support comes at 1.0020, followed by the multi-year low set this week at 0.9951. A break below the latter could result in the pair approaching the 0.9800 threshold before meeting buyers.

EUR/USD sentiment poll

The FXStreet Forecast Poll suggests that the pair is close to an interim bottom. Bears are still in control in the weekly perspective, as bears stand at 67% of the polled experts, with the pair seen on average at 1.0087. However, there is a strong shift in sentiment in the monthly and quarterly perspectives, as bulls take over, while those betting on a decline decrease sharply. The pair is seen then returning to the 1.0400 region on average.

The FXStreet Overview chart shows that those waiting for a recovery may be willing to sell at higher levels. The three moving averages under study maintain their bearish slopes. EUR/USD is barely seen above 1.0200 next week, but the number of potential targets widens in the monthly perspective to 1.000/1.0800. Finally, and in the quarterly view, most targets accumulate between 1.0200 and 1.0600, hinting at persistent pressure on the shared currency.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.