USD Q1 2026 outlook: US Dollar forecast and key catalysts

- US Dollar (USD) poised for early‑year weakness — Q1 likely sees corrective downside.

- Fed easing expectations, global growth optimism, and geopolitical developments will drive USD direction.

- Daily and weekly charts point to initial downside with key support near 96–97 DXY, while resistance around 100 will define short‑term bullish invalidation.

The U.S. Dollar starts 2026 on a cautious footing, with Q1 set to test the impact of monetary policy divergence, labor market signals, and risk sentiment. Daily and weekly timeframes highlight bearish corrective structures unless critical resistance near 100 is reclaimed.

The Fed is widely expected to signal easing through one or two rate cuts in response to moderating inflation and softening employment data, undermining the USD’s yield advantage.

Simultaneously, global growth expectations and ongoing geopolitical developments may reduce safe‑haven flows into the dollar. Traders should anticipate volatile swings with a bearish tilt, monitor key levels on DXY, and watch for catalysts that could accelerate either side of the move.

What could drive USD in Q1 2026

1. Fed policy and interest rates

- The Federal Reserve is expected to ease with 25–50 bps of cuts early in 2026.

- Rate cuts would reduce the real yield advantage of the USD versus other major currencies.

Impact: A dovish Fed typically weakens the dollar and supports currencies like EUR, GBP, and AUD.

2. Labor market data

- Early 2026 Non-Farm Payrolls, unemployment rate, and wage growth reports will influence market perception of Fed easing.

- Stronger-than-expected labor data could temporarily stabilize the USD; weaker data would accelerate declines.

Impact: High sensitivity to U.S. employment releases; surprises can trigger sharp intraday moves.

3. Risk sentiment and global macro

- Positive risk-on sentiment (equity rallies, easing global tensions) tends to pull capital away from safe havens like the USD.

- Geopolitical developments, such as tensions in the Middle East, Asia, or Americas, particularly the recent developments in the take-over of the United States of Venezuela, may temporarily boost the dollar as a hedge.

Impact: Risk appetite swings drive short-term USD flows independent of fundamentals.

4. FX flows and reserve dynamics

- Early 2026 could see structural shifts in reserve holdings (China, EU), lowering USD demand.

- Capital rotations into non-USD assets (equities, commodities) amplify Q1 weakness.

Impact: Structural flows create a persistent downward bias, especially on dips.

