EUR/USD Weekly Forecast: Central banks´ hawkishness spooked believers

- The Fed and the ECB monetary policy announcements revived growth-related concerns.

- European inflation is still on the loose, United States price pressures receding.

- EUR/USD is technically bullish and could extend its rally towards 1.0900.

The EUR/USD pair rallied to 1.0735 on Thursday, its highest since early June. It heads into the weekly close trading at around 1.0620, holding on to substantial gains and poised to extend them.

The week was loaded with first-tier events, some of them expected and some of them bringing surprises to financial boards. The United States published the Consumer Price Index (CPI) for November, on Tuesday, which rose at an annual pace of 7.1%, easing from the previous 7.7%, and below the 7.3% anticipated by market players. Easing price pressures confirmed the newly adopted Federal Reserve (Fed) path of a slower pace of quantitative tightening, spurring optimism. The Greenback plummeted as stock markets roared higher.

Federal Reserve nowhere near pausing hikes

The US central bank announced its decision on Wednesday, and as widely anticipated, it hiked the benchmark rate by 50 basic points (bps). Surprisingly, the accompanying statement was pretty much unchanged from the previous one.

Further surprises came from the Federal Reserve Summary of Economic Projections (SEP) and Fed Chairman Jerome Powell. Policymakers upwardly revised inflation forecasts while taking down growth prospects.

“The inflation data received so far for October and November show a welcome reduction in the monthly pace of price increases. But it will take substantially more evidence to give confidence that inflation is on a sustained downward path,” said Powell. Furthermore, the central bank sees no immediate end to rate hikes but announced more hikes are in the docket.

Market participants initially welcomed the Fed’s outcome but gave it a second thought early Thursday. Softer-than-anticipated Chinese figures and the fact that the United States Federal Reserve will not give up on tightening triggered a sell-off among high-yielding assets and boosted the US Dollar.

European Central Bank surprised with its hawkishness

The European Central Bank (ECB) also decided on monetary policy these days. The EUR surged with the ECB announcement, as the central bank delivered a 50 bps rate hike, but for a change, President Christine Lagarde was hawkish. Lagarde announced further quantitative tightening, through the end of the APP program. The current portfolio will decline at a measured and predictable rate beginning in March 2023, announcing there won’t be reinvestments of maturing securities. The monthly average decline will be €15 billion until the end of the second quarter of 2023. Furthermore and within the press conference, Lagarde said that policymakers expect to raise rates "significantly further" because inflation is far too high, adding that it is “obvious” that more 50 bps hikes should be expected for a period of time. Finally, she said that a potential recession would be short-lived and shallow.

Inflation and growth under scrutiny

Indeed, inflation in the Euro Area remains high, as the November Consumer Price Index was confirmed at 10.1% YoY, above the preliminary estimate of 10.0%. The German CPI in the same period was confirmed at 11.3%, a multi-decade high.

Lagarde’s words pushed EUR/USD towards the aforementioned high, but growth-related concerns weighed more. Wall Street nosedived and helped the US Dollar to recover some ground.

So, inflation is still a major problem, and growth has not yet bottomed. Optimism collapsed, and so did stock markets. A word of warning, at this point, this scenario will not be enough to save the US Dollar but will instead limit the bullish potential of the EUR.

Heading into the winter holidays season, the macroeconomic calendar has little of relevance to offer next week. The most relevant figures will be the final estimate of the US Gross Domestic Product (GDP), expected to be confirmed at 2.9% and November Durable Goods Orders, expected to remain pat.

