EUR/USD Weekly Forecast: Bears take a breath, but don’t expect them to give up

- European and American policymakers have put taming inflation before stimulating growth.

- Inflation will take center stage next week as major economies unveil CPI updates.

- EUR/USD has room to extend its bullish correction, but buyers have little chances of succeeding.

The EUR/USD pair edged higher and headed into the weekend trading at around 1.0050, recovering from 0.9863 – a level last seen in December 2002. The American currency remained strong throughout the first half of the week but started changing course on Wednesday, to finally giving up on Thursday as a result of central banks’ noise.

Central banks put inflation before growth

The European Central Bank decided to hike rates by 75 bps as anticipated, taking the benchmark deposit rate to 0.75%. The central bank also pledged to keep hiking rates as “inflation remains far too high and is likely to stay above target for an extended period.” President Christine Lagarde said that probably more than two but less than five increases would be needed to push rates to neutral, adding that a 75 bps movement should not be considered a norm. Additionally, the central bank upwardly reviewed its inflation forecasts for this year and the next, while cutting growth forecasts.

Conversely, US Federal Reserve chief Jerome Powell delivered yet another hawkish message. Powell said the central bank needs to keep acting forthrightly “until the job is done,” referring to bringing inflation back towards 2%.

Government bonds took a dive following the events, with near-term German Bund yields jumping to their highest in over a decade. US Treasury yields also advanced but remained below their weekly peaks, preventing the dollar from turning higher.

“Price stability is the top priority,” ECB’s Lagarde clarified on Friday, as her American counterpart, put inflation before growth. US policymakers have dismissed the risk of a recession, despite two consecutive quarterly Gross Domestic Product contractions. Meanwhile, the Union faces the worst crisis since its creation. The Russian company Gazprom has cut off gas supplies to Europe indefinitely.

European energy crisis steepens

Ahead of the ECB announcement, the focus was on skyrocketing energy prices, hitting households and businesses evenly. Mid-week, European non-ferrous metal producers called for emergency EU action to prevent permanent deindustrialization in a letter to the European Commission President, Ursula Von der Leyen. Producers noted that “50% of the EU’s aluminium and zinc capacity has already been forced offline due to the power crisis.”

The EU will meet in the upcoming days to define an oil price cap to Russia, to which Russian President Vladimir Putin responded that a G7 oil price cap "would be an absolutely stupid decision," adding they would not supply "anything" if it's contrary to Russian economic interest. "No gas, no oil, no coal, no fuel oil, nothing." Additionally, Moscow announced the construction of new pipelines to transport gas, some of which pass through Mongolia to China.

Profit-taking ahead of the weekend and the better tone of global equities weighed on the greenback, but have we seen the last of its rally? A due correction is much needed, so further USD losses are possible but not likely to be sustainable over time. Speculative interest is well aware of the risks the US may face, but there’s no clear view yet on how the energy crisis will affect the Union in the winter.

The US is better positioned to deal with the economic challenges, eventually leaning the scale further into the USD benefit.

Economic resilience, a light of hope

On a positive note, macroeconomic data has shown resilience. Despite the fact that S&P Global downwardly revised its businesses outputs for August, official data has beat expectations. The official US ISM Services PMI unexpectedly rose to 56.9 in the month, while the EU upwardly revised its Q2 Gross Domestic Product to 0.8% QoQ. Consumer confidence at both shores of the Atlantic remains depressed amid continued inflationary pressures, with more clarity on the matter coming next week.

On Tuesday, Germany will publish the final estimate of its August Consumer Price Index, expected to be confirmed at 7.9% YoY. On the same day, the US will publish the August CPI expected to have increased by 8.1% YoY, shrinking from 8.5% in the previous month.

Later in the week, the US will release August Retail Sales and the preliminary estimate of the September Michigan Consumer Sentiment Index, while the EU will release the final estimate of its August inflation data.

It is worth noting that the US Federal Reserve enters blackout mode ahead of its monetary policy announcement on September 21.

EUR/USD technical outlook

The EUR/USD pair hit a three-week high of 1.0112 ahead of the close, retreating from the level as dollar buyers are not ready to give up. The weekly chart shows that technical indicators are barely recovering from oversold readings, as the pair develops roughly 300 pips below a firmly bearish 20 SMA. The longer moving averages maintain their downward slopes but are too far away to be technically relevant. At this point, the modest bounce from record lows is barely seen as corrective and not enough to confirm an interim bottom.

Technical readings in the daily chart support a possible bullish extension. The pair is above its 20 SMA for the first time since mid-August, although the moving average maintains its bearish slope. Technical indicators head firmly north, with the Momentum well into positive levels but the RSI at around its midline. Finally, the longer moving averages keep heading south far above the current level, limiting the chances of a trend change.

Bulls may need to push the pair above the 1.0220 price zone to become more confident. A daily descending trend line coming from this year's high at 1.1494 falls around the level, providing strong static resistance. Once above the area, the next relevant resistance is the 1.0340 price zone.

Support could be found at 0.9990, 0.9920 and the 0.9860 price zone. Should the pair break below the latter, the long-term bearish trend will likely pick up pace, with the next relevant target at 0.9700.

EUR/USD sentiment poll

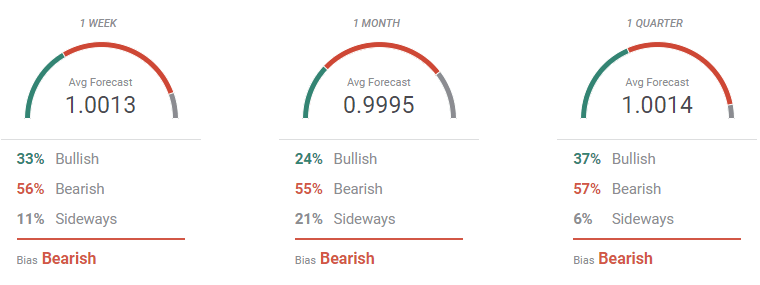

According to the FXStreet Forecast Poll, the EUR/USD pair is seen averaging parity for the next three months, although the poll offers some interesting takeaways. The first one is that bears dominate the three time frames under study, accounting for over 50% in all cases. Bulls, on the other hand, are down to 24% in a one-month view, suggesting sellers are still holding the grip.

The Overview chart shows that the near-term moving average remains directionless, as the spread of potential targets is well-limited around the current level. The monthly moving average turned lower as most targets accumulate below parity, although some wild cards have appeared with bets up to 1.12. However, the quarterly view offers once again a bearish moving average and most targets below the current level, while none above 1.10. Pretty much, a corrective advance seems likely in the upcoming weeks, although the long-term perspective is still bearish.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.