Gold 2026 outlook: Price forecast, structure and key drivers

- Gold enters 2026 as a structurally supported asset, not a late-cycle hedge.

- Policy uncertainty, reserve diversification, and capped real yields keep gold attractive throughout the year.

- Daily and weekly structures favor continuation, with pullbacks viewed as corrective while price holds above higher-timeframe support.

Gold’s role in 2026

Gold begins 2026 in a very different position than in previous cycles. This is no longer a market driven purely by fear spikes or short-term inflation hedging. Instead, gold is trading as a strategic allocation — supported by macro uncertainty, evolving monetary frameworks, and sustained institutional demand. The price action reflects this shift. On both daily and weekly timeframes, gold has transitioned from aggressive expansion into controlled continuation, suggesting strength without exhaustion. As investors navigate a year defined by policy ambiguity rather than crisis, gold stands out as one of the few assets benefiting from unresolved uncertainty rather than reacting to shock events.

Market narrative — What’s driving Gold in 2026

1. Monetary policy without conviction

In 2026, gold is responding less to actual rate moves and more to confidence in policy direction. Central banks may cut, pause, or adjust — but the market’s underlying concern is whether policy tools still function smoothly in a highly leveraged global system.

Gold thrives in environments where outcomes are uncertain but not chaotic. As long as real yields remain capped and policy guidance remains conditional, gold retains its appeal without needing aggressive easing.

2. Risk premium has become structural

Geopolitical tensions, trade fragmentation, and political uncertainty are no longer shock events — they are persistent features of the macro landscape. This creates a permanent risk premium embedded in asset pricing.

Gold benefits from this environment because it performs best when risk is unresolved rather than explosive. Investors are not panicking; they are hedging possibility.

Why Gold is structurally attractive in 2026

Gold’s strength this year is not based on one catalyst — it’s the result of multiple long-term forces aligning simultaneously.

Gold as a hedge against policy credibility risk

Markets in 2026 are pricing confidence, not just inflation. Years of aggressive fiscal expansion and shifting monetary frameworks have introduced doubt about long-term policy consistency. Gold’s neutrality — free from balance sheets, guidance, or political reliance — makes it increasingly valuable when credibility becomes the risk.

Reserve diversification is no longer optional

Central banks are not buying gold tactically — they are reallocating structurally. This steady diversification away from currency concentration creates persistent underlying demand that absorbs downside rather than chasing upside.

This matters because it changes gold’s behavior during pullbacks. Sell-offs are shallower, shorter, and more orderly.

Complex markets favor simple assets

As portfolios grow more complex — AI-driven equities, fragmented liquidity, unstable correlations — gold’s simplicity becomes a feature, not a limitation. It serves a single purpose: capital preservation without counterparty risk.

In complex systems, simplicity carries a premium.

The opportunity cost argument has shifted

The traditional argument against gold — rising yields — carries less weight in 2026. Even if nominal yields remain elevated, real yields are capped and volatile. In uncertain rate environments, stability becomes a return.

Gold’s opportunity cost is no longer about yield — it’s about avoiding variability.

Gold is not late-cycle

Unlike prior cycles where gold peaked alongside fear, current positioning suggests gold remains early-to-mid cycle. Participation is still broadening, not unwinding.

This implies:

