EUR/USD Weekly Forecast: Chaotic US developments signal wild days ahead

- News that US President Trump contracted COVID-19 spurred risk-aversion.

- The USD fluctuated alongside hopes and sorrow over a US stimulus bill.

- EUR/USD’s shy recovery cannot grant additional gains ahead.

The American dollar was unable to sustain its positive momentum this week and edged lower against most major rivals. The shared currency, on the other hand, was among the worst performers against the greenback, lacking self-strength. The EUR/USD pair bottomed for the week at 1.1614 and heads into the weekend trading at around 1.1720.

The main market motor these days was the risk-related sentiment, centred around a US stimulus bill and a post-Brexit trade deal. The cherry on the cake was the announcement this Friday that US President Donald Trump and wife Melania contracted COVID-19.

Trump’s health took over the news feeds, overshadowing a dismal US Nonfarm Payroll report. According to the official release, the US added 661K new jobs in September, much worse than the 850K expected. The unemployment rate in the same period ticked down to 7.9% from 8.4%, beating the 8.2% expected.

At the beginning of the week, optimism ruled. Signs of economic progress and stabilizing coronavirus cases in Europe provided support to the pair. The positive mood, however, was quite fragile and easily undermined by fundamental news.

Politics, it’s all about politics

The American dollar suffered from the news that US House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin engaged in negotiations to clinch a deal on a coronavirus aid package but to no avail. On Thursday, House Democrats approved a $2.2 trillion Democratic plan to provide economic relief, which is unlikely to pass the Republican-majority Senate. Republicans package accounts $1.6 trillion.

Expectations mounted ahead of the first US presidential debate between Trump and Biden, providing little of substance to investors. It was a spat which didn’t lack mockery and interruptions. The only thing worth highlighting is that Trump refused to say that he would accept the election results, as he has repeatedly been saying that mail-in ballots will lead to a rigged election.

Meanwhile, ECB’s President Christine Lagarde mounted on the verbal intervention train, as she said that "it is clear that the external value of the euro has an impact on inflation." Speaking at the Institute for Monetary and Financial Stability, Lagarde paved the way for more stimulus, indicating that the central bank stands “ready to adjust all of its instruments, as appropriate, to ensure that inflation moves towards its aim in a sustained manner, in line with its commitment to symmetry.”

Macroeconomic figures point to a slow and painful recovery

Data released these days was mixed, with improvement seen in consumer confidence, growth-related figures and employment number. Anyway, the economic recovery in the US and the EU continues to be slow-motion, and far below pre-pandemic levels. At this point, it is clear that the economic comeback will take much longer than initially estimated.

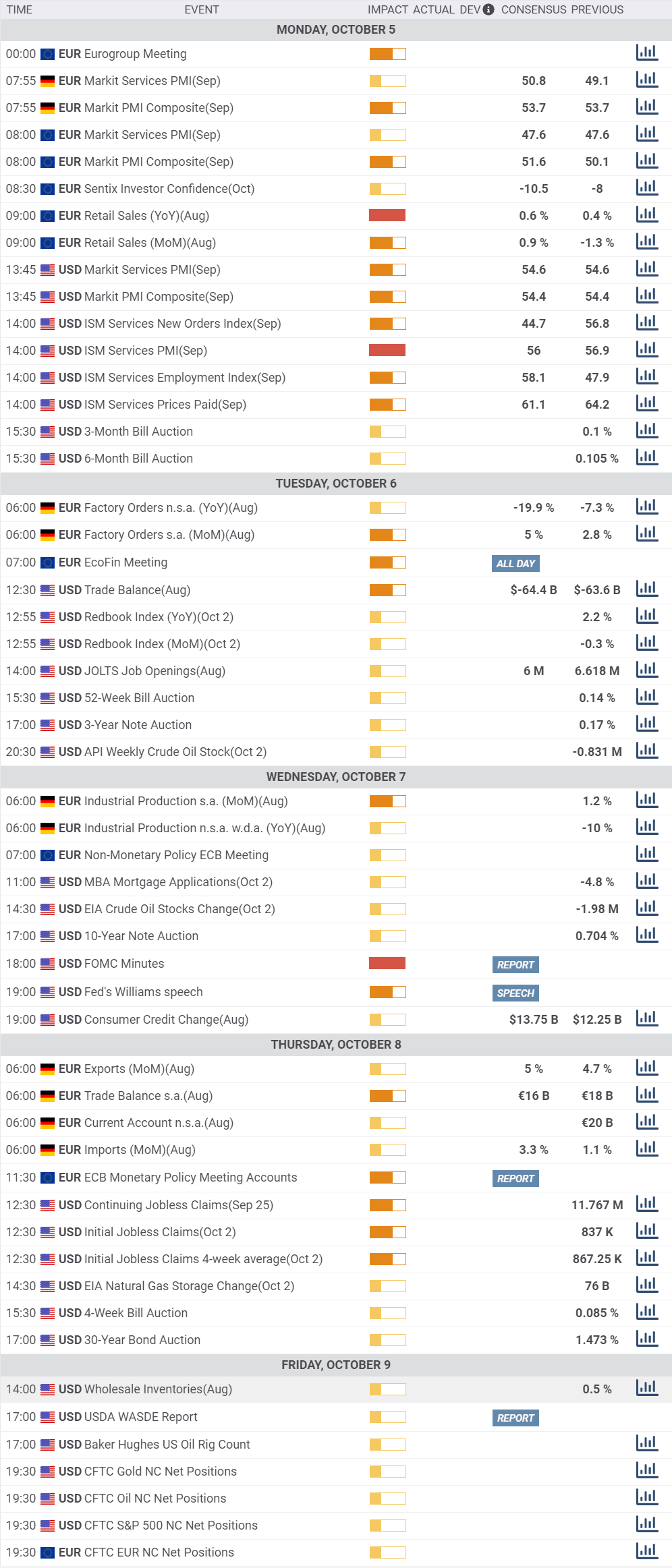

The upcoming week will kick-start with the final versions of the September Markit Services PMIs for the EU and the US, and the official ISM Services PMI for this last, foreseen at 56 from 56.9 in the previous month.

