EUR/USD Price Forecast: Cautiously optimistic

- EUR/USD retreated from multi-week highs and returned below 1.1400.

- The US Dollar made quite a sharp reversal after bottoming out in six-week troughs.

- The JOLTs report came in above expectations in April; Factory Orders disappointed.

Driven by fresh US Dollar (USD) strength, the Euro (EUR) has surrendered a big chunk of Monday’s advance, sending EUR/USD back to the 1.1360 zone despite briefly surpassing 1.1450 earlier in the day, the highest level in the last six weeks.

By the same token, the US Dollar Index (DXY) managed to regain composure and rapidly bounced off the 98.50 zone, or six-week troughs, reclaiming the 99.00 barrier and beyond in a context of further recovery of US yields across the curve.

Tariffs return to centre stage

After President Trump declared intentions to boost taxes on imported steel and aluminium—from 25% to 50%—in a move that restored world trade war worries, sentiment towards the Greenback worsened further. The declaration followed charges that China broke an earlier deal with the US on easing trade restrictions on vital minerals.

It is worth recalling that those increased levies on steel and aluminium are expected to kick in on Wednesday, the same day the Trump administration wants nations to make their best proposals in trade talks.

Markets were already on edge given rumours of a possible 50% import charge on Europe. Although that report had first underpinned the single currenct and the Dollar on optimism for fresh US-EU discussions, more general issues over the lack of progress in negotiations with China and the UK have limited risk appetite

Policy divergence back in focus

Once again, FX dynamics are being driven in great part by different central bank policies.

Though trade concerns and inflation were weakening, the Federal Reserve (Fed) refrained from acting on rates in May. Subsequent meeting Minutes revealed internal disagreement on how best to strike a compromise between the Fed's employment mission and inflation management.

Furthermore, markets now show an increasing likelihood of two rate cuts, possibly beginning in September.

The European Central Bank (ECB), on the flip side, is widely anticipated to trim its interest rates by 25 basis points at its June 5 event, lowering the Deposit Facility rate to 2.00%.

Still, officials are wary. While Bundesbank President Joachim Nagel cautioned it was "too early" to indicate future cuts, Chief Economist Philip Lane raised persistent inflation concerns—especially if EU-US trade negotiations fail.

Speculators turn bullish on EUR

CFTC statistics for the week ending May 27 showed that net longs in the EUR rose to around 79.5K contracts, the highest level in two weeks. Just the opposite, commercial traders increased their net shorts, which means more hedging activity. In addition, open interest rose to 760.5K contracts, its highest level since December 2023.

Technical picture: Bulls remains in control

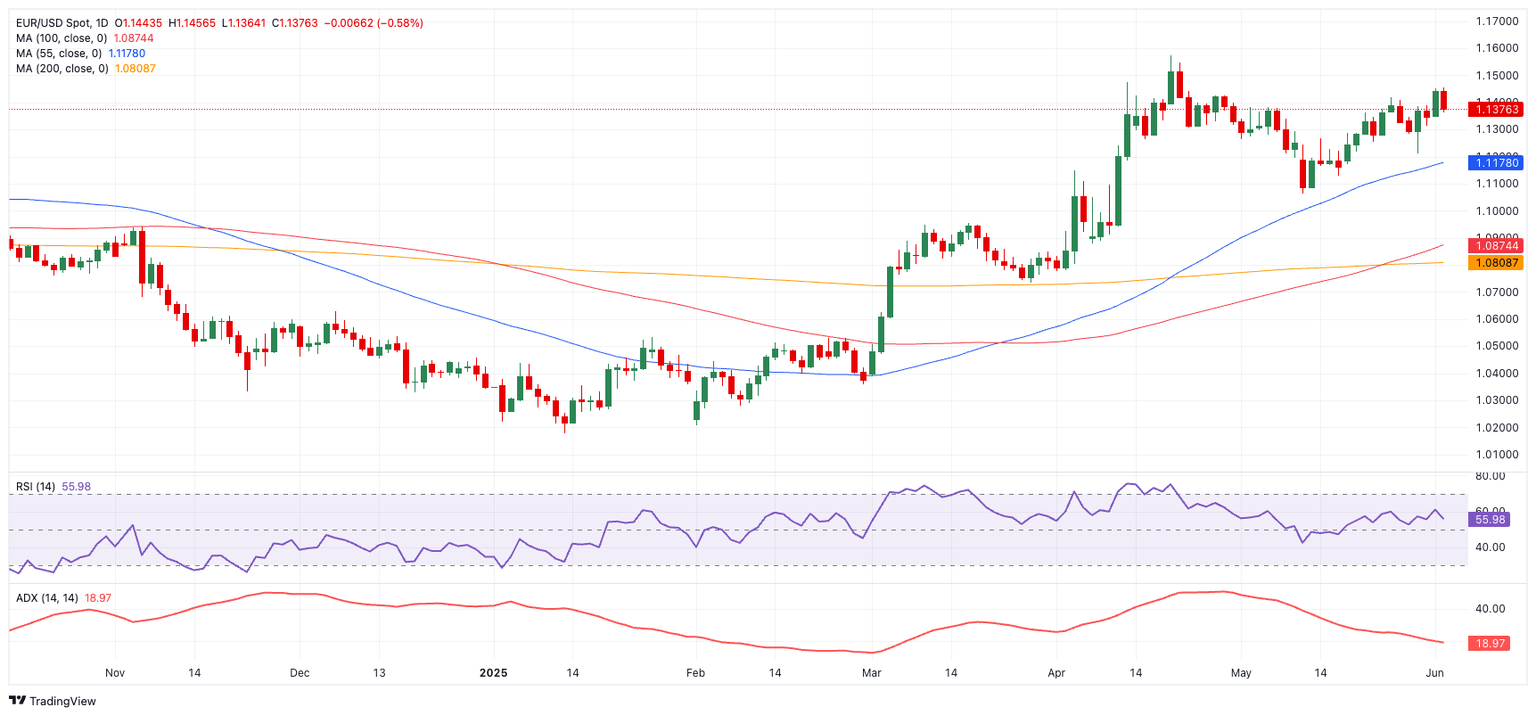

Still well-supported above its 200-day simple moving average (SMA) at 1.0816, the near-term outlook for the pair appears constructive.

The YTD high at 1.1572 (April 21) marks immediate resistance, followed by the 1.1600 milestone, and the October 2021 top comes at 1.1692 (October 28).

On the downside, temporary support emerges at the 55-day SMA at 1.1183, then the May low at 1.1064 (May 12), while further south appears the psychological 1.1000 level. A break below the latter would activate a potential move to the crucial 200-day SMA.

Momentum indices provide a mixed picture. Though the Average Directional Index (ADX) at 19 indicates the trend may be losing some steam, the Relative Strength Index (RSI) around 56 indicates a developing bullish momentum.

EUR/USD daily chart

The road ahead

The latest HCOB Services PMI for Germany and the Eurozone is expected on June 4. Germany will report its Factory Orders and the HCOB Construction PMI on June 5. On the same day, the EMU will also release its HCOB Construction PMI and Producer Prices. On June 6, Germany will disclose its Balance of Trade data. This will come before the euro area's Retail Sales, Employment Change, and final Q1 GDP Growth Rate numbers.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.