- Corrections are more likely to be corrective

- Trend integrity remains intact

- Long-term allocation is still building

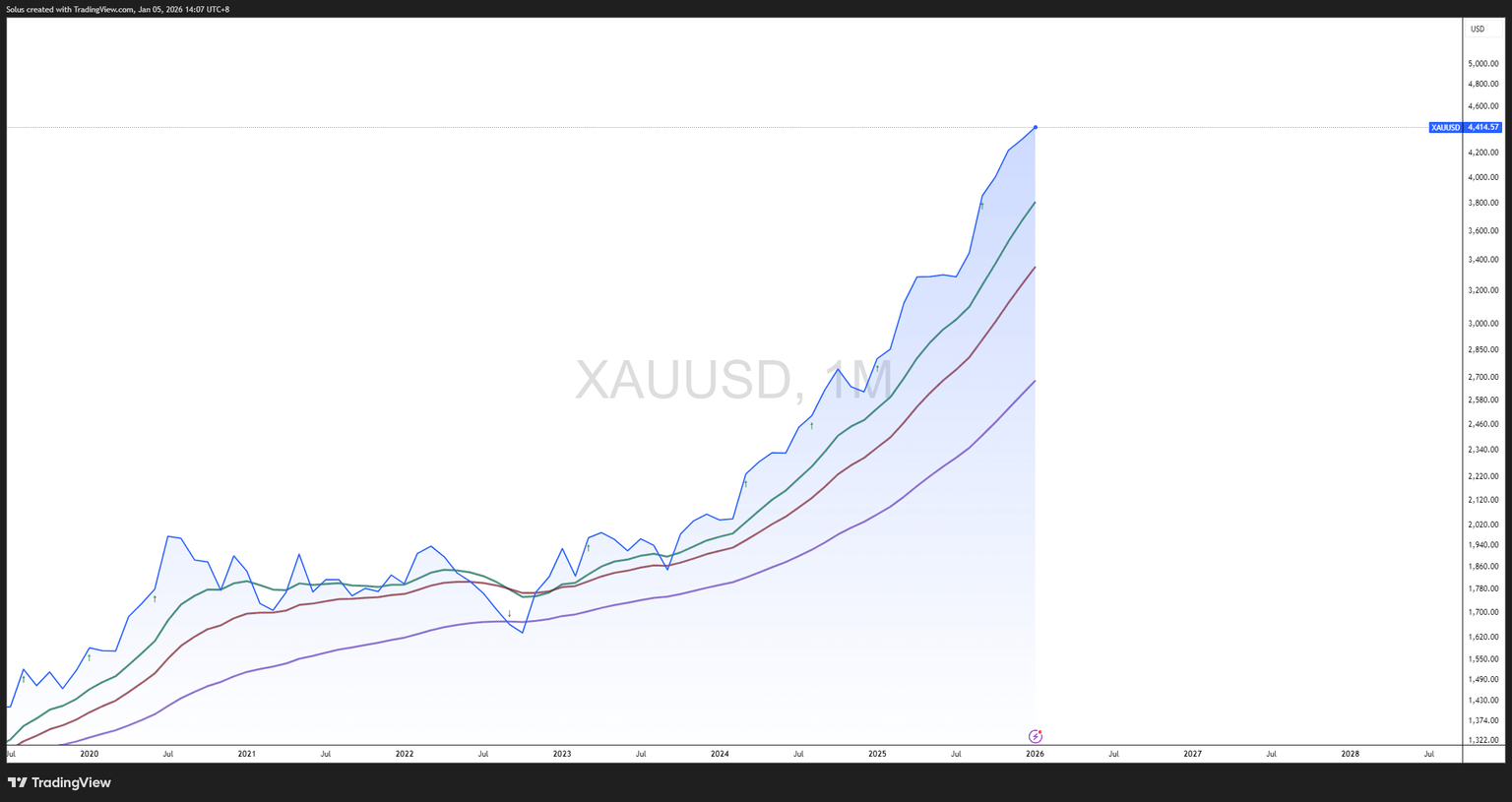

Technical outlook — Daily and weekly structure

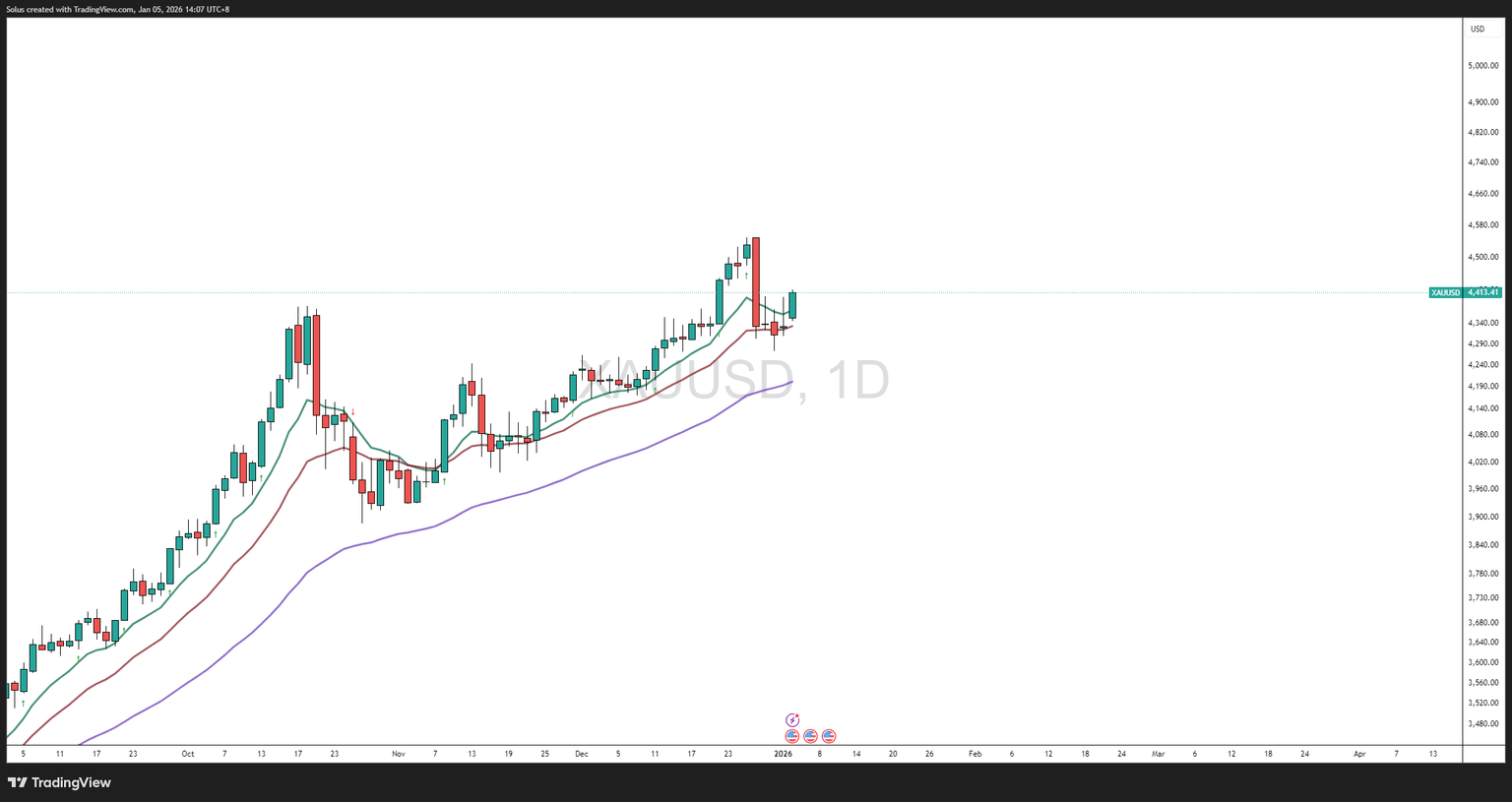

Daily timeframe — Controlled continuation

- Structure: Higher highs and higher lows remain intact.

- Key Support Zone: $4,250 – $4,350

- Near-Term Resistance: $4,600 – $4,700

As long as price holds above the $4,300 region, pullbacks continue to resemble re-accumulation, not distribution.