EUR/USD technical outlook

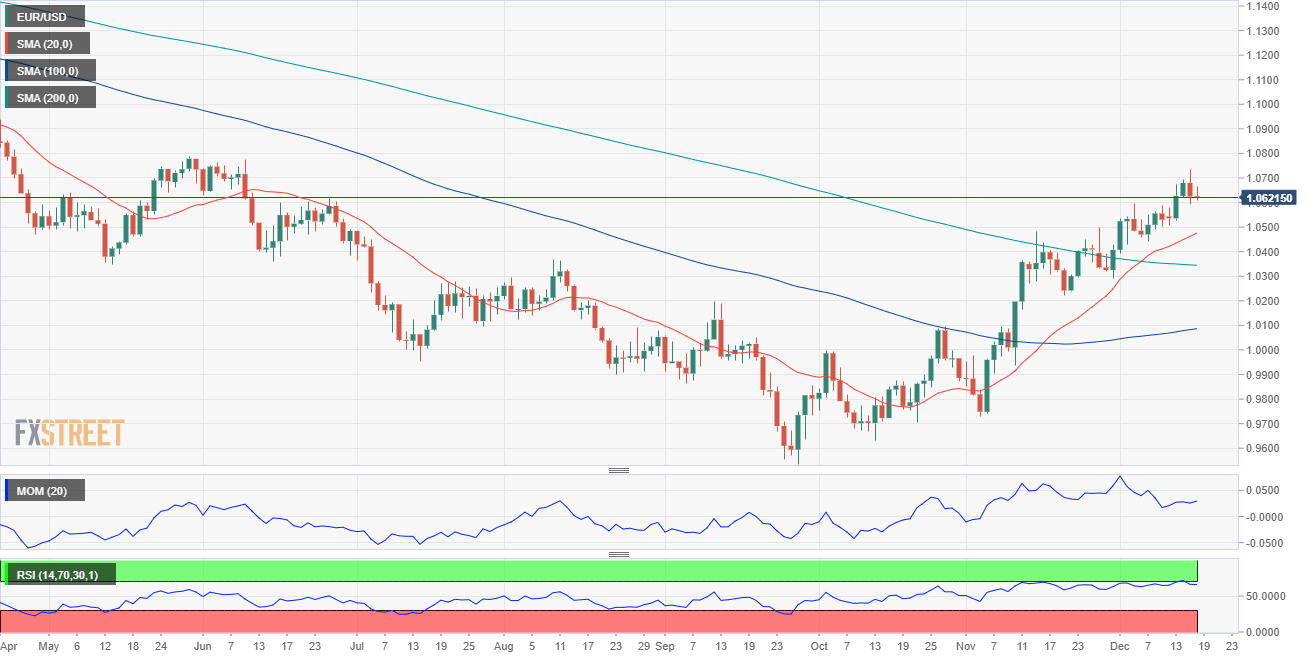

From a technical perspective, EUR/USD has room to continue advancing. The weekly chart shows that the pair continues to develop far above a now bullish 20 Simple Moving Average (SMA), which currently develops at around 1.0100. The 100 SMA heads south below the 200 SMA, both far above the current level. Finally, technical indicators retain gains near overbought levels, with the Momentum currently consolidating and the Relative Strength Index (RSI) aiming north at around 62.

According to the daily chart, bulls are also in control of EUR/USD. The pair keeps developing well above all of its Moving Averages, with the 20 SMMA heading firmly north above the longer ones. Technical indicators, in the meantime, have lost their directional strength but consolidate well above their midlines, indicating the absence of selling interest.

EUR/USD topped at 1.0786 in May, and market players will be looking for a bullish breakout of that level to keep adding longs. Once above it, the path is quite clear towards 1.0900. Corrective declines amid profit-taking can push the pair down towards the 1.0500/30 price zone, although buyers will likely reappear in the region.

EUR/USD sentiment poll

According to the FXStreet Forecast Poll, EUR/USD will lose ground in the near term. However, it seems that once again, price action caught the speculative interest off guard. In the weekly perspective, 50% of the polled experts are looking for a potential slide below the 1.0600 mark, although in average, the pair is seen around it.

In the monthly perspective, only 9% of experts are looking for higher highs although there is a wide accumulation of bets in the 1.0400/1.0600 price zone, while those looking for another leg below parity continue to decrease.

Finally, in the quarterly perspective, most targets accumulate between 1.0400 and 1.1200, in line with a sustained advance in the months to come.

Moving averages in the Overview chart are frankly bullish for the first time in months, and except in the near term, most targets came above the moving averages, reflecting increasing buying interest alongside hopes for further recoveries.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.