EUR/USD Price Forecast: Further gains still remain in the pipeline

- EUR/USD seems to have met some decent resistance below 1.0900.

- The US Dollar kept the trade near recent multi-month lows.

- Global markets remain under pressure on tariff uncertainty.

A volatile start to the week saw EUR/USD hover around recent multi-month peaks in the 1.0830 zone, managing to keep the trade above the critical 200-day SMA.

In the meantime, investors continued to assess Germany’s recent announcement of a massive €500 billion infrastructure fund—unveiled by the country’s prospective coalition government during last week. This ambitious plan features sizable investments in public projects and reforms to borrowing rules, fortifying Europe’s economic outlook amid persistent global trade uncertainties. Traders interpreted the move as a powerful growth driver for the Eurozone, lifting overall market confidence.

The EUR/USD’s irresolute performance was also accompanied by the lacklustre advance in the US Dollar (USD), which managed to regain some composure and slightly reverse part of the recent multi-day deep pullback. In the meantime, investors have grown increasingly uneasy about the US economy’s resilience, exacerbated by President Trump’s fluctuating stance on trade.

Trade tensions and geopolitics remain front and centre

Recent trade headlines highlight the volatile environment:

- New tariffs: The US imposed 25% tariffs on Canadian and Mexican goods, alongside a 20% tariff on Chinese imports, triggering retaliatory measures and intensifying market anxieties.

- Temporary Relief: President Trump announced Mexico and Canada would temporarily dodge tariffs on goods under the United States-Mexico-Canada Agreement (USMCA) until April 2.

- Market Implications: Tariffs can fan inflation pressures—potentially supporting the USD if the Federal Reserve (Fed) opts for tighter policy. Yet they can also dampen growth, leading the Fed to adopt a more cautious stance and weighing on the dollar.

Meanwhile, Europe remains on edge about possible US tariffs on EU exports, which could drag on the euro. But some relief emerged on reports suggesting progress toward a peace deal between Russia and Ukraine, offering a glimmer of hope after the recent tense White House meeting between Presidents Trump and Zelenskyy.

Central bank policies in the spotlight

- Federal Reserve: At its most recent meeting, the Fed left interest rates at 4.25%–4.50%. Chair Jerome Powell underscored robust US economic fundamentals, controlled inflation, and a tight labour market—implying no immediate push toward lower rates. However, trade-driven price increases could complicate the Fed’s policy path.

- European Central Bank (ECB): The ECB trimmed its key rates by 25 basis points, hinting at the possibility of further easing. Policymakers cited rising economic uncertainty—thanks to trade tensions with the US and planned large-scale military spending—as the impetus behind this move. The ECB also lowered its growth projections for the Eurozone, while raising its near-term inflation forecasts but expecting price pressures to level out by 2026.

