EUR/USD Weekly Forecast: Corrective advance over?

- The Eastern European crisis keeps pressuring financial markets into risk-off mode.

- The US Federal Reserve surprised investors with a hawkish tightening path.

- EUR/USD is closer to resuming its decline and reaching fresh yearly lows below 1.0805.

The EUR/USD pair managed to recover some ground this past week but ended it at around 1.1020, below the 38.2% retracement of the 2022 slump at 1.1070. Financial markets were all about Russia-Ukraine developments and the lack of progress in peace talks after three weeks.

War and the US Federal Reserve

Pretty much, Russia is willing to find a diplomatic solution as long as it is in accordance with its main strategy, that is, that Kyiv recognizes the independence of the Donbass region through the creation of the People’s Republics of Donetsk and Luhansk. On the other hand, Ukraine made it clear that they would not negotiate “an inch of Ukrainian territory,” according to one of President Zelenskyy's aides, Ihor Zhovkva.

Contradictory headlines about progress in negotiations sent the safe-haven dollar back and forth throughout the week, with sentiment-related trading briefly interrupted by the US Federal Reserve monetary policy decision.

The US central bank hiked the main rate by 25 bps to a 0.25%-0.50% range, as expected, but surprised market participants with hawkish announcements for the upcoming meetings. The dot plot included six more rate hikes for this year, while Chair Jerome Powell said that they made “excellent progress” on their plan for reducing the balance sheet, adding details could be agreed by the time of the May meeting.

Chief Powell noted that the Russia-Ukraine conflict poses a risk to economic growth and inflation, something that leaders from several central banks have also noted. Nevertheless, international sanctions on Moscow keep piling up, without the Kremlin giving up an inch.

Pandemic not over

Meanwhile, the coronavirus pandemic returned to the headlines. China reported record contagions, announcing a strict lockdown in major cities. Europe is lifting restrictions at the same time a new wave hits the region, and the number of cases soars. The world is moving into learning to live with the illness, but could it succeed?

Vaccines have been proven to efficiently prevent serious illness, but one shot every four months seems unsustainable. The antiviral drugs developed so far also help but are far from perfect.

Despite Chinese action, it seems unlikely that the west will choose to return to lockdowns or to take any other measure that implies restrictions.

Are economies feeling the heat?

A couple of macroeconomic releases published in the last few days indicated that economies are feeling the heat of war. The German March ZEW survey showed that Economic Sentiment plummeted to -39.3 in the country and to -38.7 for the whole EU. Meanwhile, inflation heated up in the Union, as the February reading was upwardly revised to 5.9% YoY.

Across the pond, US February Retail Sales were up a modest 0.3%, while the Producer Price Index in the same period was confirmed at 10%.

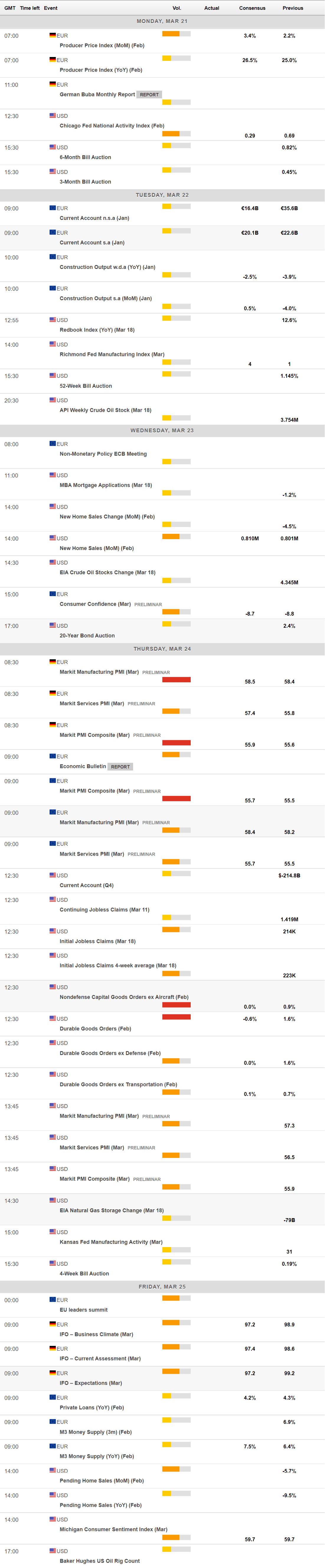

The upcoming week will bring the preliminary estimates of the Markit March Manufacturing PMIs for Europe and the US, while the latter will release February Durable Goods Orders.

