EUR/USD Weekly Forecast: Confident bulls ready to push the Euro higher

- US Federal Reserve and European Central Bank announcements boosted optimism.

- Financial markets welcome softer-than-anticipated US inflation figures.

- EUR/USD bullish case firmer, last barrier at 1.1000.

The EUR/USD pair ends the week with substantial gains near a multi-week high of 1.0970, as optimism returned to financial markets following first-tier events. Investors welcomed United States (US) inflation figures, indicating price pressures have continued to recede in May, taking some steam off the Federal Reserve (Fed).

Inflation eases, markets breathe

The US Consumer Price Index (CPI) rose a modest 0.1% MoM in May and increased by 4% from a year earlier, easing from April readings and below the market expectations. The core annual CPI was up by 5.5%, as expected. Furthermore, the Producer Price Index (PPI) declined by 0.3% MoM while advancing by 1.1% YoY in the same month, according to the US Bureau of Labor statistics.

Speculative interest dropped the US Dollar anticipating a dovish Fed decision and increased odds of ending the tightening cycle. The central bank finally came out on Wednesday, and as widely anticipated, American policymakers left the key borrowing rate at 5%-5.25%. However, Federal Open Market Committee (FOMC) members anticipated at least two more 25 basis points (bps) rate hikes, against the general belief the Fed will deliver just one additional hike.

The hawkish skip initially triggered risk-aversion, giving the US Dollar a short-lived boost, although EUR/USD managed to retain the 1.0800 threshold from where it slowly began recovering.

As usual, Chairman Jerome Powell poured cold water on market concerns with his press conference. Powell said the FOMC hadn’t yet made a decision about July, yet at the same time, he sounded optimistic about easing inflation. The mood improved, and stocks bounced off lows, putting pressure on the USD and helping EUR/USD to regain ground.

Bottom line, the Fed is confident that hiking rates and shrinking the balance sheet will end up taming inflation. They also dropped the aggressive monetary tightening, reducing the odds of a recession. And while June’s announcement was far from dovish, it reaffirmed the conservative stance adopted this year following the banking crisis. The US economy gives signs of improved health, and the only concerns remain about the labor market being quite tight.

No surprises from hawkish ECB

Across the pond, the European Central Bank (ECB) unveiled its monetary policy decision on Thursday. European policymakers announced rates increases of 25 bps, taking the Deposit Facility rate to 3.5%. President Christine Lagarde & co delivered a hawkish statement, although it did not surprise financial markets.

Despite the Harmonized Index of Consumer Prices (HICP) showing prices cooled down at a faster-than-expected pace, European policymakers still expressed concerns about inflation. In fact, they upwardly revised headline and core expectations for this and next year. The central bank now expects headline inflation at 5.4% this year, at 3% in 2024 and at 2.2% in 2025. Additionally, policymakers downwardly revised growth prospects to 0.9% this year and to 1.5% in 2024.

President Christine Lagarde made it clear that the central bank is far from pausing, adding they are not done yet and anticipating another round of hikes in July. She also added that the terminal rate is something they would know when they get there, leaving the door open to more moves. EUR/USD extended its advance and captured the 1.0900 threshold, maintaining the bullish tone on Friday.

So, what now?

Generally speaking, global inflation is on a downward path, and while growth may remain tepid, economies are progressing. At the same time, central banks’ monetary tightening is near its end, regardless of some additional hikes still on the docket. Things are falling into place, with financial markets turning optimistic as a result. Unless something terrible happens in the Eurozone, the Euro will continue benefiting from the better mood. At some point in the future, the US Dollar may recover its strength on the back of solid growth, but that’s not the immediate case. It seems a more likely scenario for the last quarter of this year or early 2024.

