Congratulations on cashing Silver profits above $100

If you took your silver profits above $100 – congratulations. You were likely one of the few that did.

Silver plunged in a clear way, and this doesn’t look like a correction. It looks like the beginning of the slide.

Why? Three main reasons and several other ones.

- The size of the decline is not typical. It’s a 31% slide just today. SO FAR. Yes, silver had previously rallied substantially on a day-to-day basis, so a breather should also be volatile, but what we see today exceeds what one might expect in normal circumstances.

- The all-important $100 level was invalidated. We don’t have a daily close yet, but the intraday move to $95 and then a comeback to “only” (yes, I know that compared to $30, this level is still very high, but when you compare it to the $120+ high, this word is justified) $98. EDIT: I wrote the above when silver was at $98. It then collapsed below $80 within a few hours.

- Silver is declining in this way after reaching my long-term upside target.

-1769983032847-1769983032848.png&w=1536&q=95)

The Fibonacci extension technique worked for the fourth time. Truly remarkable for two reasons:

- I’ve been writing about this target for years.

- To my knowledge, nobody else featured this specific upside target (please comment below the analysis if you know someone that did).

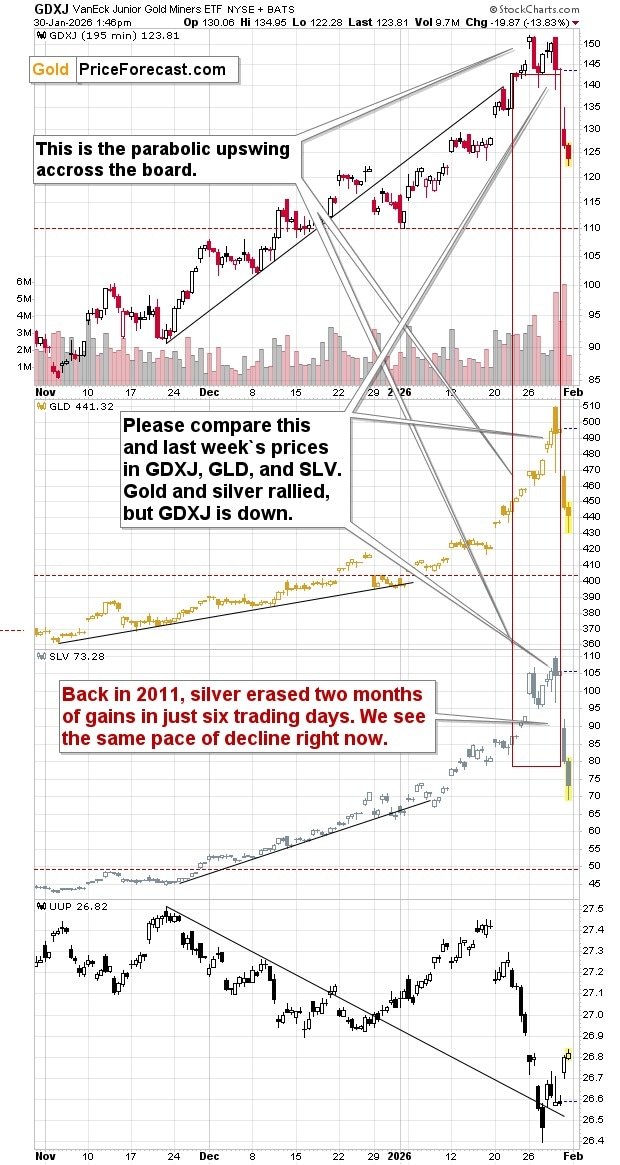

Yes, silver will eventually recover and most likely soar well above $120, but before that happens… Remember – back in 2011, silver erased two months of gains in just six trading days.

-1769983054799-1769983054800.png&w=1536&q=95)

The pace of white metals’ decline was truly extreme.

Just like what we saw today.

If this self-similar pattern continues, silver could get back to $50 within 1-2 weeks. Please note that I’m not saying that this is the most likely outcome – it isn’t – but I am saying that this is a possibility that should be kept in mind.

What’s more likely in my view is that we’ll get a very steep decline to [reserved to Gold Trading Alert subscribers] and then consolidation and rebound – likely before another wave of declines.

