EUR/USD Forecast: Bulls taking their chances

EUR/USD Current price: 1.1638

- ECB policymakers still diverge on how to handle financial facilities.

- US data missed expectations, but optimism persisted throughout the session.

- EUR/USD has room to extend its advance in the near term after breaching 1.1670 resistance.

The EUR/USD pair retreated from a fresh three-week high of 1.1669 and currently trades in the 1.1640 price zone. Financial markets looked at government bond yields for direction amid a scarce macroeconomic calendar. US yields were down through the first half of the day, weighing on the American currency, jumping to fresh multi-week highs after Wall Street's opening.

The shared currency was affected by comments from European Central Bank chief economist Philip Lane, who said that medium-term inflation pressure are under the ECB's target. However, another European policymaker, Bostjan Vasle, noted there are early signs that wage pressures in the euro area could become material and pose inflation risks, adding that the Pandemic Emergency Purchase Program (PEPP) should be ended in March if "economic trends continue."

The macroeconomic calendar included EU Construction Output, which declined by 1.3% MoM in August after posting a modest 0.1% advance in the previous month. The US published September Housing Starts, down 1.6% and Building Permits, which fell by 7.7%.

On Wednesday, Germany will publish the September Producer Price Index, while the EU will unveil the final reading of September inflation data. The US calendar has nothing relevant to offer, as the country will only release MBA Mortgage Applications for the week ended October 15.

EUR/USD short-term technical outlook

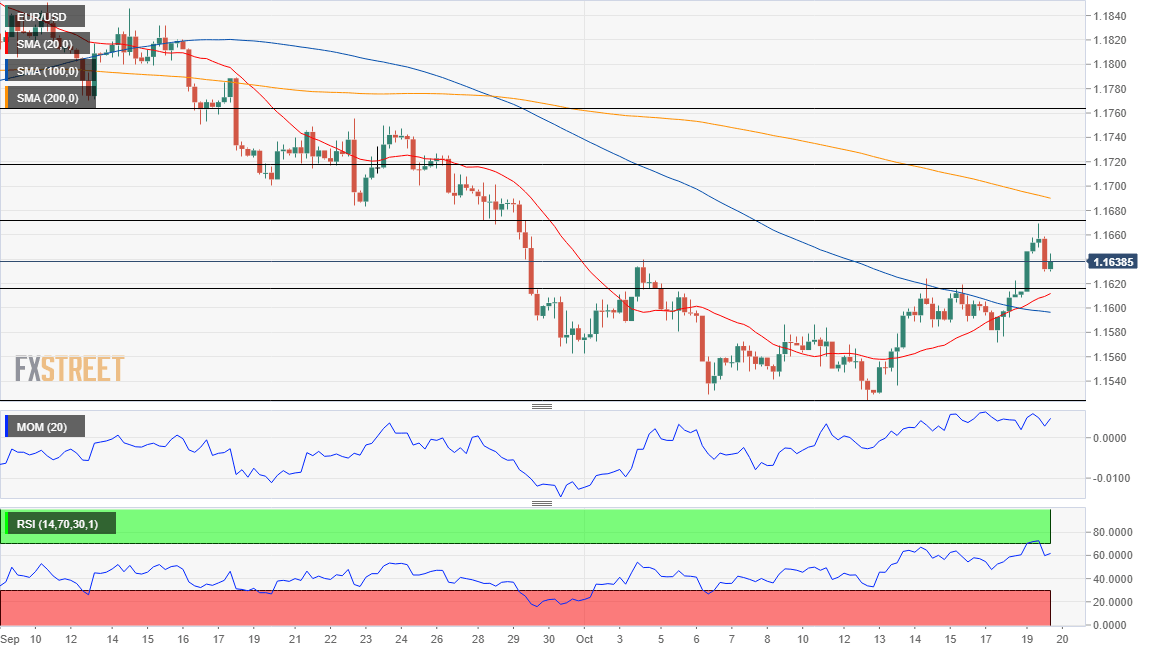

The EUR/USD pair topped at the 38.2% retracement of its latest daily slump at 1.1670, ending a fifth consecutive day with gains. The pair has turned bullish in its daily chart, and further gains could be expected if it breaks the mentioned Fibonacci resistance level. In the mentioned time frame, technical indicators have crossed into positive levels, maintaining their bullish slopes. The pair is also developing above a mildly bearish 20 SMA, which converges with the 23.6% retracement of the same decline at 1.1615.

The pair has room to advance also in the near term, as the 4-hour chart shows that the pair is currently developing above its 20 and 100 SMAs, with the shorter one crossing above, the longer one. Additionally, the Momentum indicator resumed its advance within positive levels while the RSI indicator holds steady at around 61.

Support levels: 1.1615 1.1570 1.1525

Resistance levels: 1.1670 1.1715 1.1750

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.