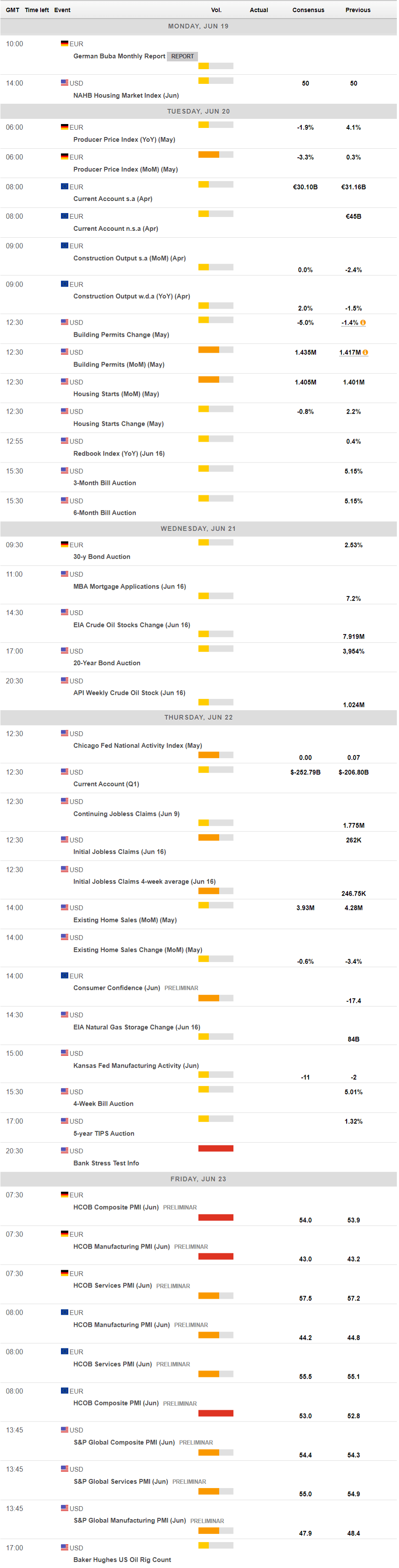

Data-wise, the upcoming week will bring some interesting events. Fed Chairman Jerome Powell will testify before Congress next Wednesday, and there is a good chance he will provide additional clues on Fed’s thinking. The US will also publish the Bank Stress Test, a measurement of the banking system's health. Finally, on Friday, S&P Global will release the preliminary estimates of its June PMIs for the EU and the US. The services sector is expected to continue outperforming the manufacturing one, with the latter seen holding within contraction territory on both shores of the Atlantic.

