USD/JPY tests resistance after Nikkei-led surge

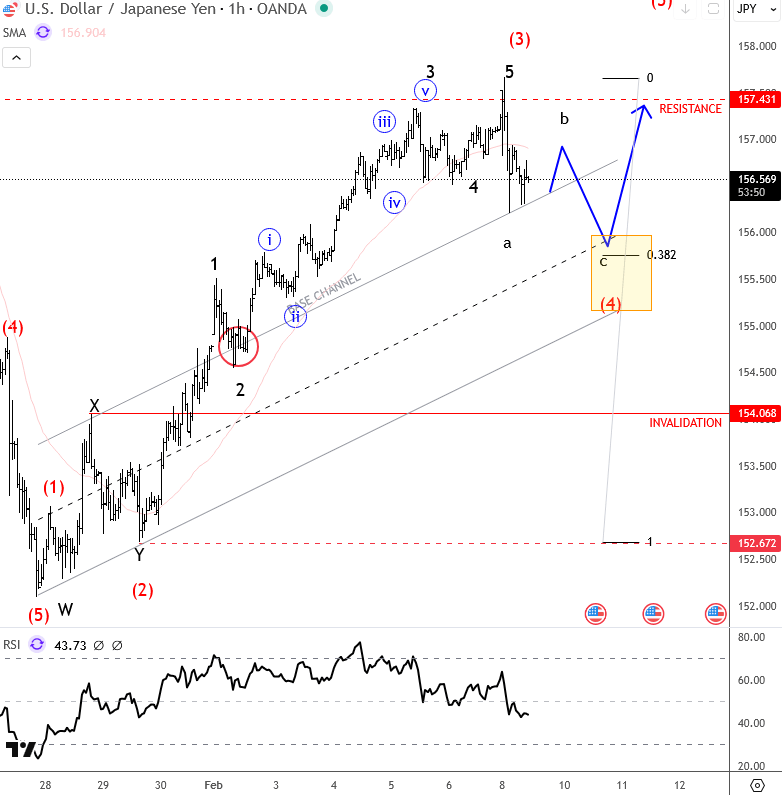

Nikkei surged to fresh highs and USD/JPY also gapped higher after Takaichi’s election win, reflecting a strong risk-on response and renewed yen weakness. However, the pair is now testing the 157.43 resistance area, where momentum is starting to slow and a short-term corrective pullback is developing. From an Elliott wave perspective, this setback looks like a wave four pause following the recent impulsive rally. Such a correction would be typical after a sharp gap higher and could find support near the base channel zone between 156.00 and 155.50, before the broader uptrend potentially resumes.

If buyers step back in around that support region, the pair could attempt another push higher within wave five. A break back above 157.43 would be the first signal that the correction has likely ended. On the other hand, a deeper drop below 155.50 would suggest a more complex consolidation is unfolding. For now, the structure still favors dips being temporary as long as the pair holds above key channel support.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.