EUR/USD Forecast: Euro needs to claim 1.1360 to extend recovery

- EUR/USD has managed to erase the losses it suffered on Powell remarks.

- Key resistance seems to have formed around 1.1360.

- Investors await US data releases and Powell's testimony before Financial Services Committee.

Following a sharp decline witnessed during the American trading hours on Tuesday, EUR/USD has regathered its bullish momentum and climbed above 1.1300. However, the pair needs to overcome the 1.1360 hurdle to attract additional buyers.

While testifying before the US Senate Banking Committee on Tuesday, FOMC Chairman Jerome Powell said that it would be appropriate to speed up the pace of asset tapering. Powell further added that it was a good time to retire the word "transitory" for inflation. Following these hawkish remarks, the probability of the Fed leaving the policy rate unchanged by June 2022, according to the CME Group's FedWatch Tool, declined to 23.7% from 43.8% on Monday.

Powell will testify before the House Financial Services Committee later in the day and he is unlikely to change his tone regarding the policy outlook. Although the dollar could show resilience against its rivals on hawkish policy outlook, the fact that the US Dollar Index retreated sharply following the initial upsurge suggests that EUR/USD's losses are likely to remain limited. Meanwhile, the 10-year US Treasury bond yield stays below 1.5% and caps the greenback's gains.

The ADP Employment Change and the ISM Manufacturing PMI will also be featured in the US economic docket on Wednesday.

ADP Jobs Preview: Dollar rally? Why the greenback is set to rise on (almost) any figure.

EUR/USD Technical Analysis

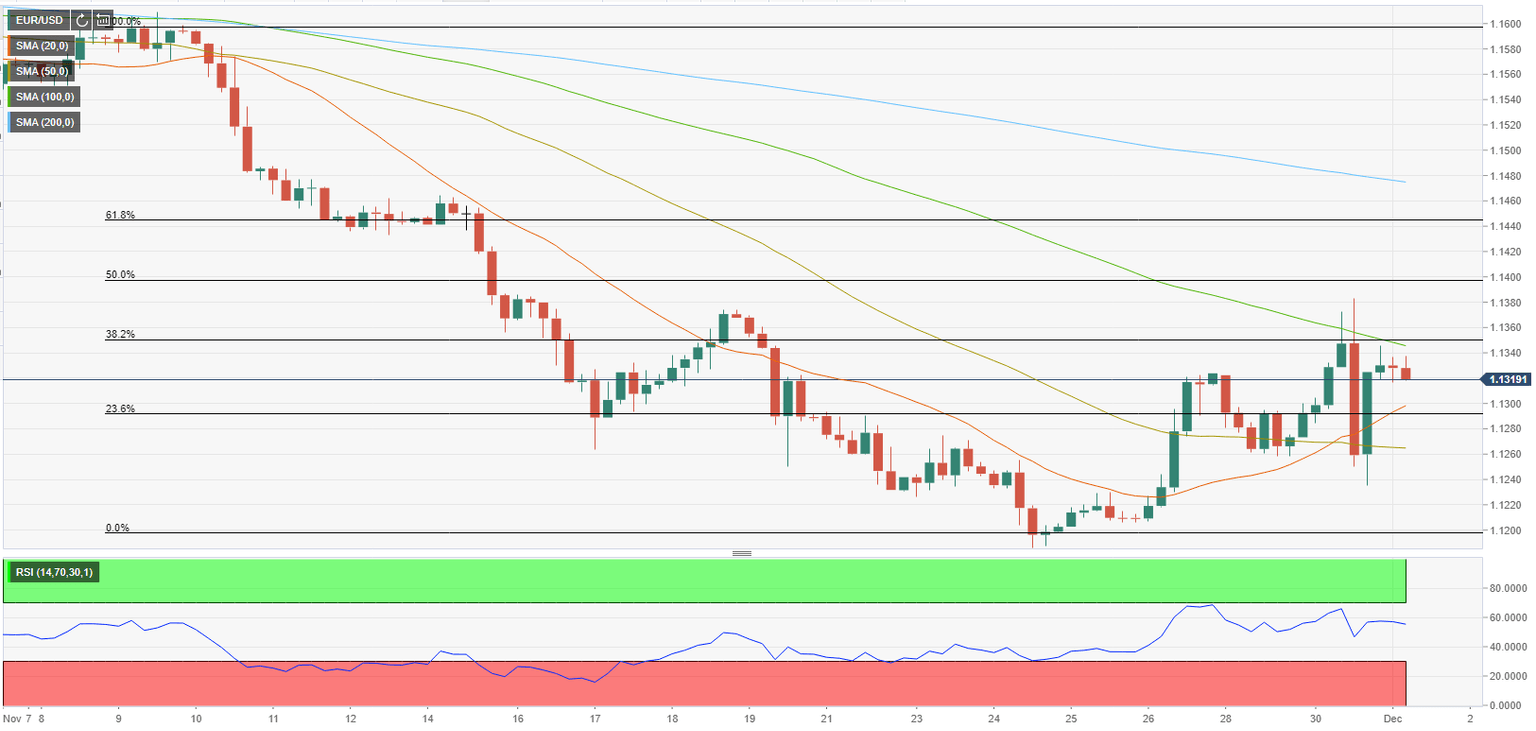

On the four-hour chart, the Relative Strength Index (RSI) indicator has returned to 60 after edging lower to 50, suggesting that sellers remain on the sidelines for the time being.

However, strong resistance seems to have formed around 1.1360, where the Fibonacci 38.2% retracement of November's downtrend meets the 100-period SMA. In case buyers manage to flip that level into support, additional gains toward 1.1400 (Fibonacci 50% retracement) and 1.1450 (Fibonacci 61.8% retracement) could be witnessed.

On the other hand, 1.1300/1.1290 (psychological level, Fibonacci 23.6% retracement, 20-period SMA) aligns as initial support before 1.1260 (50-period SMA) and 1.1235 (Tuesday low).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.