EUR/USD Forecast: Dollar soars alongside US inflation

EUR/USD Current Price: 1.2082

- US inflation soared to 4.2% YoY in April, boosting speculation of a tighter monetary policy.

- Government bond yields jumped to their highest in almost a month.

- EUR/USD trades at fresh weekly lows and could keep falling in the near-term.

The American dollar edged higher across the FX board, following the release of upbeat US data. The country’s Consumer Price Index hit 4.2% YoY, higher than the 3.6% expected. The core reading jumped to 3%, also surpassing expectations. The EUR/USD pair pierced the 1.2100 threshold with the news, now trading around 1.2065, its daily low. Higher inflation in the US sent stocks sharply lower and US Treasury yields higher, with that on the 10-year note hitting 1.69%. Speculative interest priced in persistent higher inflation will end up forcing the US Federal Reserve to begin with tightening earlier than expected.

Across the ocean, the European macroeconomic calendar was scarce. Germany published April inflation figures, which showed that the annual CPI was up 2% as expected. Most European markets will be closed this Thursday amid Ascension Day. The US will publish the April Producer Price Index and Initial Jobless Claims, foreseen at 490K for the week ended May 7.

EUR/USD short-term technical outlook

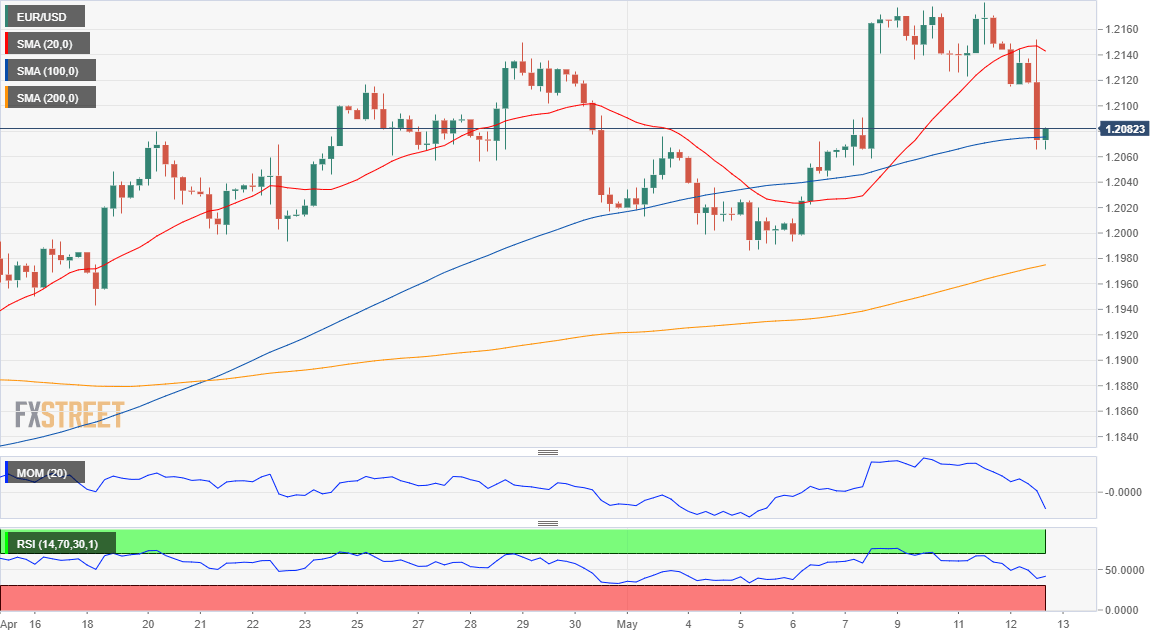

The EUR/USD pair has room to extend its decline in the near-term. The 4-hour chart shows that the pair is currently struggling around its 100 SMA, which maintain a modest bullish slope. The 20 SMA is turning lower well above the current level, indicating increasing selling pressure. Technical indicators have bounced modestly from intraday lows but lack strength enough to confirm an upcoming recovery. The pair could extend its slide below 1.2000 if the dismal mood persists.

Support levels: 1.2060 1.2025 1.1980

Resistance levels: 1.2110 1.2150 1.2190

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.