EUR/USD: New opportunities at the support level

Powell said yesterday about the same thing as on Wednesday, but this time the market believed him more, and the dollar went on a confident offensive this morning, continuing yesterday's still modest growth.

The euro is actively decreasing today both in the main cross-pairs and against the dollar. Published this morning, macro data for Germany and the Eurozone pointed to a continuing decline in business activity.

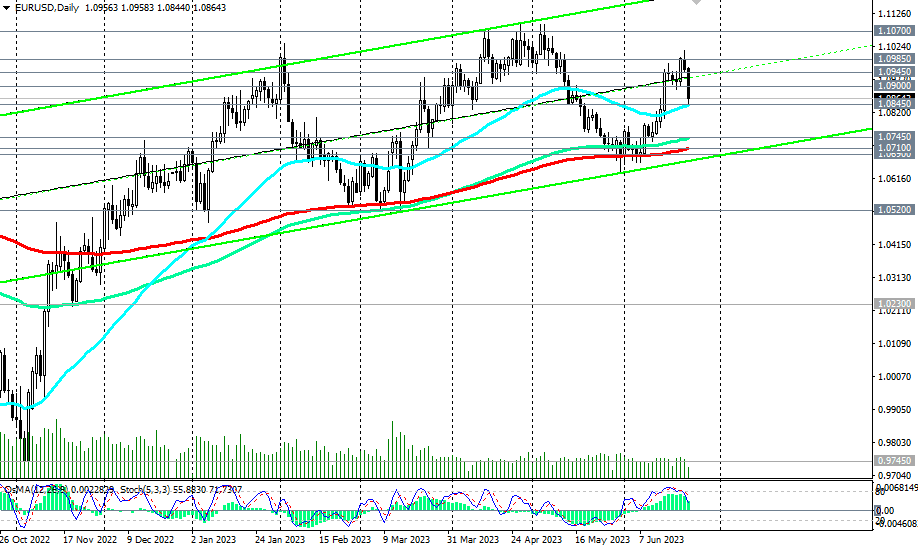

However, given the medium-term uptrend of EUR/USD, the decline should be assessed as corrective for now, providing an opportunity to enter new long positions with the prospect of growth towards the resistance level 1.1570.

Thus - buying from the levels 1.0845, 1.0850. The breakout of the resistance level 1.0900 (EMA200 on the 1-hour chart) will strengthen the positive dynamics of EUR/USD, and the breakout of the resistance levels 1.0945 (EMA144 on the weekly chart), 1.0985 will confirm our assumption.

Today, the focus of investors will be macro statistics on business activity in the manufacturing and service sectors of the American economy.

Preliminary PMIs (from S&P Global) are expected to show moderate growth in June in the manufacturing sector and the composite indicator (48.5 and 54.4 vs. 48.4 and 54.3, respectively), while PMI in the sector services decreased slightly (to 54.0 from 54.9 in May), while remaining above the value of 50, which separates the growth of activity from the slowdown. In May, manufacturing PMI fell for the first time this year, suggesting that a prolonged cycle of rising interest rates (read: the cost of borrowing for businesses) is already hurting businesses, pushing the economy into recession.

If the data on business activity in the US turns out to be better than the forecast, this will increase the likelihood of another Fed rate hike, which will positively affect the dollar (markets are now pricing in a 77% chance of a Fed rate hike in July).

However, the PMI data worse than the forecast will say about the strengthening of economic problems in the US. This is a negative factor for the dollar.

Support levels: 1.0845, 1.0800, 1.0745, 1.0710, 1.0685, 1.0600, 1.0520, 1.0500.

Resistance levels: 1.0900, 1.0945, 1.0985, 1.1000, 1.1070, 1.1100.

Author

Yuri Papshev

Independent Analyst

Independent trader and analyst at Forex market. Trade experience - more than 10 years. In trade Yuri Papshev uses a combination of fundamental and technical analysis.