EUR/USD Forecast: Dead cat bounce could provide sell opportunity, euro faces three headwinds

- EUR/USD is on the back foot amid rising COVID-19 cases in Europe.

- Growing doubts about US fiscal stimulus may further boost the safe-haven dollar.

- US retail sales may disappoint again and add to the risk-off mood.

- Euro/dollar is entering oversold conditions according to Friday's four-hour chart.

When Germany – one of the world's leaders on COVID-19 testing – is struggling with tracing, there is a problem all over the old continent. The surge in coronavirus cases one of the reasons weighing on EUR/USD, and technicals may only provide a temporary, "dead cat bounce" move.

Here are the reasons to favor shorting euro/dollar:

1) Infections surge, governments act

After suffering either local or moderate increases in COVID-19 cases, recent days have seen surges. France is imposing a nighttime curfew in Paris and other cities, Germany is struggling with contact tracing and Barcelona's restaurants are closing. The caseload is even worse in Belgium and the Netherlands.

Source: FT

Governments are trying to avoid national lockdowns and limitations to movements, but the current restrictions – and fears of new ones – already weigh on economic activity and hurt the common currency. The latest comes from Italy, where the government is also considering a curfew.

2) US stimulus talks are going nowhere

President Donald Trump tweeted "go big" on a relief package and wants to offer more than $1.8 trillion. Will he reach House Speaker Nancy Pelosi's $2.2 trillion? That may the wrong question, as Trump's fellow Republicans want only a skinny $500 billion deal. Senate Majority leader Mitch McConnell said a small package is enough and seems focused on the Supreme Court.

Without stimulus, markets are falling and the safe-haven dollar is in demand.

McConnell may also be counting out Trump – who continues trailing rival Joe Biden in national and state polls. The RealClearPolitics shows a 9.4% lead for the former VP, FiveThirtyEight is showing an 87% for a Biden victory, and The Economist is pointing to 91%.

Biden and Trump appeared in separate town-hall events in a bid to convince undecided voters – fewer in 2020 than in 2016. Biden's lead is larger than Clinton's at this point in the race:

Source: RCP

For markets, the bigger question becomes the Senate. If Dems win the upper house, they could push through a quick and generous stimulus bill. The battle is closer there and speculation about a "blue wave" – a clean sweep for the opposition – remain rife.

3) Another data disappointment?

After several quiet days on the economic calendar, the Retail Sales report for September is set to rock markets. Consumption is central to the world's largest economy and the lapse of several government aid programs in late July already took its toll in August.

Expectations for the upcoming release are already moderate, but have they gone far enough? Another shortfall could further fuel demand for the safe-haven dollar.

See US Retail Sales September Preview: It's about employment

Later in the day, the University of Michigan's preliminary Consumer Sentiment Index is set to show a stall in the recovery. The latest jobless claims figures jumped to 898,000, worse than expected.

See US Michigan Consumer Sentiment October Preview: It's really an employment survey

Overall, the deck is stacked against EUR/USD.

EUR/USD Technical Analysis

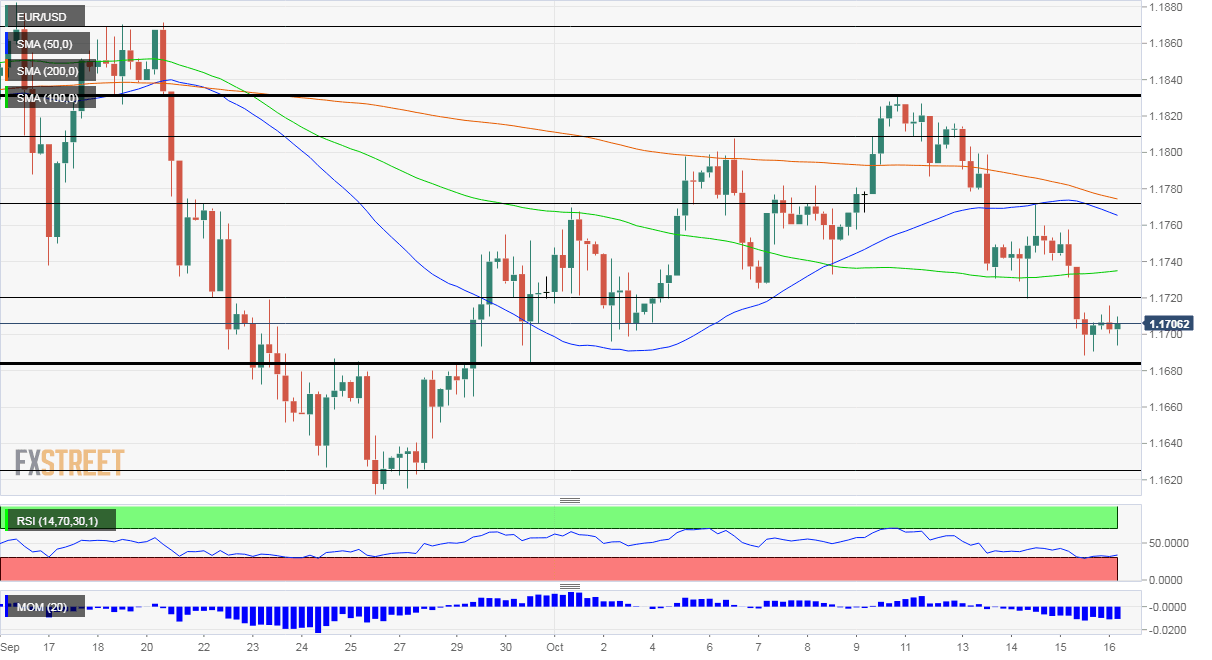

The Relative Strength Index on the four-hour chart is flirting with the 30 level – nearing oversold conditions. That implies a potential bounce – yet it may only be limited. Momentum remains to the downside and EUR/USD is trading below the 50, 100, and 200 Simple Moving Averages.

All in all, the picture is bearish.

Critical support awaits at 1.1685, which provided support on Thursday and also in late September. Further down, last month's lows of 1.1625 and 1.1610 await the currency pair.

Some resistance is at 1.1720, which separated ranges earlier this week, followed by 1.1770, a swing high, and 1.1810.

More: Big move coming in EUR/USD? Fiscal stimulus and coronavirus are the keys

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.