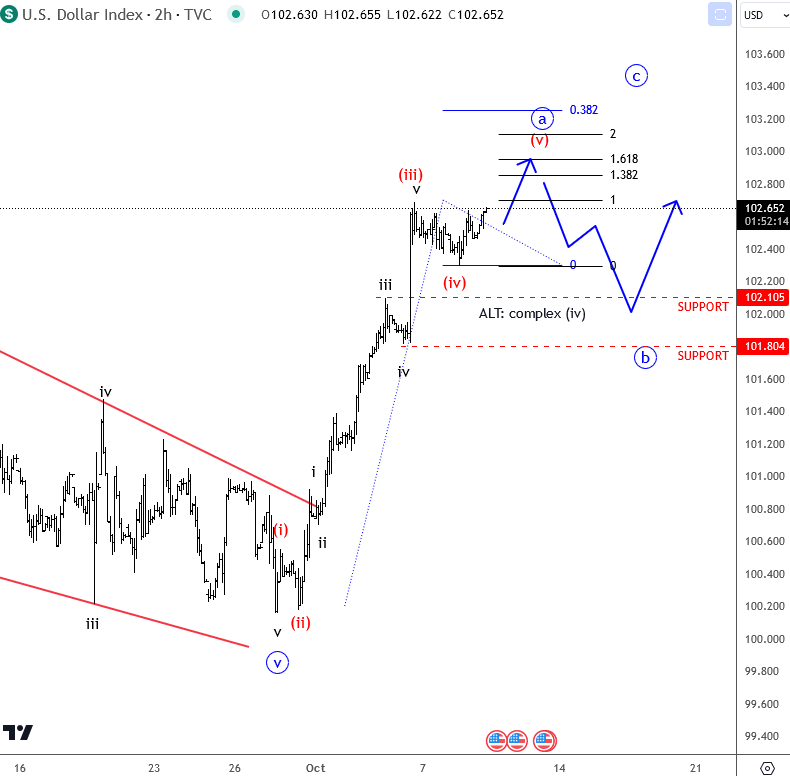

Dollar: Buy a dip

It looks like the dollar index is still on the rise and may already be heading higher into the 5th wave, unless wave four becomes more complex. Keep in mind that there could be some resistance around the 103 level, which might complete this first impulse from the end of September. But we’re not yet sure what exactly could trigger a retracement, but we have the FOMC meeting minutes later today during the US session, and, as you know, the key event will be the US CPI release on Thursday. So the market might not move too far ahead of these two events, but generally speaking, we believe the Dollar Index should push even higher after any three-wave retracement. Key support levels to watch are 102.10 and 101.80.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.