EUR/USD Price Forecast: Buyers retain control with a cautious approach

EUR/USD Current price: 1.1361

- Markets keep an eye on global trade progress and the upcoming Federal Reserve decision.

- EU Sentix Investor Confidence improved in April as the tariffs’ dust settled.

- EUR/USD gains modest upward traction, near-term resistance at 1.1370.

The EUR/USD pair advances on Monday, holding on to modest gains early in the American session at around 1.1360. The US Dollar (USD) eases against all its major rivals as investors look at progress, or the lack of it, in global trade negotiations, while waiting for the Federal Reserve (Fed) monetary policy decision to be announced on Wednesday.

Over the weekend, United States (US) President Donald Trump reiterated that meetings to achieve trade deals are underway with multiple countries, including China, adding the main priority is to secure a “fair” deal with Beijing.

Trump also said that levies on Chinese imports will eventually be lowered, “ because otherwise you could never do business with them,” he concluded. The news maintained financial markets in a good mood, underpinning Asian and European indexes. Wall Street, however, is poised for a tepid start to the week.

Data-wise, the Eurozone (EU) released May Sentix Investor Confidence, which improved to -8.1 from -19.5 in April. The official report states that, after the massive shock from US tariffs, the dust is settling. Investors are revising their economic assessments, and Expectations rebounded strongly and are back in positive territory.

The US session will bring the April ISM Services Purchasing Managers’ Index (PMI), foreseen at 50.6, slightly below the 50.8 posted in March.

EUR/USD short-term technical outlook

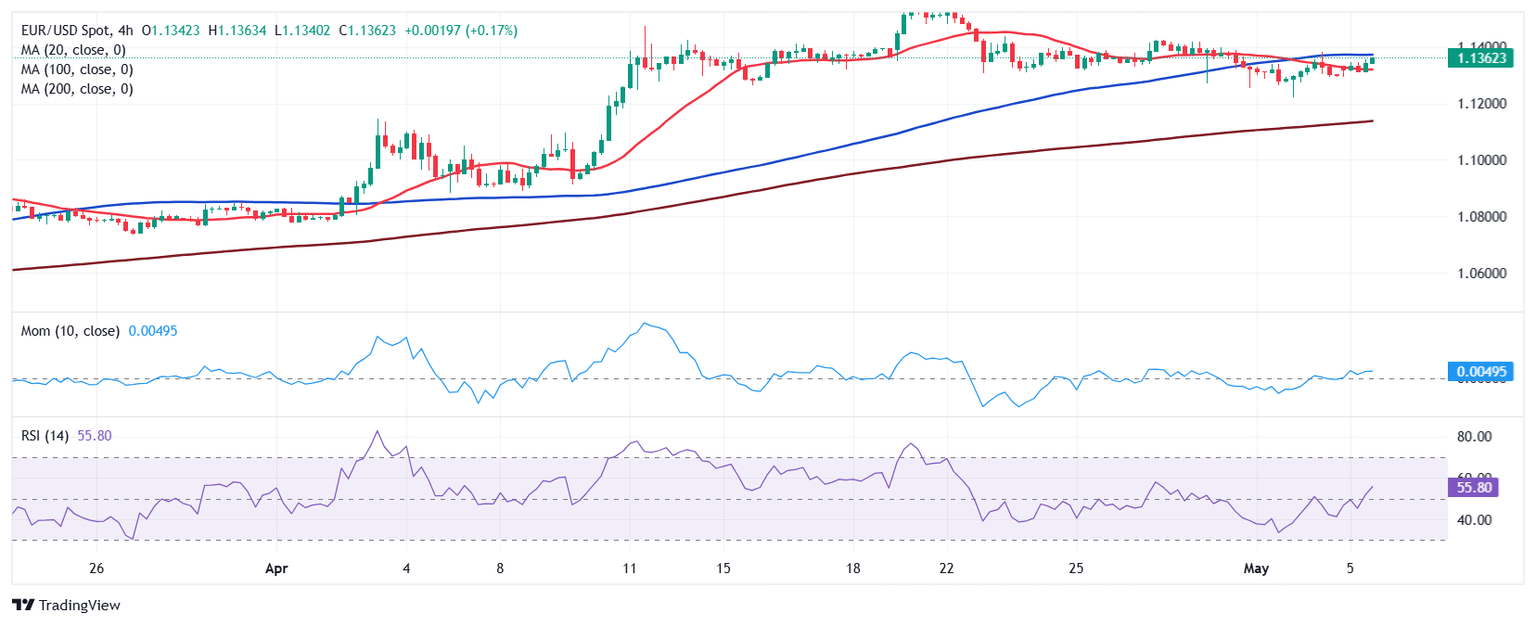

Technically, the daily chart for the EUR/USD pair shows bulls retain control, but stand cautious. The pair met buyers for a third consecutive day at around a bullish 20 Simple Moving Average (SMA) while the 100 and 200 SMAs grind higher far below the shorter one. Technical indicators, in the meantime, are slowly grinding higher, with the Momentum indicator stuck around its 100 line, yet the Relative Strength Index (RSI) indicator aiming to resume its advance at around 58.

In the near term, and according to the 4-hour chart, EUR/USD is neutral. The pair is trapped below a mildly bullish 100 SMA, providing immediate resistance at around 1.1370, while above a mildly bearish 20 SMA at 1.1325. The 200 SMA, in the meantime, lacks directional strength in the 1.1120 region. Finally, technical indicators advance with modest strength, although they are barely above their midlines.

Support levels: 1.1325 1.1275 1.1230

Resistance levels: 1.1370 1.1410 1.1465

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.