Some may say that all those reasons are silver-specific, and the rest of the precious metals sector is pointing to higher prices.

But it doesn’t.

Miners face reality check

The GDXJ plunged by about 14% (so far), and it looks like those that claimed that mining stocks can only go up will get a painful reality check.

This is just a beginning.

Why?

Gold plunged below $5,000.

The daily chart looks bad, but the weekly chart…

-1769983119925-1769983119926.png&w=1536&q=95)

The weekly gold chart is horrible.

Gold didn’t just invalidate its move above $5,000. It declined this week in the most bearish way imaginable – with an enormous shooting star.

This single-week candlestick is enough to make one close any remaining long positions in gold (except for insurance ones – perhaps limiting them).

How low can gold slide before pausing here?

Global markets in retreat

Stock market seems ready to slide as it once again invalidated the move above 7,000.

Bitcoin is declining as well (you ARE shorting it, right? I wrote about that several times now. There’s much more to come in my view.).

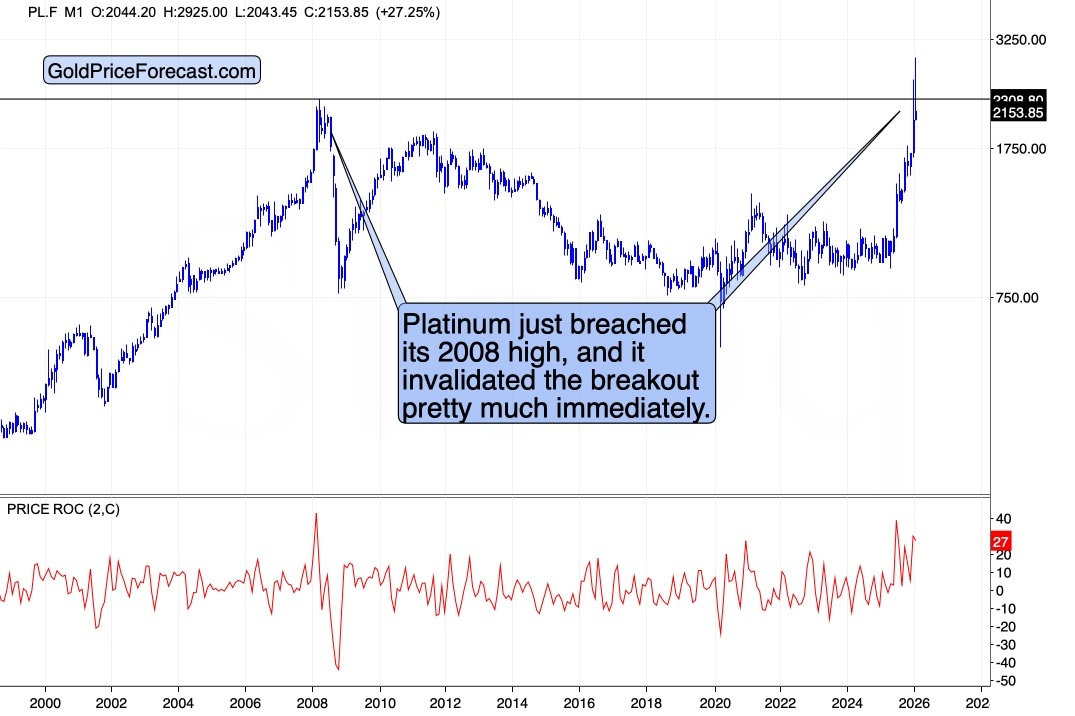

On top of all that, platinum just clearly invalidated its breakout above the 2008 high.

Just like gold, platinum formed a truly exceptional reversal, but while gold’s reversal is in weekly terms, platinum’s reversal is a monthly one, making it extremely bearish, especially when combined with the above-mentioned invalidation.

All those signs confirm each other.

Many people are selling today but many more will only start selling once the fear grows – at much lower prices.

If you took profits from your silver investments above $100 or close to my $120 target – congratulations – this one goes to your personal book of records.

There’s more to come.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Przemyslaw Radomski, CFA

Sunshine Profits

Przemyslaw Radomski, CFA (PR) is a precious metals investor and analyst who takes advantage of the emotionality on the markets, and invites you to do the same. His company, Sunshine Profits, publishes analytical software that any