EUR/USD Weekly Forecast: Bulls to push it further up regardless overbought conditions

- The softer-than-anticipated United States Consumer Price Index triggered a US Dollar sell-off.

- Hawkish European Central Bank failed to impress market players.

- EUR/USD long-term bullish case supported by sentiment, 1.1494 at sight.

The EUR/USD pair rallied roughly 300 pips this week, breaking through different psychological levels to peak at 1.1244 on Friday. It currently trades a handful of pips below such a high, immune to the usual profit-taking ahead of the weekend.

United States inflation brings relief

The pair surged as the US Dollar collapsed following news that inflation continued to ease in the United States (US). The Consumer Price Index (CPI) rose 0.2% MoM in June and 3.0% YoY, while the core annual reading was 4.8%. Additionally, the country reported wholesale inflation, showing the Producer Price Index (PPI) advanced a modest 0.1% in the same month and also 0.1% from a year earlier.

All inflation-related readings were below their previous monthly estimates and missed market forecasts, meaning that, despite the still tight labor market, price pressures continued to retreat towards the Federal Reserve (Fed) 2% goal. As price pressures receded, the need for monetary tightening diminishes. As a result, the risk of an upcoming recession diminished.

Following the US CPI release, global stocks turned north, with the Nasdaq Composite and the S&P500 soaring to multi-month highs. In contrast, the Dollar Index (DXY) plummeted below the 100.00 mark for the first time since April 2022. Demand for safe-haven assets equalled that of high-yielding ones, except for Gold, which faded a part of its initial rally ahead of the weekly close.

Optimism overshadowed Fed officials’ comments, as Governor Christopher Waller repeated on Thursday he favors more rate hikes this year. His words came as no surprise, as market participants already priced in the chances of at least two more hikes this year following the latest Federal Open Market Committee (FOMC) meeting. “The robust strength of the labor market and the solid overall performance of the U.S. economy gives us room to tighten policy further,” Waller noted. Earlier in the week, San Francisco Federal Reserve President Mary Daly said it was too early to declare victory on inflation, adding policymakers would “need to move rates up to restrictive territory.”

Hawkish European Central Bank nearing the end of the tightening cycle

Across the pond, the European Central Bank (ECB) released the June policy meeting minutes. The document reiterated what policymakers have been saying lately, that is, that monetary policy still had more ground to cover. It also reaffirmed the data-dependent, meeting-by-meeting approach. Finally, the statement read: “The level of the peak deposit facility interest rate, as well as its duration, as embodied in the forward curve and reflected in the staff projections, could be judged as insufficient to bring inflation back to the 2% medium-term target.” No surprises there, with a neutral impact on the Euro.

Inflation in the Euro Zone remains elevated amid the more cautious approach taken by the ECB. On Tuesday, Germany confirmed the June Harmonized Index of Consumer Prices (HICP) at 6.8% YoY, more than doubling the American one.

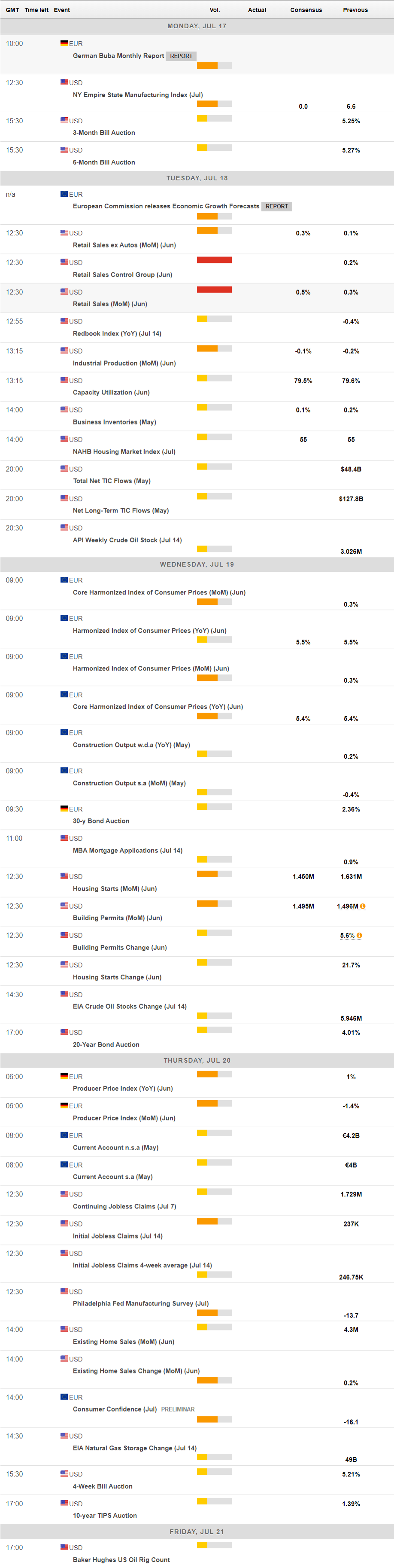

Data-wise, the upcoming week will bring little of interest, which means the focus will remain on sentiment. There is a good chance financial markets would remain optimistic, maintaining the pressure on the USD.

Among the most relevant figures, the US will publish June Retail Sales, foreseen up by 0.5% MoM, while the EU will offer the final estimate of the June HICP, expected to be confirmed at 5.4% YoY.