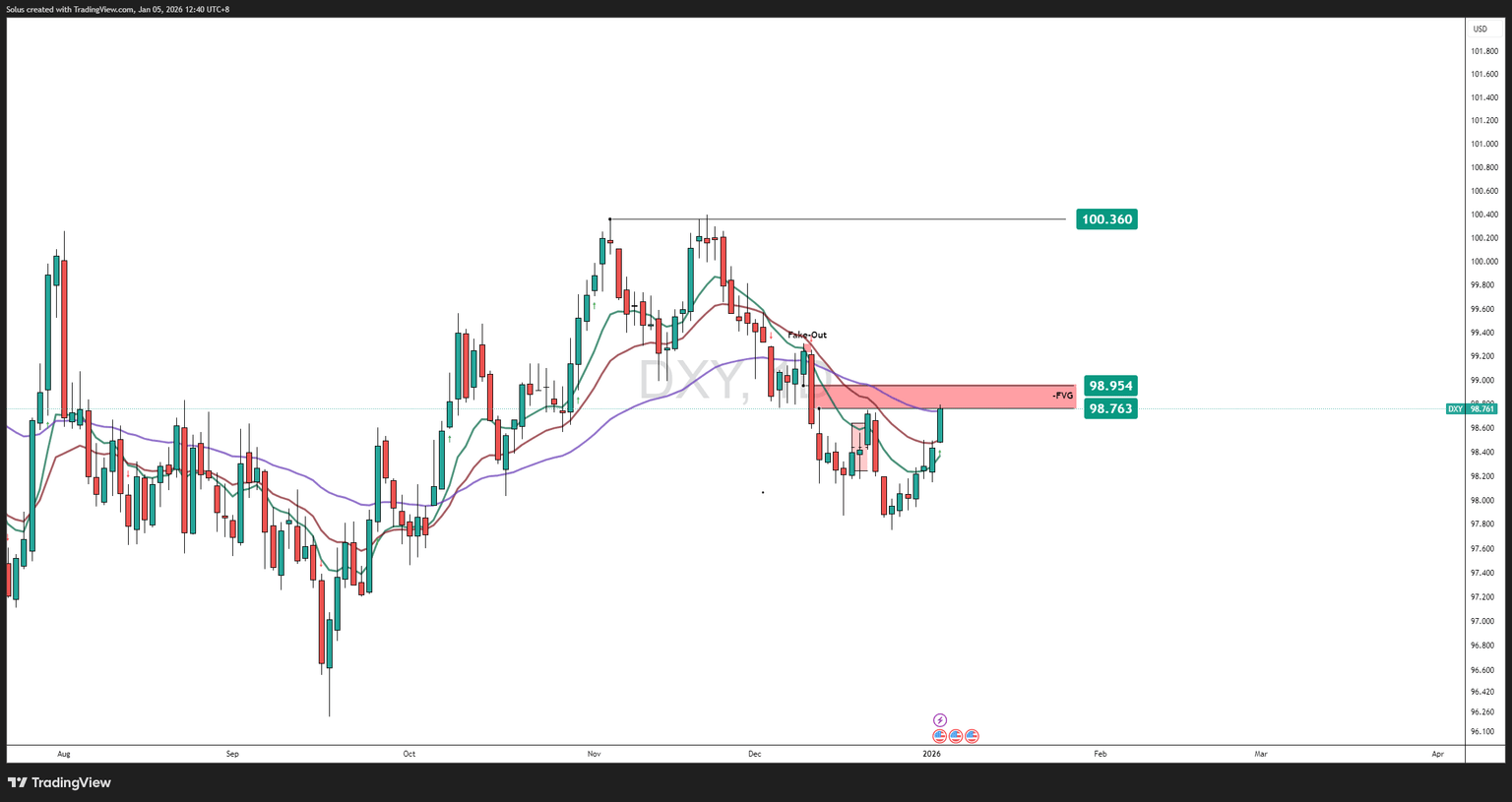

Technical outlook — Daily and weekly timeframes

Daily timeframe — Short-term bias

- Structure: Corrective consolidation with lower highs and volatile swings; bearish-leaning.

- Key Levels:

- Resistance: 100.0–100.5.

- Support: 96.5–97.2.

Daily Bias: Bearish unless daily closes above 100.5 confirm short-term bullish reversal.

