Elliott Wave View: S&P 500 (SPX) rally should resume [Video]

![Elliott Wave View: S&P 500 (SPX) rally should resume [Video]](https://editorial.fxstreet.com/images/Markets/Equities/SP500/wall_street_nyse2-637299021353183737_XtraLarge.jpg)

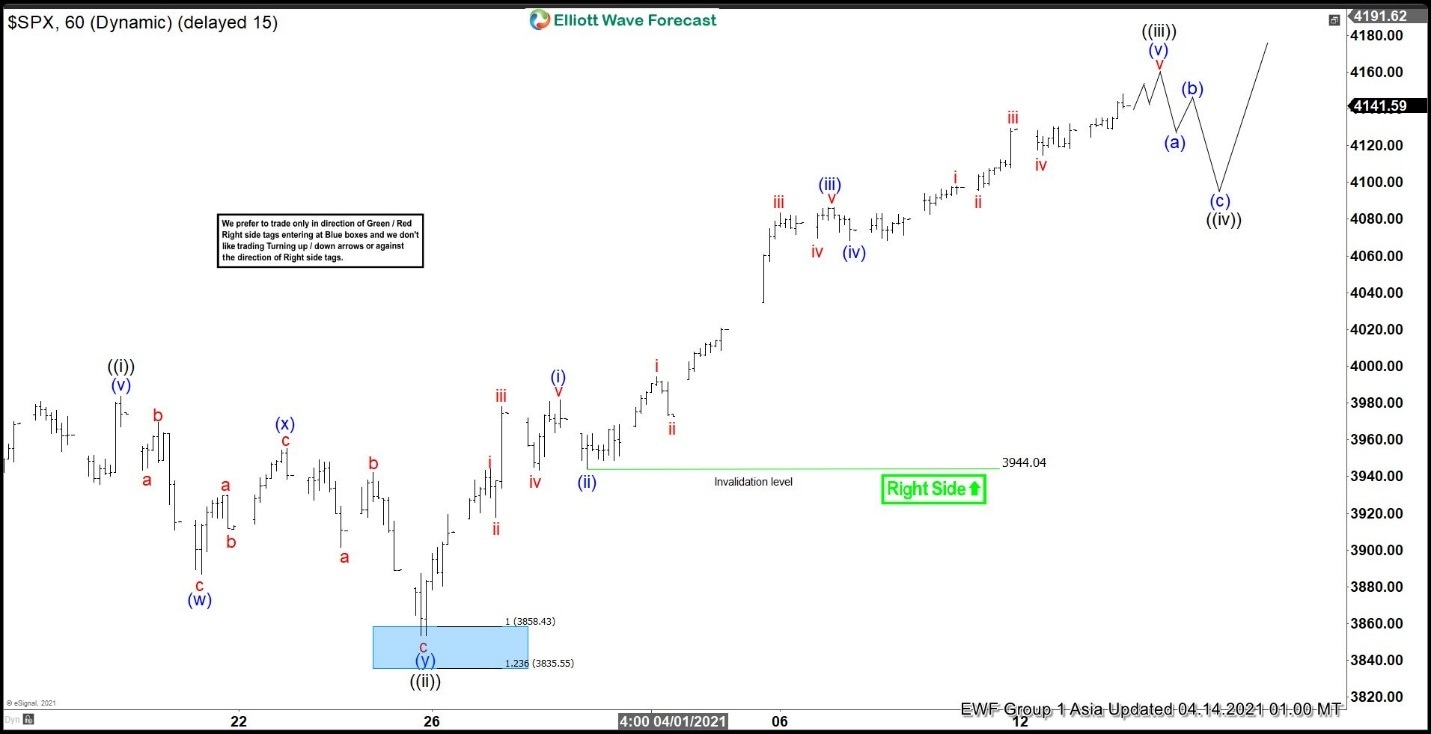

Short term Elliott wave view in S&P 500 (SPX) suggests the rally from March 5, 2021 low is unfolding as a 5 waves impulsive structure. Up from March 5 low, wave ((i)) ended at 3983.87 and wave ((ii)) pullback ended at 3853.50. Internal of wave ((ii)) unfolded as a double three where wave (w) ended at 3886.75, wave (x) ended at 3955.31, and wave (y) ended at 3853.50.

Index then resumed higher in wave ((iii)) which subdivides into another impulsive structure in lesser degree. Up from wave ((ii)) low, wave (i) ended at 3981.83 and wave (ii) pullback ended at 3944.04. Index resumes higher again in wave (iii) towards 4086.23 and pullback in wave (iv) ended at 4068.14.

Near term, expect wave (v) of ((iii)) to end soon. Index should then pullback in wave ((iv)) to correct cycle from March 25 low before the rally resumes. Wave ((iv)) pullback should ideally reaches 23.6 – 38.2% Fibonacci retracement of wave ((iii)). The pullback area can start to be measured once we know where wave ((iii)) ends. As far as wave ((ii)) pivot at 3853.50 remains intact, expect pullback to continue finding support in 3, 7, or 11 swing for further upside. The right side in the Index remains higher (bullish).

SPX 1 Hour Elliott Wave Chart

S&P 500 (SPX) Elliott Wave Video

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com