EUR/USD technical outlook

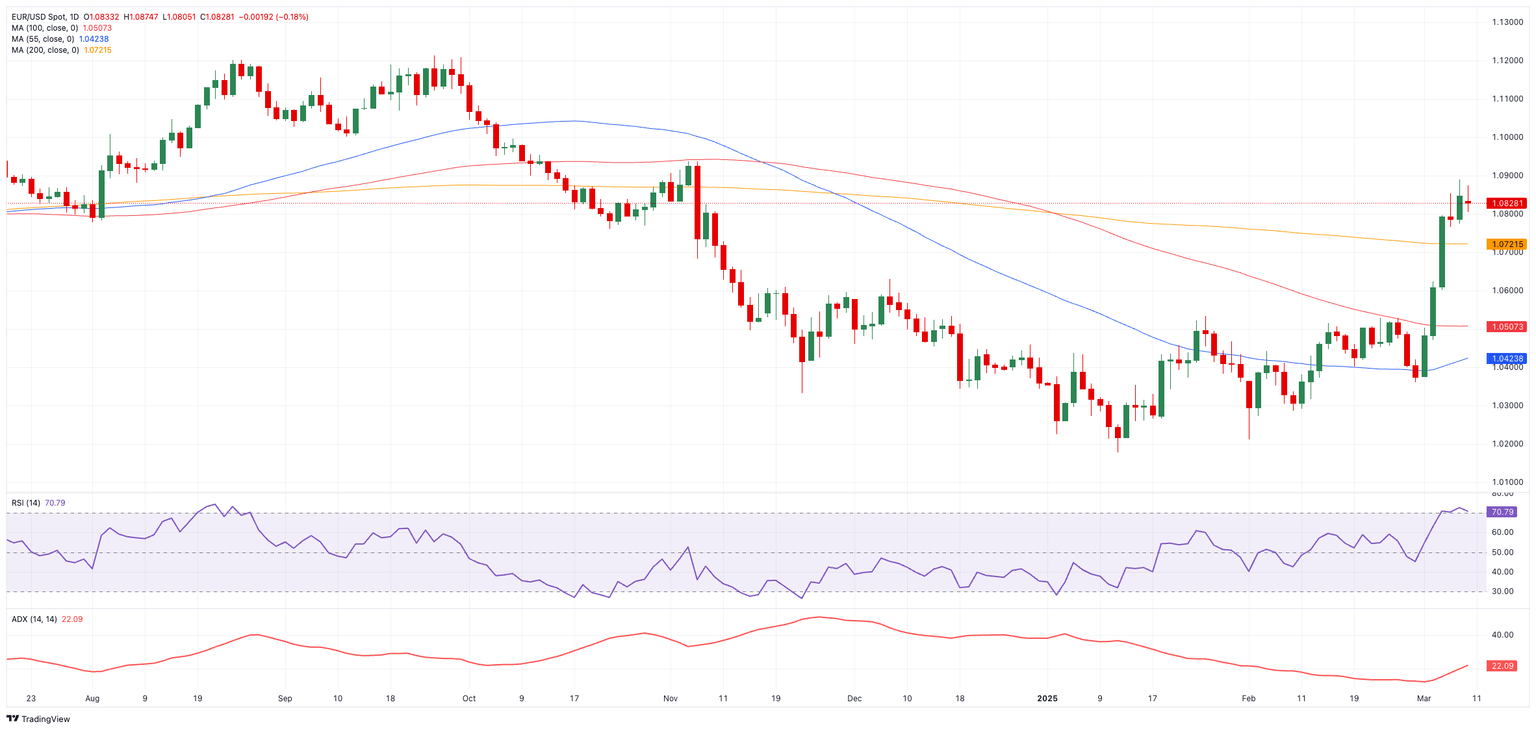

Immediate resistance stands at 1.0853, the 2025 high from March 6. A decisive break above this level could pave the way toward 1.0936, the November 2024 high, followed by 1.0969, which corresponds to the 23.6% Fibonacci retracement of the September–January sell-off.

On the downside, key support levels include the 200-day SMA at 1.0725, seconded by the interim 100-day SMA at 1.051 and the 55-day SMA at 1.0424. Down from here emerges 1.0359, the February 28 low. Further support is seen at 1.0282, the February 10 low, 1.0209 from February 3, and the 2025 bottom at 1.0176, recorded on January 13.

Momentum indicators reflect an overbought market, with the Relative Strength Index (RSI) hovering around 72, while the Average Directional Index (ADX) continues to rise, hitting 22 and suggesting a strengthening trend.

EUR/USD daily chart

Short-term considerations

Looking ahead, EUR/USD’s near-term trajectory will be shaped by several key factors. Trade developments, including any changes in tariff policies or retaliatory measures, could swiftly alter market dynamics. Central bank actions, particularly the diverging monetary paths of the Federal Reserve and the European Central Bank, will remain a crucial driver of currency flows.

Eurozone growth prospects, supported by Germany’s infrastructure plans and broader European fiscal strategies, may provide continued strength for the single currency. Additionally, geopolitical headlines will play a significant role—progress in resolving the Russia-Ukraine conflict could lift risk sentiment, while setbacks might weigh on the euro.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.