EUR/USD Forecast: Upside limited despite the broad dollar’s weakness

EUR/USD Current Price: 1.1347

- Germany confirmed the December Consumer Price Index at 5.3% YoY, its highest since 1993.

- Global government bond yields soared amid speculation central banks will have to tighten.

- EUR/USD maintains its bearish stance in the near term needs to break below 1.1305.

The EUR/USD pair peaked at 1.1356 on Wednesday, settling in the 1.1340 price zone, a level around which it hovered for most of the European session. The dollar was unable to attract investors, under mild pressure ever since the day started, despite fresh peaks in government bond yields during London trading hours.

News coming from Germany, confirming inflation at its highest since 1993 in December sent the German 10-year bund yield to 0.025%, its highest in over three years. In response, the yield on the 10-year US Treasury yield touched 1.902%. Nevertheless, European indexes managed to post modest gains, providing temporal support to Wall Street, as US indexes opened in the green. As the American session went through, however, equities lost momentum and return to the red.

The US published December Building Permits, which rose 1.4% and Housing Starts that were up 4%. On Thursday, the EU will release the final readings of December inflation figures, while the US will publish the usual weekly unemployment figures.

EUR/USD short-term technical outlook

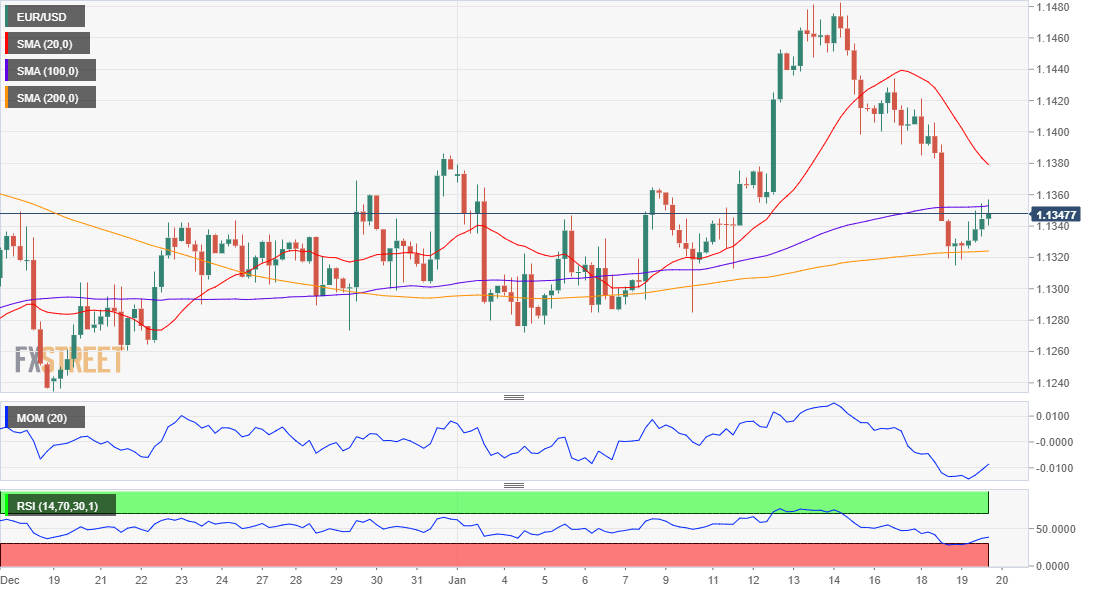

The EUR/USD pair keeps trading between Fibonacci levels, now above 1.1305 but below 1.1385, the 23.6% and the 38.2% retracements respectively of the 1.1691/1.1185 slide. The pair is neutral in the daily chart, trading right below a flat 20 SMA and, as technical indicators lack directional strength around their midlines. The 100 SMA, however, maintains a firmly bearish slope above the current level.

The near-term picture favors another leg lower, as, in the 4-hour chart, the pair is trapped between flat 100 and 200 SMAs, while the 20 SMA heads firmly lower well above the current level. At the same time, technical indicators remain within negative levels, with the Momentum heading lower and the RSI stable at around 39.

Support levels: 1.1305 1.1260 1.1220

Resistance levels: 1.1385 1.1440 1.1485

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.