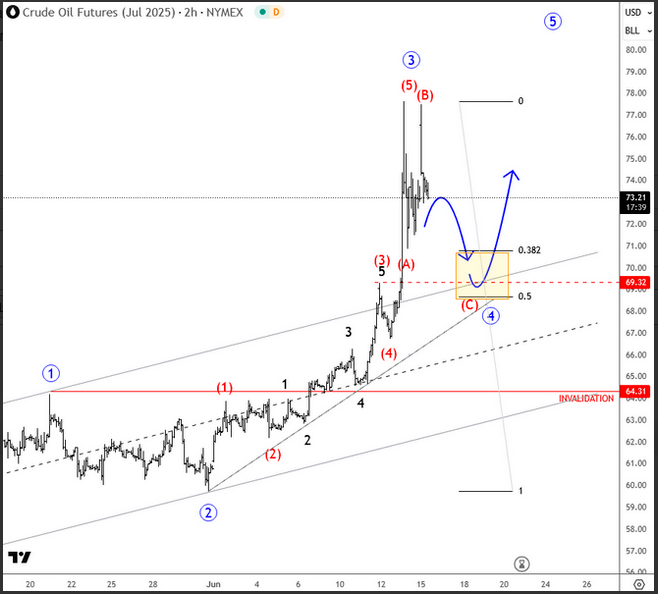

Crude Oil: Wave four support at $69-70

Despite fresh attacks between Israel and Iran over the last 24 hours, energy prices are coming back down after the earlier spike into the 77–78 zone. This suggests crude oil is still in the middle of a fourth wave retracement, which could go a bit deeper. Watch for a possible retest of the 38.2% or even 50% Fibonacci retracement levels—support could show up around 70 or down to 69 dollars per barrel. Based on the latest developments, I still see a broader ongoing uptrend in play, as long as crude oil holds above 64.31, since wave four must not enter wave one territory.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.