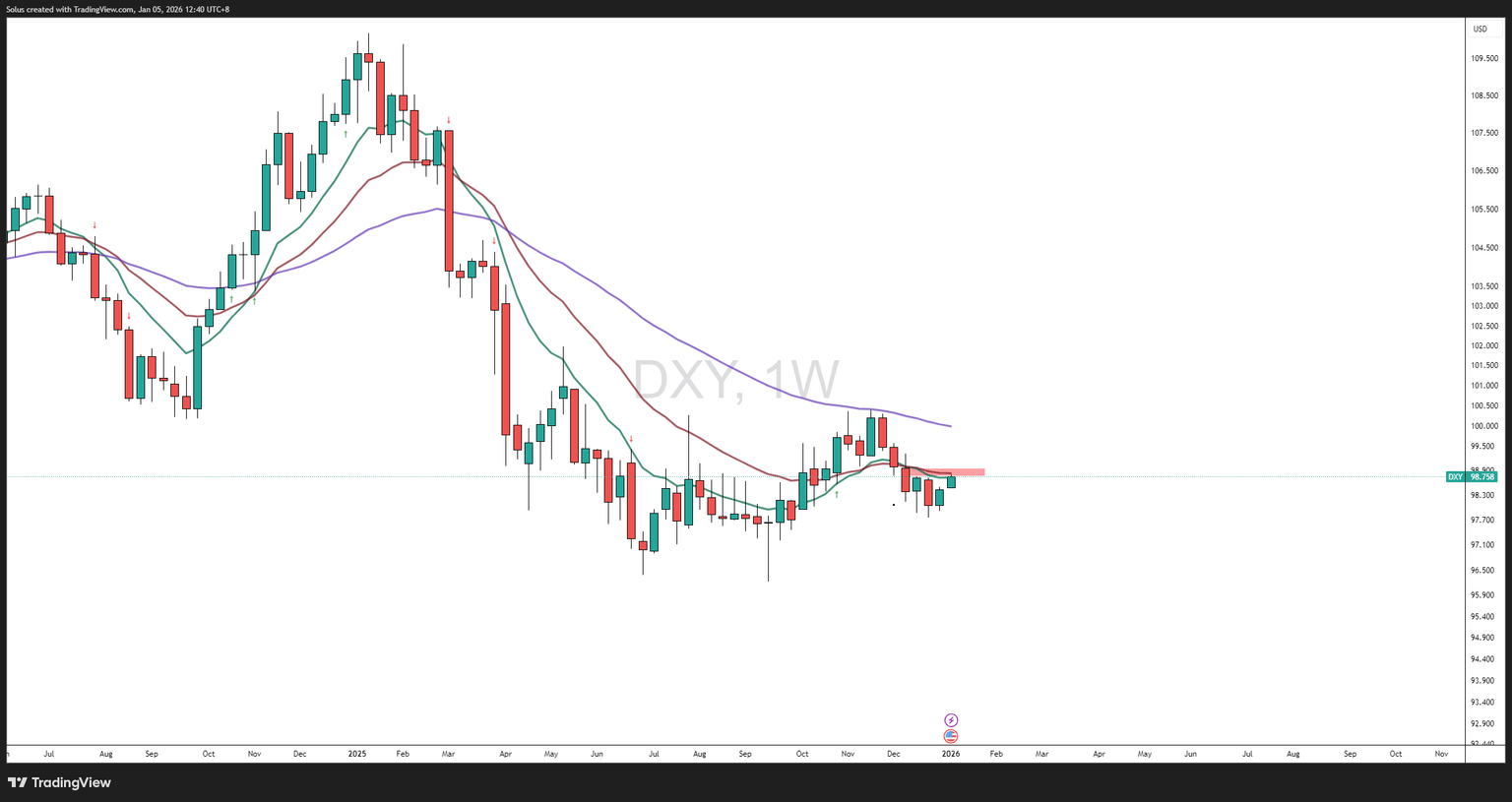

Weekly timeframe — Intermediate bias

- Structure: Downtrend with lower highs; range compression suggests corrective weakness.

- Key Levels:

- Bullish Invalidator: Weekly close above 100–101

- Support: 95–96 cluster

Weekly Bias: Bearish continuation for Q1; stabilization possible only after testing 95–96 support.

Scenarios for Q1 2026 USD

Bullish scenario

- Triggers: Fed delays easing, labor surprises, geopolitical shocks

- Targets: 100–102 DXY

- Risk: Break above 102 signals broader corrective rally

Bearish scenario

- Triggers: Fed implements cuts, weak employment, positive risk-on sentiment

- Targets: 96–95 DXY

- Risk: Breach below 95 could accelerate downside into mid-2026

Summary table — Q1 2026

Timeframe | Bias | Key Levels |

|---|---|---|

Daily | Bearish/Neutral | 96.5–100.5 |

Weekly | Bearish | 95–101 |

Catalysts | Rate cuts, labor data, risk sentiment, FX flows | — |

Q1 Outlook: USD likely to face downside pressure in early 2026 as Fed easing and improving global risk sentiment combine. Traders should watch DXY 96–97 as the key support zone and 100–101 as short-term resistance.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.