EUR/USD Price Forecast: A technical correction should not be ruled out

- EUR/USD came under pressure following recent multi-month peaks.

- The US Dollar rebounded marginally, reversing part of the current weakness.

- US inflation readings came in short of estimates in February.

After three consecutive daily advances, EUR/USD gave away a small part of those gains on the back of the lacklustre bounce in the US Dollar (USD).

Indeed, the pair briefly dropped below the 1.0900 support, while the US Dollar Index (DXY) revisited the 103.80 zone on the back of further improvement in US yields across various time frames vs. a small dip in the 10-year bund yields.

It is worth mentioning that the ongoing rally lifted the pair to a shouting distance from the 23.6% Fibo of the pronounced September-January sell-off, currently at 1.0969.

Trade jitters and a fragile Dollar

Investor anxiety over the US economy persists, driven by US President Donald Trump’s evolving stance on trade.

Fresh tariffs—including a 25% duty on Canadian and Mexican goods and a 20% tariff on Chinese imports—have rattled markets, even though Canada and Mexico were granted a temporary reprieve until April 2.

While tariffs can push inflation higher and prompt the Federal Reserve (Fed) to tighten policy, they can also weigh on economic growth, which might force the Fed to be more cautious, complicating the Dollar’s outlook.

Hope emerges on the Russia-Ukraine front

The Euro also found support from reports of progress in Russia-Ukraine peace negotiations. After a tense White House meeting between Presidents Trump and Zelenskyy, any hint of reduced geopolitical tension tends to boost risk appetite and favour currencies like the Euro (EUR).

Central banks: The ongoing driver

The Fed recently kept rates in the 4.25%–4.50% range, with Chair Jerome Powell emphasizing strong US fundamentals, subdued inflation, and a tight labour market. However, rising prices from tariffs could complicate the Fed’s policy decisions.

Across the Atlantic, the European Central Bank (ECB) cut key rates by 25 basis points and indicated it might consider additional easing if uncertainties persist. The ECB also trimmed Eurozone growth forecasts while slightly raising near-term inflation estimates, although it expects price pressures to settle by 2026.

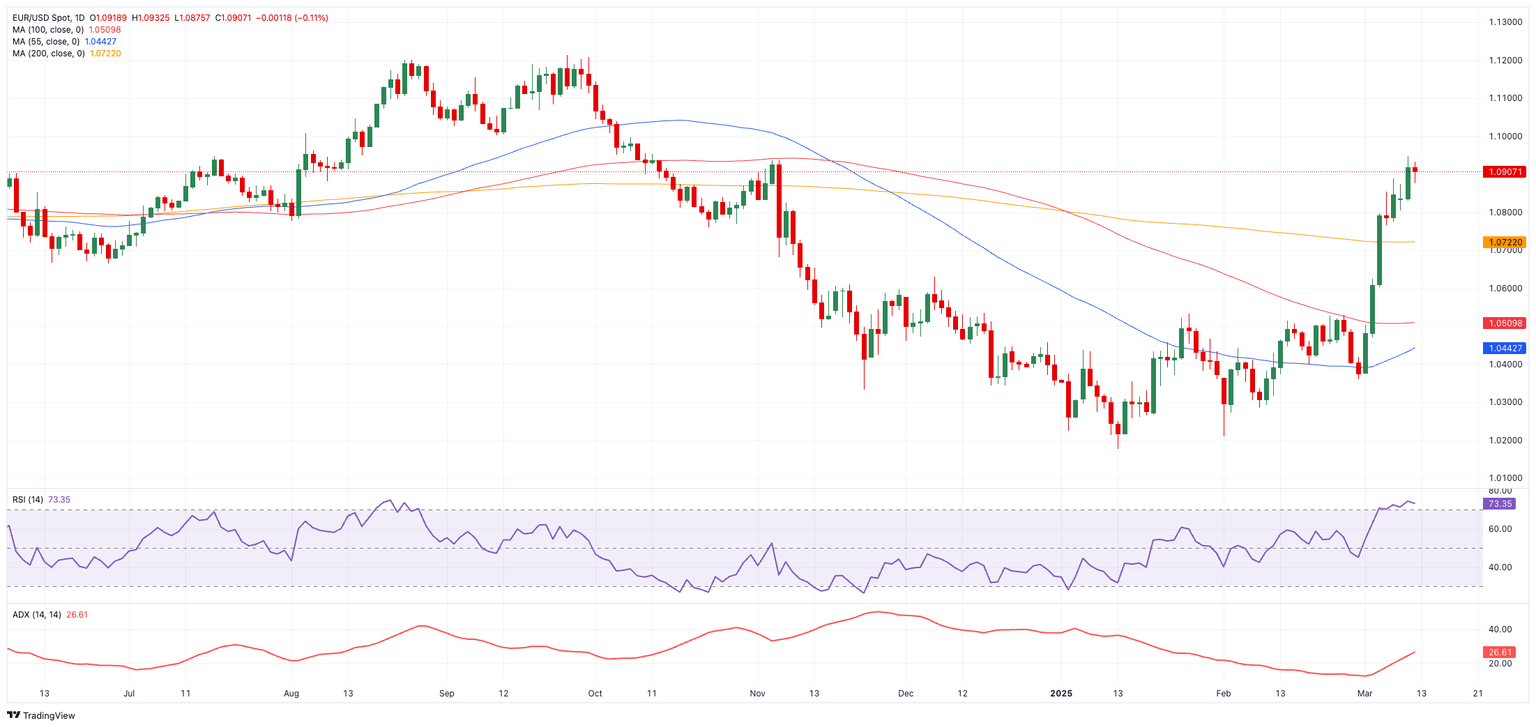

EUR/USD technical picture

The pair faces immediate resistance at 1.0946 (the 2025 high from March 11). A solid break above that level could see a test of 1.0969, the 23.6% Fibonacci retracement of the September–January downtrend, all prior to the key 1.1000 threshold.

On the other hand, key support begins at the 200-day Simple Moving Average (SMA) around 1.0726, followed by the interim 100-day and 55-day SMAs at 1.0517 and 1.0442. Below those levels lie 1.0359 (February 28 low), 1.0282 (February 10 low), 1.0209 (February 3), and 1.0176 (the 2025 bottom from January 13).

Momentum indicators signal an overbought market, with the Relative Strength Index (RSI) hovering near 74 and the Average Directional Index (ADX) rising to almost 27, hinting at a strengthening uptrend. The persistence of these overbought conditions could spark a technical correction in the not-so-distant future.

Short-term outlook

Looking ahead, EUR/USD is poised to respond to shifts in trade policy, differences in central bank strategies, and signs of growth in the Eurozone—particularly from Germany’s proposed spending plans. Developments in the Russia-Ukraine situation will also remain a pivotal factor in shaping market sentiment over the coming days.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.