Gold climbs on weak US data and rising Fed rate cut expectations

Gold (XAU/USD) is rising on soft economic data and growing Fed rate cut expectations. The U.S. labor market is showing signs of stress, with slowing job growth and a rising unemployment rate. Retail sales showed no growth, while consumer spending continues to weaken. These developments have increased bets on further Federal Reserve easing. At the same time, China’s economic slowdown has added to global growth concerns. These factors have strengthened gold’s position both fundamentally and technically.

Gold gains on dovish Fed signals and weak US data

Gold remains supported by growing expectations of policy easing from the U.S. Federal Reserve. A series of soft data points, including weaker job growth and stagnant retail sales, have strengthened the case for further rate cuts. The labor market added 64K jobs in November, slightly above expectations, but previous data revealed a significant 105K decline in October due to the government shutdown. The unemployment rate also rose to 4.6%, the highest since 2021, indicating a cooling in labor market conditions.

At the same time, U.S. consumer spending appears to be losing momentum. Retail sales were flat in October after a downward revision in the prior month. This weakness has deepened expectations that the Fed will cut rates again in the coming months. Reports suggest that Donald Trump is considering Christopher Waller for the next Fed chair position. His policy views are widely seen as supportive of lower interest rates, which adds to expectations of a more accommodative stance. Markets are now pricing in an extended easing cycle, which typically supports gold due to its non-yielding nature.

Moreover, China’s economic data has added to the broader risk-off tone. Industrial output slowed to 4.8% year-over-year in November, its weakest pace since August 2024. Retail sales also disappointed, rising just 1.3%, which marked the slowest pace since 2022. These figures raised fresh concerns about global growth and increased demand for safe-haven assets like gold. With mounting macro uncertainty and concerns about market instability, capital continues to shift toward hard assets.

Gold extends uptrend within broadening wedge pattern toward new highs

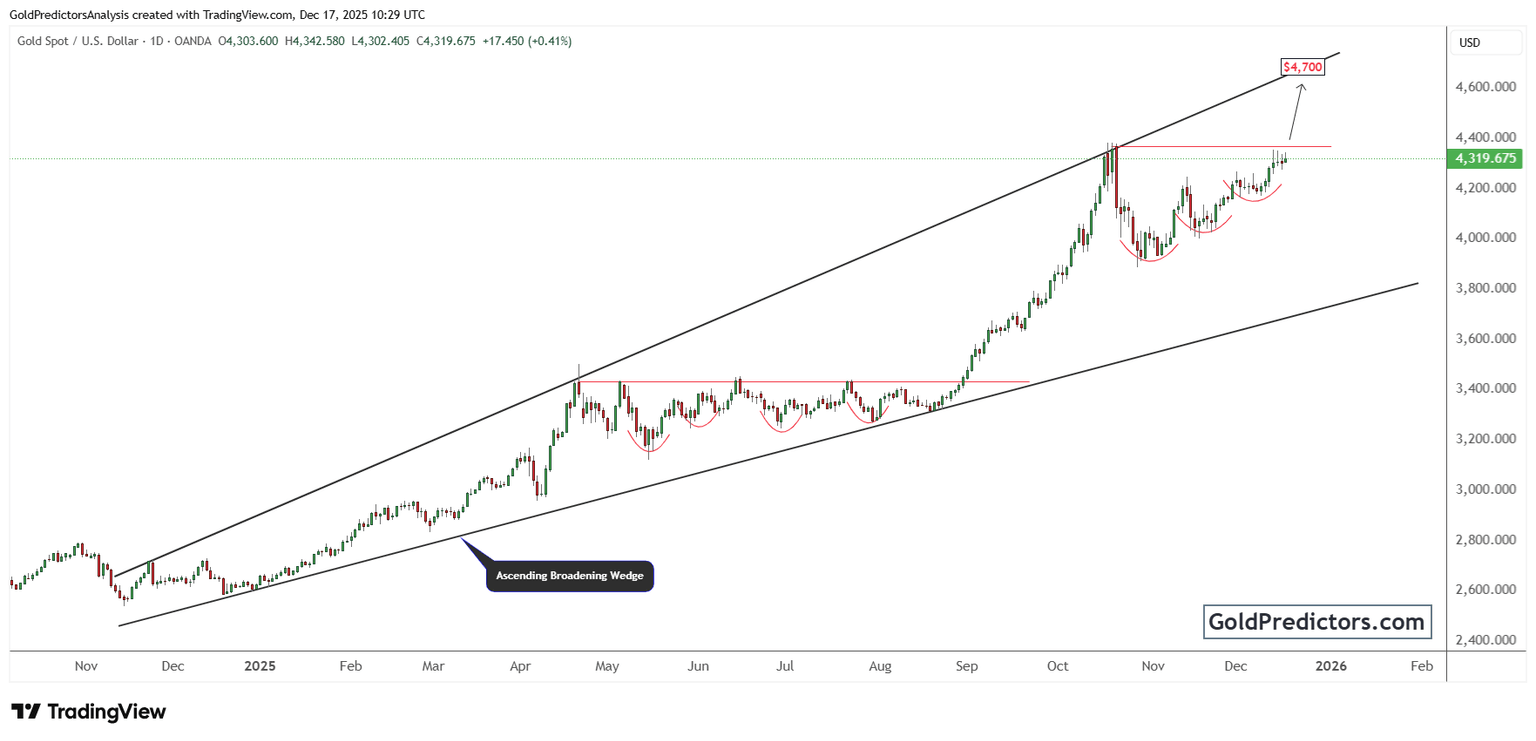

The gold chart below shows a well-defined ascending broadening wedge, stretching from late 2024 through 2025. This pattern reflects expanding volatility, but with an overall upward bias. After consolidating along the lower boundary of the pattern, gold surged toward the upper wedge, marking a bullish continuation phase. The pattern remains intact and supports the long-term bullish trend.

Within the wedge, a series of cup-like structures formed throughout late 2025, creating a base just below the $4,400 level. These formations suggest repeated accumulation and failed attempts to break lower. Most recently, gold has built another rounded bottom, positioning itself near the upper neckline. A breakout above this horizontal barrier could confirm the next leg higher toward the projected target of $4,700.

Meanwhile, the price action remains well-supported by an upward-sloping support level, which has consistently held throughout the year. Momentum is building as price tightens near resistance, suggesting a potential breakout is near. If gold closes above $4,400 with strength, it would validate the bullish pattern and trigger renewed upward momentum. This move would also confirm the multi-month consolidation phase as a temporary pause within a larger uptrend.

Gold outlook: Fed easing and global risks support higher prices

Gold remains in a strong uptrend as falling economic indicators and dovish Fed expectations drive safe-haven demand. Weak labor data, flat retail sales, and rising unemployment have increased the likelihood of further rate cuts. At the same time, global growth concerns, especially from China, continue to support the shift into hard assets. Technically, gold is nearing a breakout point within a bullish broadening wedge. A close above key resistance would confirm renewed momentum and signal the next leg higher.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.