EUR/USD Weekly Forecast: Central banks walking at the edge of a cliff

- US Federal Reserve Chairman Jerome Powell's hawkish words hit the US Dollar.

- Fresh Euro Zone and United States inflation figures are on the docket next week.

- EUR/USD long-term bearish trend intact, chances of a corrective advance increased.

The EUR/USD maintained the bearish route, falling for a sixth consecutive week to reach a two-month low of 1.0765. The pair heads into the close trading at around 1.0790, recovering some ground on Friday. On the one hand, mounting fears of a Euro Zone recession undermined demand for the Euro, while a dismal mood fueled demand for the US Dollar.

Tepid growth forcing policymakers’ hands

Concerns arose on Wednesday when S&P Global released the preliminary estimates of the August Producer Manager Indexes (PMIs). The reports showed business activity in the Euro Zone contracted “at an accelerating pace” in the month, with output falling in manufacturing and services sectors. The Manufacturing PMI printed at 43.7, slightly better than anticipated, while the services index unexpectedly sunk into contraction territory, down to 48.3 against the 50.3 of consensus. The Composite PMI resulted in 47.0, its lowest in over two years.

German figures were equally discouraging, as business activity suffered the steepest decline in more than three years in August, according to the report. The manufacturing index came in at 39.1, while the Services PMI fell to 47.3, a 39-month low. More worrisome, the document noted an increase in inflationary pressures driven by accelerated cost and price increases in the service sector.

The EUR/USD pair nose-dived with the news despite reduced US Dollar demand, although it quickly recovered following the release of S&P Global figures. The United States Manufacturing PMI declined to 47.0 from 49.0 in July, a two-month low, while services output slid to 51.0, its lowest in six months.

But while EZ figures spurred fresh recession fears, American ones did not. The American economy may not be at its brightest spot, but for sure, it is in much better shape than the European one.

So far, the European Central Bank (ECB) has maintained the view that inflation risks grant a vigilant stance and additional monetary tightening. Nevertheless, momentum is growth for a pause, given the potential setback.

Meanwhile, US Federal Reserve (Fed) officials hinted at a dovish announcement for September. Boston Federal Reserve President Susan Collins said on Thursday that they may be at a place where the Fed can hold the policy rate steady, while Federal Reserve Bank of Philadelphia President Patrick Harker moved in the same direction. In an interview with CNBC, Harker said he thinks the Fed has “probably done enough” with monetary policy.

But overall, financial markets were waiting for central banks leaders’ words within the Jackson Hole Symposium. Fed Chair Jerome Powell surprised the market with some hawkish comments as he repeated the central bank is prepared to raise rates further if it is appropriate, while adding that above-trend growth could warrant more tightening. Finally, Powell noted that while the policy is restrictive, the Fed is not sure what a neutral rate level is. The EUR/USD pair advanced with the news, but gains were modest and short-lived, as stock markets are not taking the headlines well. The odds for a 25 basis points (bps) rate hike in September stand at 20%.

President Christine Lagarde will hit the wires ahead of the weekly close and could hit the Euro if she sounded dovish.

Inflation under the spotlight

The upcoming week is all about inflation. Germany will release the preliminary estimate of the August Harmonized Index of Consumer Prices (HICP) next Wednesday, while the EU will do it on Thursday. As for the US, the country will release the Personal Consumption Expenditures (PCE) Price Index on Thursday.

Employment-related data will also grab the market’s attention, as the US will publish the ADP survey on private job creation and several other figures ahead of the Nonfarm Payrolls report on Friday. The US is expected to have added 165K new jobs in August, while the Unemployment Rate is foreseen steady at 3.5%.

EUR/USD technical outlook

The EUR/USD pair is poised to fall further, although the extent of the decline from 1.1275 lifts the odds of a corrective advance. The weekly chart shows that these days’ high converges with a flat 20 Simple Moving Average (SMA) while buyers tried to defend the downside at around a bearish 100 SMA. The Momentum indicator does not provide directional clues, stuck around its 100 level, but the Relative Strength Index (RSI) indicator heads firmly south at around 47, anticipating lower lows ahead.

The daily chart shows that the pair is battling with a mildly bullish 200 SMA at around 1.0790. At the same time, the pair develops well below the 20 and 100 SMAs, with the shorter crossing below the longer one in the 1.0910/20 price zone. Finally, technical indicators have lost their bearish momentum but consolidate near oversold readings, not enough to confirm an interim bottom. It is also worth noting that the pair has posted a lower low and a lower high on a daily basis, in line with the dominant bearish trend.

A weekly close around the current levels should encourage sellers next week. The following relevant support level and a potential bearish target come at 1.0732, the June 12 low, while a break below the latter exposes the 1.0660 price zone. Resistance can be found at 1.0840 and 1.0920, while beyond the latter, a test of the 1.1000 figure will be on the cards.

EUR/USD sentiment poll

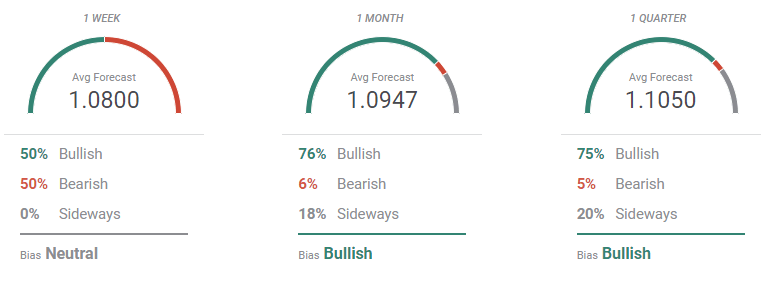

The FXStreet Forecast Poll shows speculative interest in the near term but also that most analysts are betting for a tide change. The pair is neutral in the weekly perspective, with the pair seen around 1.0800, while bullish in the monthly and quarterly views. Buyers are roughly 75% of the polled experts, while less than 10% foreseen lower lows.

The Overview chart, however, hints at increased selling interest. Moving averages in the three time frames under study are gaining downward strength, although unevenly. The bearish strength decreases as time goes by, with the quarterly moving average barely down. Still, the pair is hardly seen below the 1.0600 mark in the next few months, while in the wider perspective, gains beyond 1.1200 are still on the table.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.