Cryptocurrencies and stocks slide as Treasury yields soar

The Swiss franc declined slightly against the US dollar after the relatively strong GDP numbers from the country. According to the State Secretariat for Economic Affairs (SEC), the economy expanded by 0.3% in the fourth quarter after rising by 7.6% in Q3. This expansion led to an annualised decline of 1.6%, which was also better than the expected decline of 2.1%. Further data showed that the leading indicators increased from 96.5 in January to 102.7 in February. The leading data uses 12 indicators to forecast the state of the economy for the next six months.

It was a sea of red in the cryptocurrencies industry as the market reacted to the rising Treasury yields. Today, the US Treasuries and UK Gilts continued rising ahead of the important vote on the next stimulus. Rising yields tend to have a negative impact on prices of relatively risky assets. The price of Bitcoin has dropped from its all-time high of above $58,000 to $44,000 while Ethereum has moved from more than $2,000 to $1,500. In total, their market capitalisation has dropped to more than $1.4 trillion. Global equities also dropped, with the Nikkei 225 and DAX falling by more than 1%.

The Japanese yen weakened against the US dollar after mixed economic data from the country. According to the statistics agency, the housing starts declined by 3.1% in January after falling by another 9.0% in December. This happened as the country moved into another state of emergency. Earlier data showed that retail sales fell by 2.4% while industrial production increased by 4.2%. Meanwhile, in Tokyo, the headline CPI and core CPI dropped by 0.3%.

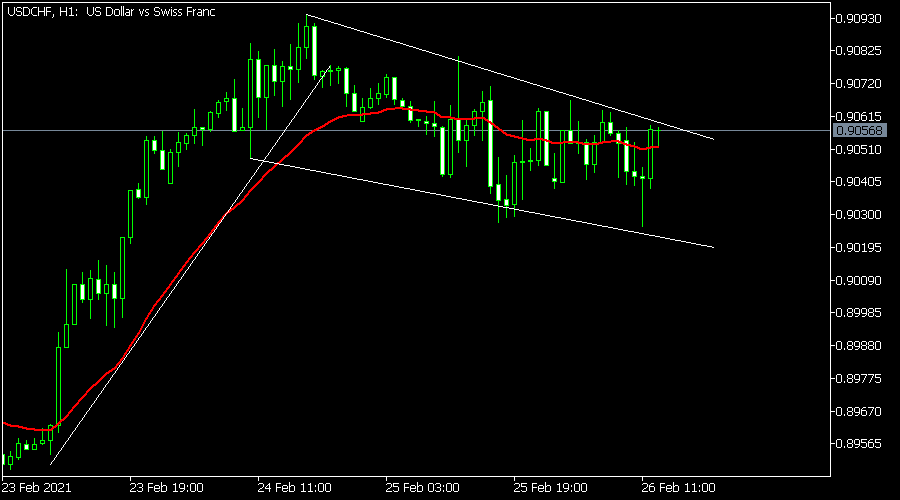

USD/CHF

The USD/CHF declined to an intraday low of 0.9026 and then rose to a high of 0.9056. On the hourly chart, the pair has formed a bullish flag pattern that is shown in white. It has also moved above the 25-day exponential moving average. Therefore, the pair will likely break-out higher because of the flag pattern. If it does, the next key level to watch is 0.9090.

EUR/USD

The EUR/USD pair continued to decline earlier today because of the rising yields in the US. It is trading at 1.2110, which is lower than this week’s high of 1.2243. On the hourly chart, the pair has moved below the 25-day exponential moving average. Oscillators like the Relative Strength Index (RSI) and the MACD have continued to fall. Therefore, the pair may continue dropping as bears target the next support at 1.2090.

GBP/USD

The GBP/USD pair dropped to an intraday low of 1.3900, which was the lowest level since February 18. On the hourly chart, the pair managed to move below the ascending trendline shown in white. It has also moved below the short and medium-term moving averages while the MACD has dropped. While the overall trend is bearish, the pair may experience a short-term recovery rally.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.