EUR/USD technical outlook

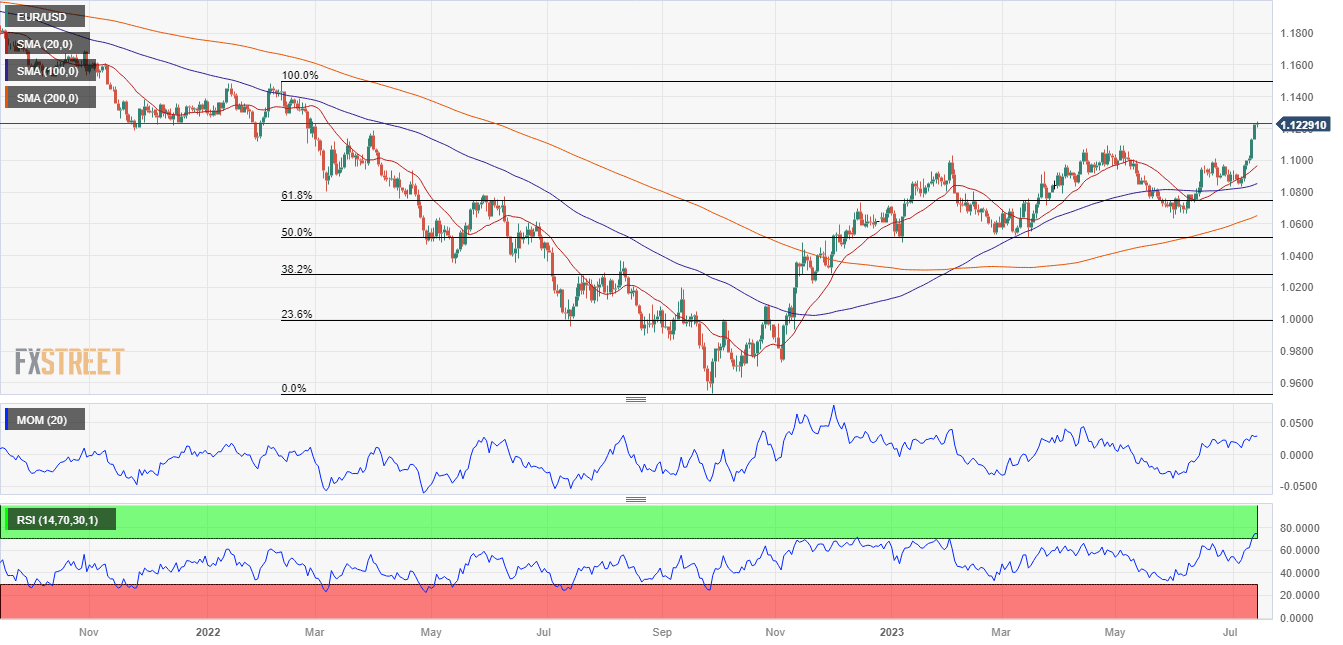

The EUR/USD pair trades at levels that were last seen in February and seems poised to extend its rally, initially to 1.1494, the 2022 yearly high. The weekly chart shows that it's settling above a flat 200 Simple Moving Average (SMA) for the first time since December 2021. At the same time, a bullish 20 SMA crosses above a still bearish 100 SMA, both far below the current level. Finally, technical indicators head firmly south within positive levels, with the Relative Strength Index (RSI) indicator nearing overbought territory.

EUR/USD closes in the green for a seventh consecutive day, and technical readings in the daily chart are giving signs of upward exhaustion. Nevertheless, the pair could experience a tepid correction or even consolidate before resuming its advance, with odds for a steeper slide being quite limited. Technical indicators have lost their upward strength within extreme overbought levels, anticipating a potential near-term decline without confirming it. At the same time, the pair continues to develop far above bullish moving averages, in line with an upward continuation in the upcoming days.

EUR/USD could test the 1.1300 threshold once beyond the weekly high, with the next resistance area located at around 1.1360. Support could be found at 1.1180, 1.1090 and the 1.1000 mark.

EUR/USD sentiment poll

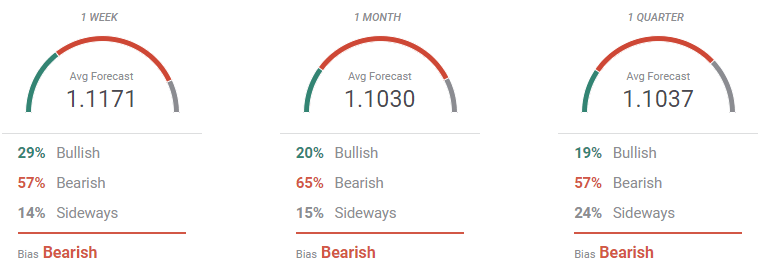

The FXStreet Forecast Poll shows that investors got caught off-guard and failed to anticipate the US Dollar sell-off. EUR/USD is foreseen way below the current level in the three time frames under study, as a 300 pips rally was not an option. Bulls stand for 29% of the polled experts in the weekly perspective but decrease to 19% in the quarterly one.

Meanwhile, the Overview chart shows that the current price outpaces average targets. Nevertheless, the weekly moving average maintains its bullish slope, with the pair seen holding above 1.1000. In the monthly view, the range of potential targets widens from 1.0600 to 1.1500, with the moving average flat, reflecting a certain level of uncertainty. Finally, in the three-month view, the moving average turned south, although the largest accumulation falls around 1.1200.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.