Next Wednesday, the FOMC will publish the Minutes of its latest meeting. The Federal Reserve has left rates unchanged at record lows, and formalized the announcement on targeted average inflation. The document has little chances of having a relevant impact on the market.

EUR/USD technical outlook

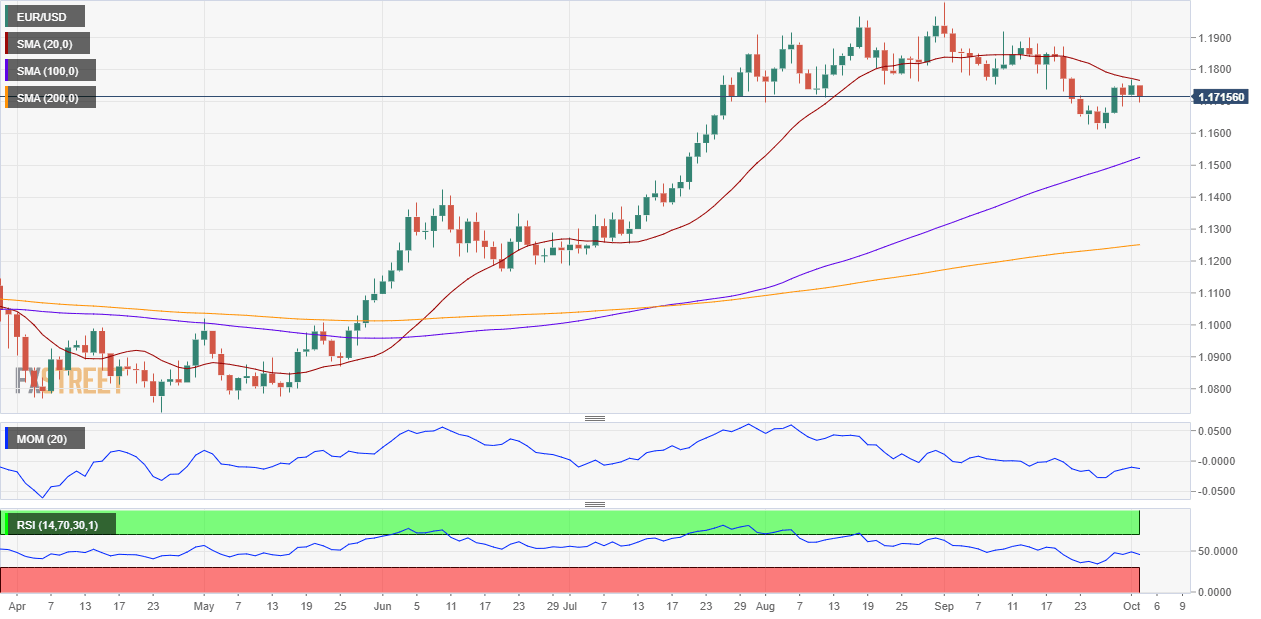

The long-term picture for EUR/USD is still bullish, according to the weekly chart. In this particular time-frame, the pair continues to develop above all of its moving averages, with the 20 SMA maintaining a firmly bullish slope after crossing above the larger ones. Technical indicators, in the meantime, have stabilized within positive levels, after the overbought conditions achieved a month ago.

In the daily chart, however, the bearish potential has increased. A mildly bearish 20 DMA caps the upside at around the weekly high at 1.1770, while technical indicators turned south within negative levels, after failing to recover into the positive territory. Still, the pair holds above a bullish 100 DMA now around 1.1520.

An immediate support level comes at 1.1670, yet the pair would need to lose the 1.1600 figure to turn bearish and test the mentioned 1.1520 dynamic support level. Above 1.1770, on the other hand, the pair could recover up to the 1.1840 region, while further gains will depend on sentiment’s dynamics.

EUR/USD sentiment poll

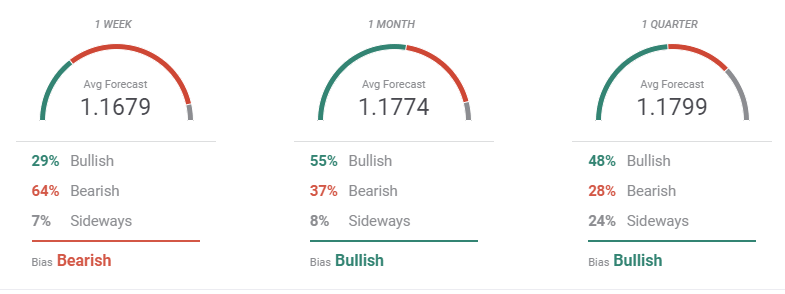

The FXStreet Forecast Poll for the EUR/USD pair shows that the bearish pressure on the pair won’t last long. A new leg lower is expected next week, but the pair is then seen turning bullish. On average, however, the pair is seen neutral and confined to familiar levels. Bulls’ strength is clearer in the monthly view, as 55% of the polled experts are going long. Surprisingly, the number of bears decreases as time goes by, down to 28% in the quarterly view.

The Overview chart shows that a quite even spread of possible targets in the monthly and quarterly perspectives, resulting in mostly neutral moving averages. The pair is foreseen as low as 1.14, and as high as 1.22, a sign of the persistent uncertainty.

Related Forecasts:

GBP/USD Weekly Forecast: Will Boris break the Brexit deadlock? Volatility set to explode

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.