EUR/USD Price Forecast: Extra gains seem on the cards

- EUR/USD lost the smile and retreated to five-day lows near 1.1460.

- The US Dollar garnered impulse after the Fed left rates unchanged.

- The Fed left the door open to extra rate cuts in the latter part of 2025.

The Euro (EUR) added to Tuesday’s weakness and drifted to fresh lows vs. the US Dollar (USD) on Wednesday. In fact, EUR/USD managed to reclaim the 1.1500 hurdle earlier in the day but eventually succumbed to the late Powell-led bounce in the US Dollar Index (DXY), which flirted with the key 99.00 barrier.

The move lower in the pair also came in tandem with extra weakness in US yields across different time frames as well as the second daily pullback in German 10-year bund yields.

Geopolitics adds to trade uncertainty

Heightened tensions in the Middle East have offset any fresh momentum from US-China trade talks, while the July 9 deadline for the “Liberation Day” tariffs continued to weigh on sentiment.

Indeed, the conflict between Israel and Iran escalated in recent hours, with market participants now starting to speculate over the potential intervention of the US in the crisis.

Divergent Central bank paths

Following the Fed’s meeting, there was unanimous agreement to keep rates between 4.25% and 4.50%, and according to the quarterly forecasts, officials now anticipate somewhat higher unemployment and inflation than they did prior to the recent tariff announcements.

Regarding future rate changes, Fed officials are still split: only two call for a single cut, while seven policymakers, up from four in March, now anticipate no reductions at all, even though the median dot plot still indicates a total of 50 basis points of cuts by year-end. Two officials anticipate an additional quarter-point cut, while eight officials see rates being lowered to 3.75% to 4.00%. The median forecast for 2026 increased slightly from 3.4% in March to 3.6%.

Back to the ECB, the central bank trimmed its deposit rate to 2.00% earlier this month but struck a cautiously hawkish tone. President Christine Lagarde ruled out further easing unless external conditions deteriorate sharply and lifted growth forecasts.

Positioning points to a bullish Euro

Speculative interest in the euro has swelled: CFTC data through June 10 show open interest near its highest level in years, with net long contracts at fresh multi-month highs. Commercial hedgers, meanwhile, have increased short exposure, signalling institutional caution.

What are techs saying?

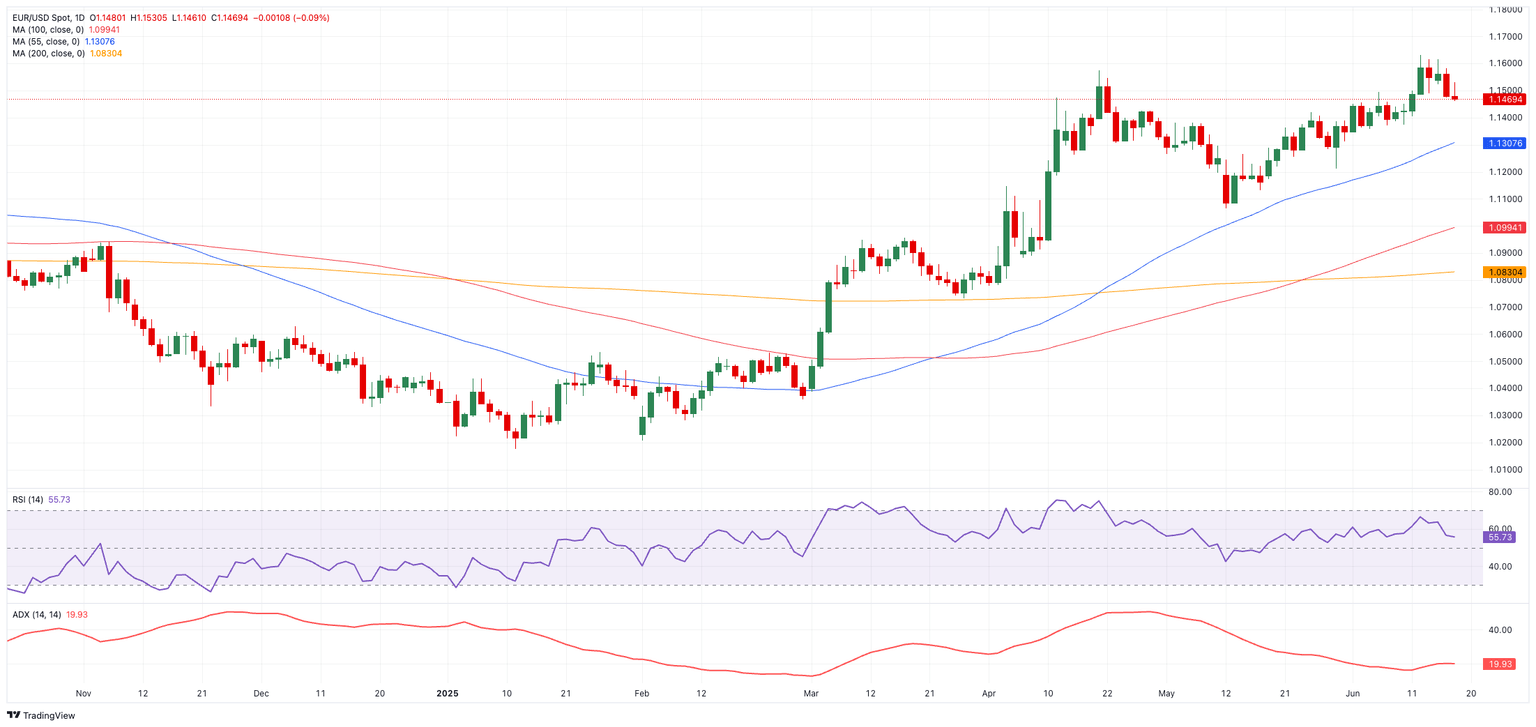

EUR/USD faces immediate resistance at the 2025 peak of 1.1631 (June 12), ahead of the October 2021 peak of 1.1692 and the round figure at 1.1700.

On the downside, support lies at the 55-day SMA at 1.1315, prior to the weekly trough of 1.1210 (May 29) and the monthly base of 1.1064 (May 12).

Momentum indicators paint a mixed picture: the Relative Strength Index (RSI) reading around 59 suggests bullish tilt, while the Average Directional Index (ADX) near 21 points to a modest trend strength.

EUR/USD daily chart

Looking Ahead

Key euro-area data this week include the EMU’s Construction Output (June 19), while German Producer Prices, the preliminary June Consumer Confidence survey, and the ECOFIN meeting are all due on June 20.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.