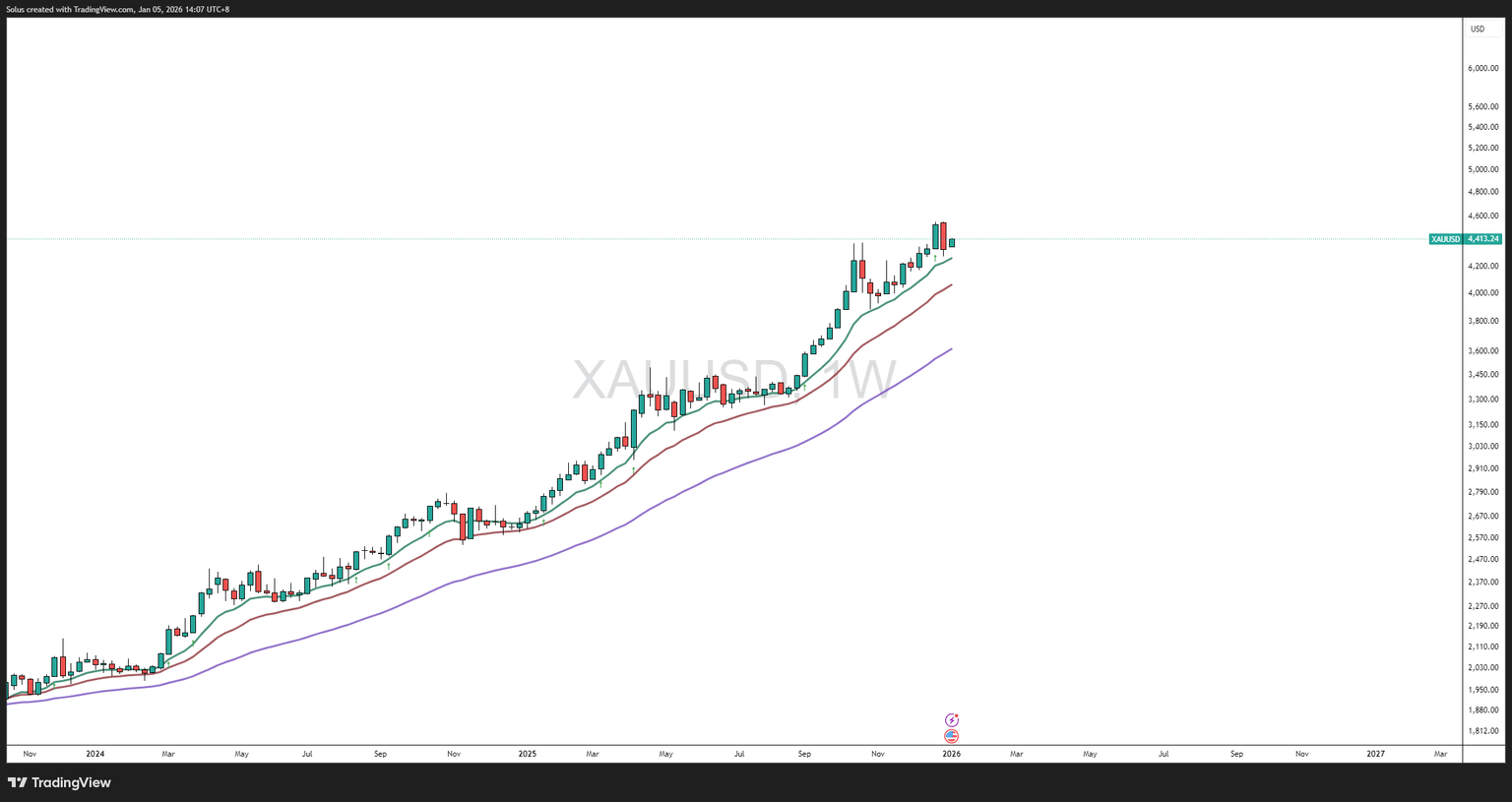

Weekly timeframe — Trend still dominant

- Structure: Clean bullish trend with no structural breakdown.

- Weekly Support: $4,200 – $4,300

- Continuation Confirmation: Acceptance above $4,550 strengthens upside conviction.

The weekly chart shows no evidence of trend failure — only momentum normalization after extended gains.

Scenario framework for 2026

Bullish continuation scenario

Conditions:

- Real yields remain compressed.

- Policy uncertainty persists.

- Structural demand continues.

Targets:

- $4,700 – $4,900.

- Extension toward $5,200 if momentum accelerates.

Range-expansion scenario

Conditions:

- Mixed macro data.

- Periodic USD strength offsets demand.

Behavior:

- Broad range between $4,300 – $4,700.

- Energy build-up for later breakout

Corrective risk scenario

Conditions:

- Sustained risk-on environment

- Sharp rise in real yields

Key Risk Level:

- Weekly loss of $4,200

- Below this, deeper corrective phase possible

2026 Gold outlook summary

Aspect | Outlook |

|---|---|

Structural Bias | Bullish |

Daily Bias | Buy pullbacks above support |

Weekly Bias | Trend continuation |

Core Drivers | Policy uncertainty, reserve demand, capped real yields |

Bottom line

Gold in 2026 is not trading as a reactionary hedge — it is trading as a baseline asset in a complex system. As long as uncertainty remains structural rather than episodic, gold’s role in portfolios remains justified.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.