Equities and cryptocurrencies ignore the hawkish Fed

Global stocks, cryptocurrencies, and commodities drifted higher as investors digested the latest interest rate decision by the Fed. In a statement on Wednesday, the bank decided to hike rates by 0.50% and signaled that the neutral rate will be between 2% and 3%. The Fed also said that it will start implementing quantitative tightening in the coming month. In theory, a hawkish Fed should be bearish for these assets. Therefore, the rebound is likely because the decision caught no one by surprise and investors had already priced in the rate hikes. In Europe, the DAX and CAC indices rose by more than 2%.

The British pound declined slightly as investors reacted to the latest interest rate decision by the Bank of England. As was widely expected, the BOE decided to hike interest rates by 0.25% in its bid to ease inflation. In a statement, the bank warned that the economy could go through a recession because of the ongoing Ukrainian crisis. It also said that it was “unable to prevent” households from being worse-off. In addition, the bank said that further rate hikes will be needed in the coming months.

The earnings season continued on Thursday. In a statement, Unicredit said that its exposure to Russia forced it to book a 1.3 billion loan provision. Still, the company managed to boost its net income by 48% to 1.2 billion euros. Meanwhile, Shell said that it had its highest ever quarterly profit as oil and gas prices rose. The company’s adjusted earnings rose to $9.1 billion, which was triple what it made in the same quarter in 2021. There are growing calls in some western countries to increase taxes on oil and gas companies.

GBP/USD

The GBPUSD pair declined to a low of 1.2455, which was the lowest level since May 2. This price is along the lower side of the Bollinger Bands. It has also moved below the 25-day moving average while the Relative Strength Index (RSI) and the Stochastic Oscillator have pointed downwards. Therefore, the pair will likely keep falling as bears target the key support at 1.2400.

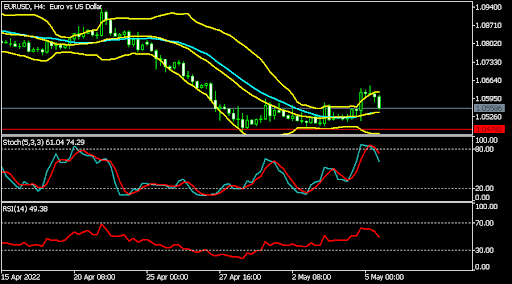

EUR/USD

The EURUSD pair declined slightly as the market continued to digest the Fed decision and EU services and composite PMI numbers. It is trading between the middle and upper sides of the Bollinger Bands while the Stochastic Oscillator is pointing downwards. The pair has also formed what looks like a bearish flag pattern. Therefore, the pair will likely keep falling as bears target the key support at 1.0480.

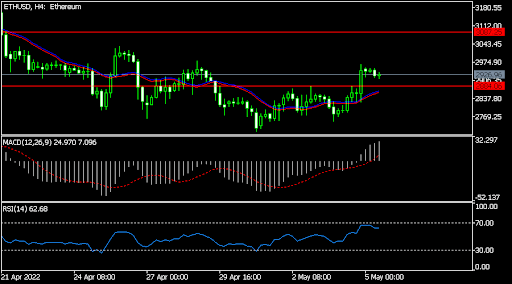

ETH/USD

The ETHUSD pair rose to a high of 2,950, which is the highest level since April 28th. On the four-hour chart, the pair has moved above the important support level at 2,885, which was the highest point on May 3. It is above the envelope indicator while the Relative Strength Index and the MACD have been rising. Therefore, the pair will likely keep rising as bulls targets the resistance at 3,000.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.