EUR/USD technical outlook

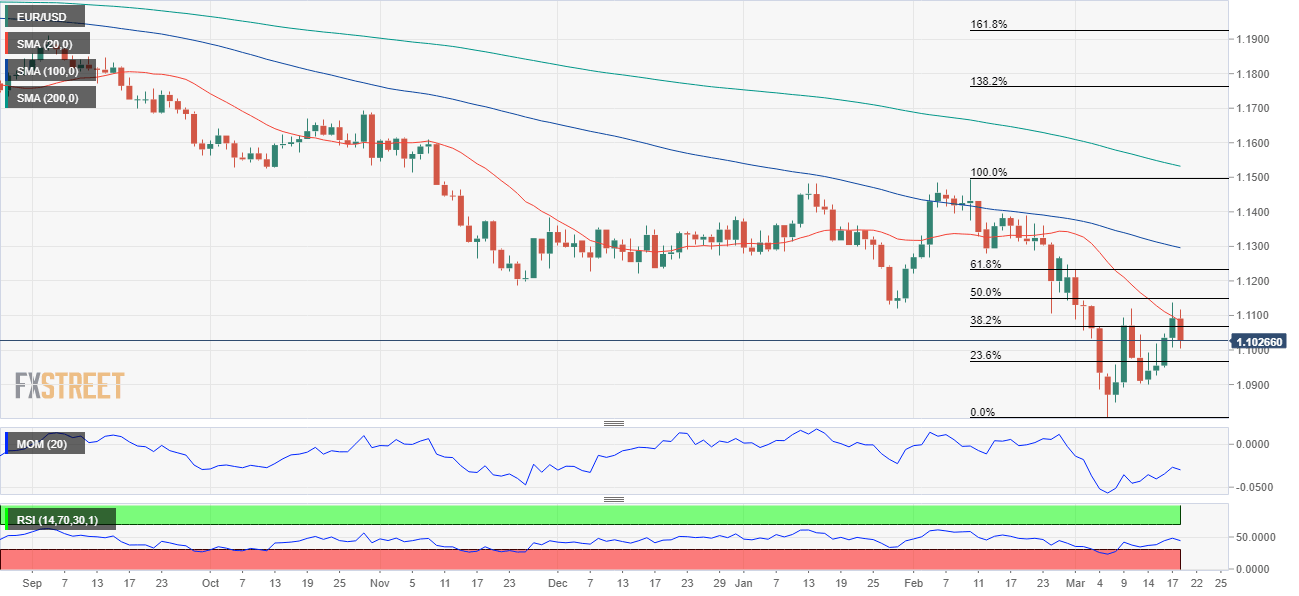

Technically speaking, EUR/USD’s recovery seems corrective. As said, the pair is developing below the Fibonacci resistance located at 1.1070, having failed to sustain gains beyond it for a second consecutive week.

The weekly chart shows that the pair continues developing below all of its moving averages, with the 20 SMA accelerating further south below the longer ones. Technical indicators have bounced modestly from oversold readings, indicating limited buying interest.

The daily chart shows that the pair is retreating after failing to surpass a firmly bearish 20 SMA, while technical indicators turned south within negative levels, hinting at further slides ahead should the pair fall below 1.0960, the next Fibonacci support level.

Below the latter, the slide could initially extend to 1.0900, en route to the year low of 1.0805. A break lower exposes a strong static support level at 1.0760.

On the other hand, the 1.1070 aforementioned level is the first resistance, ahead of 1.1150. A recovery beyond this last could see the pair recovering up to the 1.1240 price zone.

EUR/USD sentiment poll

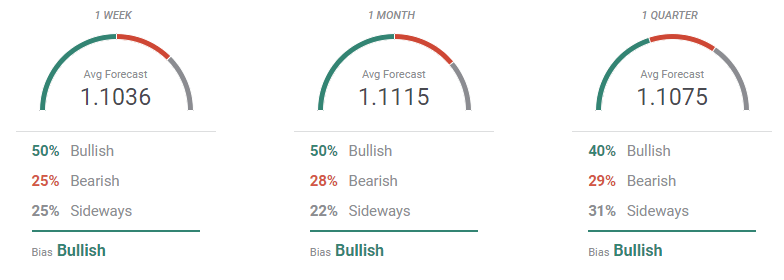

The FXStreet Forecast Poll suggests that the EUR/USD pair can extend its recovery in the upcoming days, although gains are likely to be limited. 50% of the polled experts are betting for higher levels in the weekly and monthly perspectives, but the number comes down to 40% in the quarterly view. On average, the pair is seen between the 1.10/1.11 price zone, which means that bulls are beginning to lose conviction.

The Overview chart shows that there are some market participants looking for fresh lows below the 1.0800 threshold, although the moving averages of the three time-frame under study are flat, as most targets accumulate between 1.1000 and 1.1400.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.