EUR/USD Forecast: Euro defines range before next breakout

- EUR/USD has extended its sideways grind below parity.

- The near-term outlook doesn't point to a directional bias.

- Investors await US Retail Sales and weekly Jobless Claims data.

EUR/USD has been having a difficult time making a decisive move in either direction following the sharp decline witnessed on Tuesday. The pair needs to break above parity to attract buyers and 0.9950 aligns as key support in the near term.

Amid a lack of high-impact macroeconomic data releases, EUR/USD ended up closing flat on Wednesday. European Central Bank (ECB) policymaker Francois Villeroy de Galhau said that he estimates the euro area neutral rate at below or close to 2% and added that they could reach it by the end of the year. These comments, however, failed to provide a boost to the shared currency. On the other hand, the dollar rally lost its steam with Wall Street's main indexes staging a rebound after the opening bell.

US stock index futures trade little changed so far on Thursday, suggesting that the risk perception is unlikely to provide a directional clue in the second half of the day.

Nevertheless, market participants will keep a close eye on macroeconomic data releases from the US. The weekly Initial Jobless Claims have been declining steadily in the past few weeks and another lower-than-expected reading could help the dollar hold its ground. Moreover, Retail Sales are forecast to remain unchanged in August. Since the Retail Sales number is not adjusted for price changes, it's difficult to tell how the market would react but it would be fair to say that today's data releases are unlikely to change how markets are pricing in next week's Fed rate decision.

US Retail Sales Preview: Can consumers keep up with inflation? A breather could weigh on the dollar.

According to the CME Group FedWatch Tool, the probability of a 100 basis points Fed rate hike stands at 28%, down slightly from 31% on Wednesday.

EUR/USD Technical Analysis

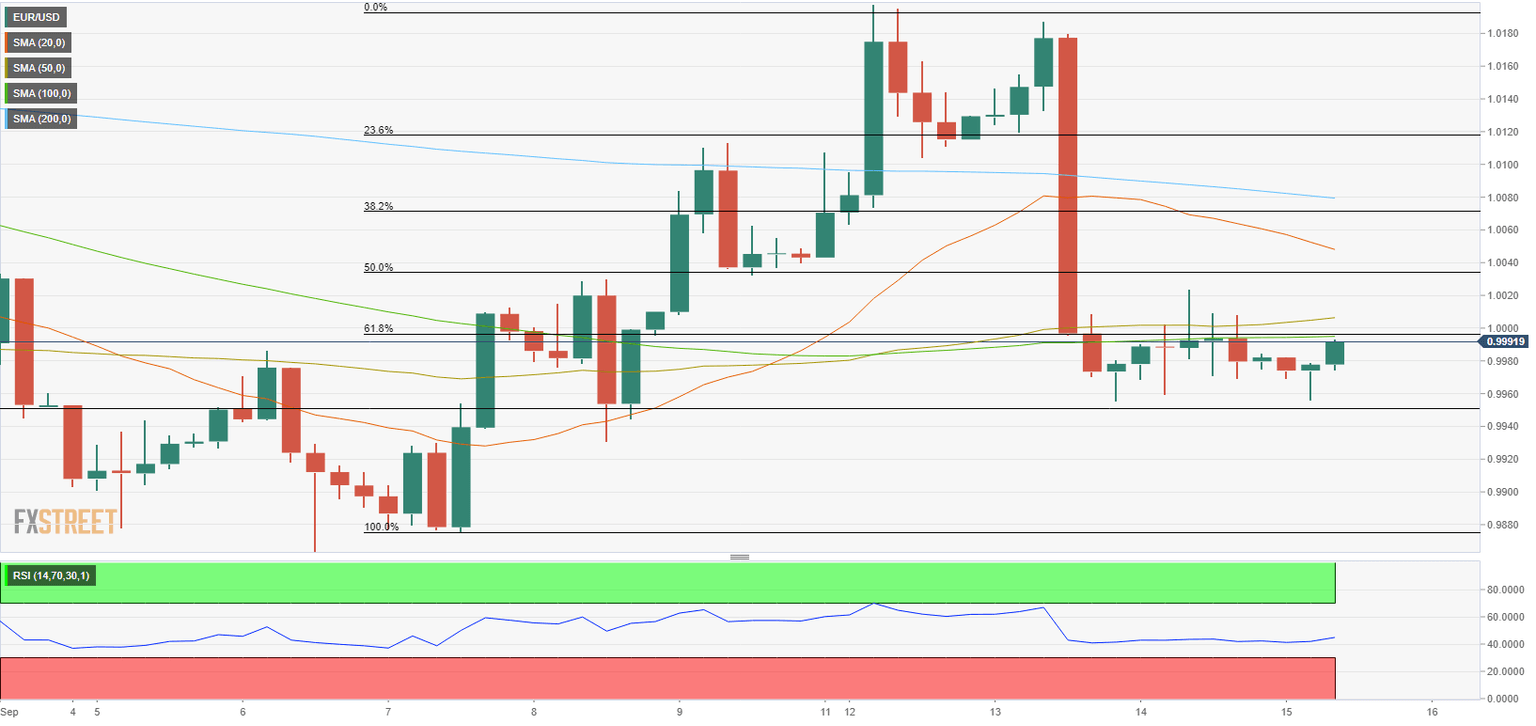

The Fibonacci 61.8% retracement of the latest uptrend forms key resistance at 1.0000. The 50 and the 100-period SMAs on the four-hour chart reinforce that level as well. In case EUR/USD manages to flip that level into support, it could target the 1.0030/40 area (Fibonacci 50% retracement, 20-period SMA) and the 1.0070/80 area (Fibonacci 38.2% retracement, 200-period SMA).

On the downside, sellers could take action with a drop below 0.9950 (static level) and cause EUR/USD to decline toward 0.9900 (psychological level) and 0.9865 (September 6 low).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.