EUR/USD Price Forecast: Buyers maintain the pressure

EUR/USD Current price: 1.1627

- Hopes about easing Middle East tensions boosted demand for the Euro.

- Federal Reserve Chair Powell repeated his wait-and-see approach amid inflation concerns.

- EUR/USD holds near a fresh 2025 high, with buyers aiming for higher highs ahead.

As the American session comes to an end, EUR/USD holds on to substantial gains near a fresh multi-year high of 1.1642. The pair rallied on Tuesday amid headlines indicating a ceasefire in the Middle East. The Iran-Israel conflict has come to a pause after the United States (US) hit Iranian nuclear facilities, and the latter responded by launching missiles at a US military base in Qatar.

Investors were anticipating a continued escalation of the conflict, but US President Donald Trump surprised financial markets by announcing through Truth Social a ceasefire. Risk appetite flooded financial boards to the detriment of the US Dollar (USD), which fell equally vs high-yielding and safe-haven rivals.

Tepid US macroeconomic data put additional pressure on the USD, as CB reported that Consumer Confidence retreated towards 93 in June after the 98.4 posted in May, while missing the market’s expectations of 99.8

Finally, Federal Reserve (Fed) Chairman Jerome Powell testified on monetary policy before Congress. Powell repeated most of what he said following the latest Federal Open Market Committee (FOMC) meeting, in which policymakers decided to leave interest rates on hold. Powell will repeat his testimony before a different commission on Wednesday.

EUR/USD short-term technical outlook

From a technical point of view, the EUR/USD pair is poised to extend its advance. The daily chart shows the pair keeps pressing highs, while developing above all its moving averages. In fact, a bullish 20 Simple Moving Average (SMA) leads the way north by providing support, currently at around 1.1460. Technical indicators, in the meantime, tick north within positive levels with uneven momentum yet still reflecting buyers’ strength.

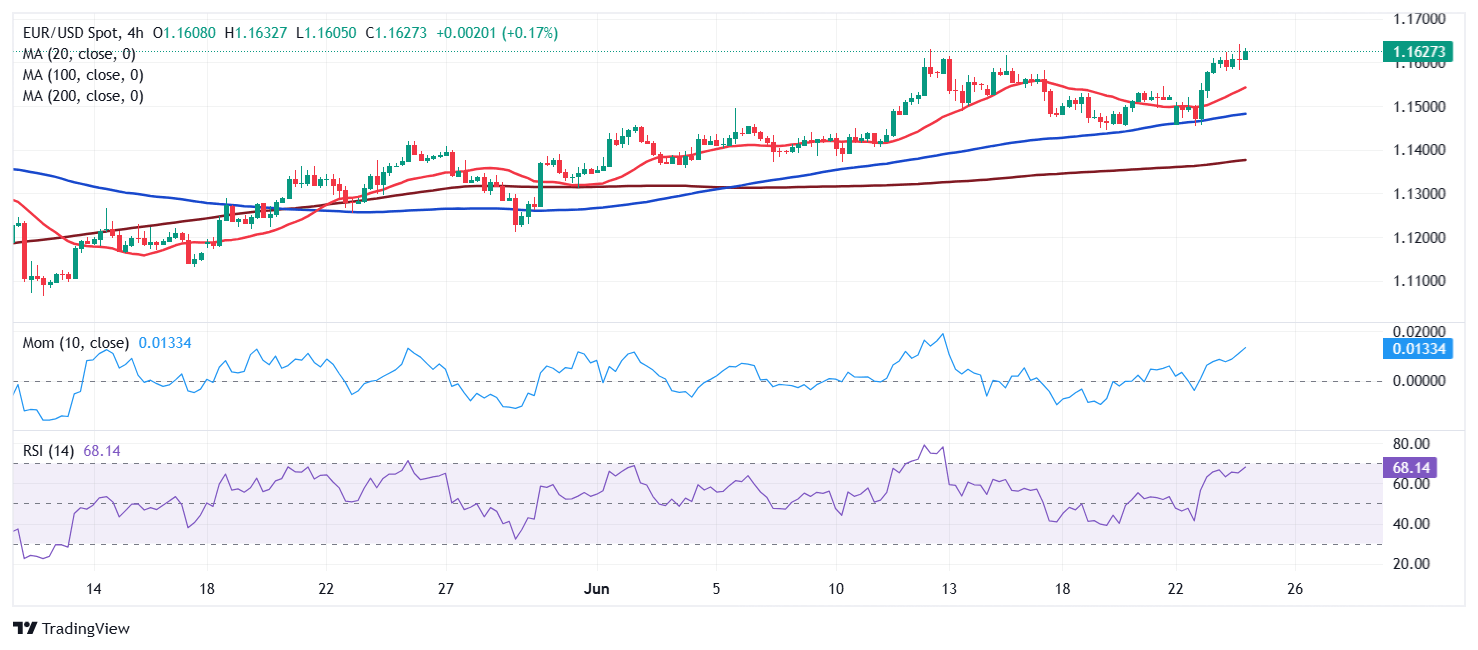

The 4-hour chart shows EUR/USD has room to extend its advance. Technical indicators keep heading higher near overbought readings, far from signalling upward exhaustion. At the same time, the 20 SMA accelerated north and currently stands at around 1.1520, while the 100 and 200 SMAs also tick higher, far below the shorter one.

Support levels: 1.1600 1.1560 1.1510

Resistance levels: 1.1660 1.1700 1.1745

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.