US Retail Sales Preview: Can consumers keep up with inflation? A breather could weigh on the dollar

- Economists expect the Retail Sales Control Group to have risen by 0.5% in August, unadjusted for inflation.

- Meeting high estimates would reflect a drop in real consumption.

- Any miss would enable the dollar to take a more meaningful breather in its uptrend.

Never underestimate the US consumer – relentless Americans have been on a shopping spree, almost regardless of price rises. In August, the highly visible price at the pump dropped and potentially left more money for Americans to buy other goods with. That is, at least what economists think. I will explain why I think estimates are high and how it could weigh on the dollar.

Gasoline prices have lowered expectations for headline retail sales to a round 0%, but investors care about core figures – as seen in Tuesday's inflation figures. In the case of retail sales, the Control Group is what matters, and here, expectations are high. A 0.5% increase is expected.

The baseline scenario

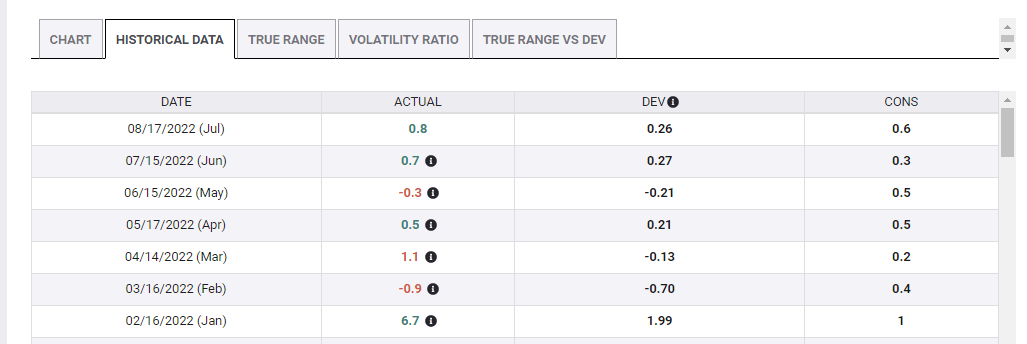

The first hole I want to poke in these expectations is that the control group beat estimates in the past two releases, so a miss cannot be ruled out.

Source: FXStreet

Secondly, a 0.5% increase would fall short of the 0.6% increase in Core CPI. It is essential to note that retail sales figures are unadjusted for inflation, contrary to Gross Domestic Product ones. Therefore, merely meeting estimates of 0.5%, lower than 0.8% and 0.7% recorded last month, would represent a contraction in real sales.

Even if the data meets estimates, there is room for a downside correction in the safe-haven dollar and an upside correction in stocks. Markets are struggling to recover from the inflation shock, and any piece of not-so-great economic news would lower pricing for a 100 bps rate hike from the Fed next week. That would weigh on the dollar.

The alternative case for an upside surprise

I think that the combination of relatively high expectations and a desire to swing back to a risk-on mood could trigger a negative outcome for the dollar as the baseline scenario. Nevertheless, a positive outcome cannot be ruled out.

If Core Retail Sales beat estimates – and especially if they repeats last month's 0.8% rise – the greenback would rise. It would show that the US consumer is unstoppable and that price pressures are far from relenting. Apart from strengthening the chances for a quadruple-sized 100 bps next week, a strong figure would diminish chances for lower rate hikes in the following meetings.

In case of upside surprise, I expect the dollar to rise, but the moves would likely be a far cry from the inflation-induced leap.

Final thoughts

As retail sales are roughly 70% of the US economy, updated data for August matters and is set to rock stocks and the dollar. My baseline scenario is for a disappointing outcome, or at least one that would enable the dollar to retreat from the highs.

However, investors are focused on inflation figures and may save some of the powder to Friday's University of Michigan's Consumer Sentiment Index report on Friday, and its critical inflation expectations figure. It matters because Fed Chair Jerome Powell said so – and its importance is even higher when it is released days ahead of the bank's decision.

All in all, Retail Sales data are important, and would serve as an opportunity to reposition ahead of yet another inflation-related figure.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.