EUR/USD technical outlook

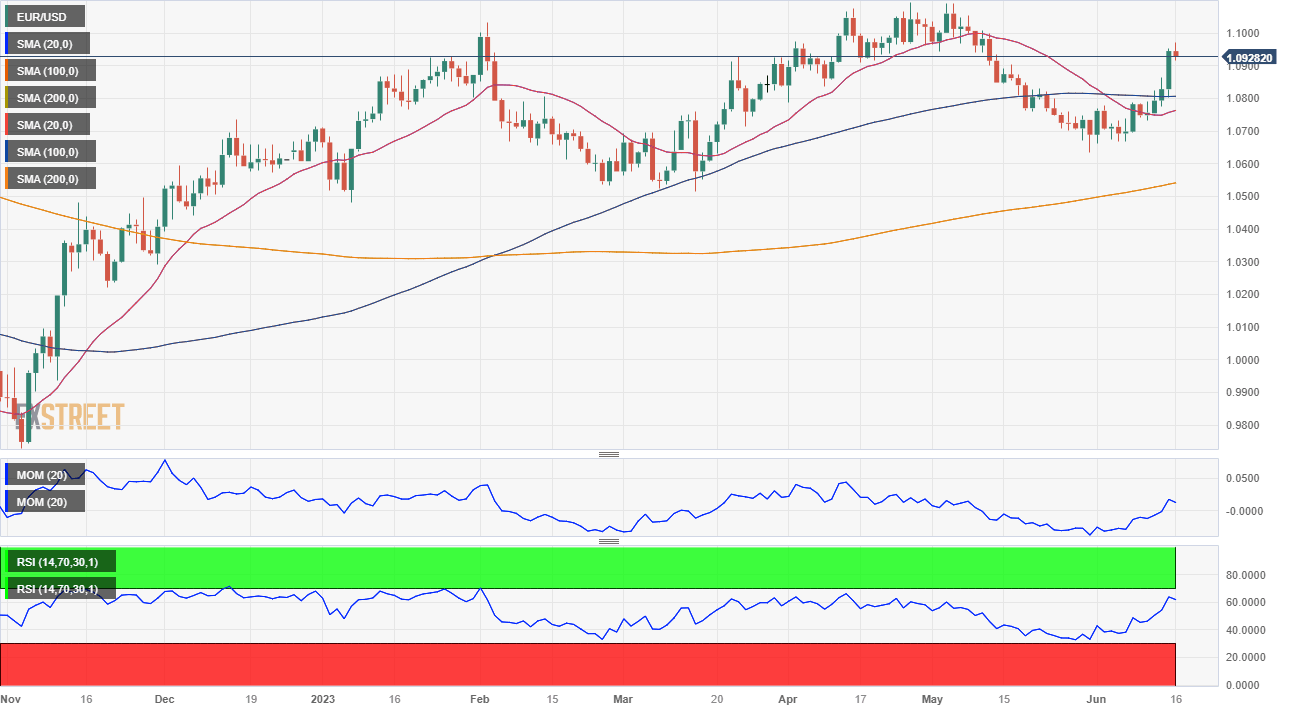

The EUR/USD pair has turned bullish, and there is room for substantial gains towards this year’s high at 1.1483, posted last February. The weekly chart shows that the pair ran above its 20 and 100 Simple Moving Averages (SMAs), with the longer one maintaining its bearish slope. Meanwhile, the 200 SMA remains directionless at around 1.1180, becoming a potential bullish target for the upcoming weeks. Finally, technical indicators head firmly north well into positive territory, reflecting buyers took over and are willing to go further up.

Technical readings in the daily chart maintain the risk skewed to the upside, although they also show that the bullish momentum paused ahead of the weekly close. The pair is trading above all its moving averages, with a directionless 100 SMA providing support at 1.0806. The 20 SMA, in the meantime, rotated north below the longer one, while the 200 SMA extends its bullish slope far below the current level. At the same time, technical indicators hold well into positive territory, partially losing their upward strength near overbought readings. Other than that, there are no relevant signs of bullish exhaustion.

The 1.1000 threshold comes as the immediate barrier ahead of the aforementioned 1.1180 level. If EUR/USD manages to advance beyond the latter, the next relevant level to watch is 1.1230.

The pair could correct lower if it slides below 1.0900, with a test of 1.0810 then on the cards. If the decline continues below the latter, the next bearish target comes at 1.0745, the 61.8% Fibonacci retracement of the 2022 yearly decline.

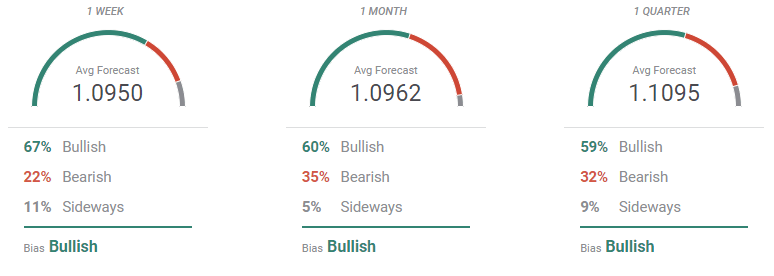

EUR/USD sentiment poll

According to the FXStreet Forecast Poll, EUR/USD will maintain the bullish path in the upcoming weeks. The percentage of buyers decreases as time goes by, but the number of those betting for a decline is low. In the weekly perspective, 67% of the polled experts aim for higher levels, leaving the average target at 1.0950. In the quarterly view, buyers stand at 59%, but the average target increases to 1.1095, suggesting investors are less willing to buy the US Dollar.

As for the Overview chart, the near-term moving averages turned north, with clear accumulations above the 1.1000 mark. The quarterly moving average also gained bullish strength, although there is a wide spread of views with EUR/USD seen as low as 1.0500 and as high as 1.1800. Still, the most congested region is between 1.1000 and 1.1200, supporting more gains in the near future.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.