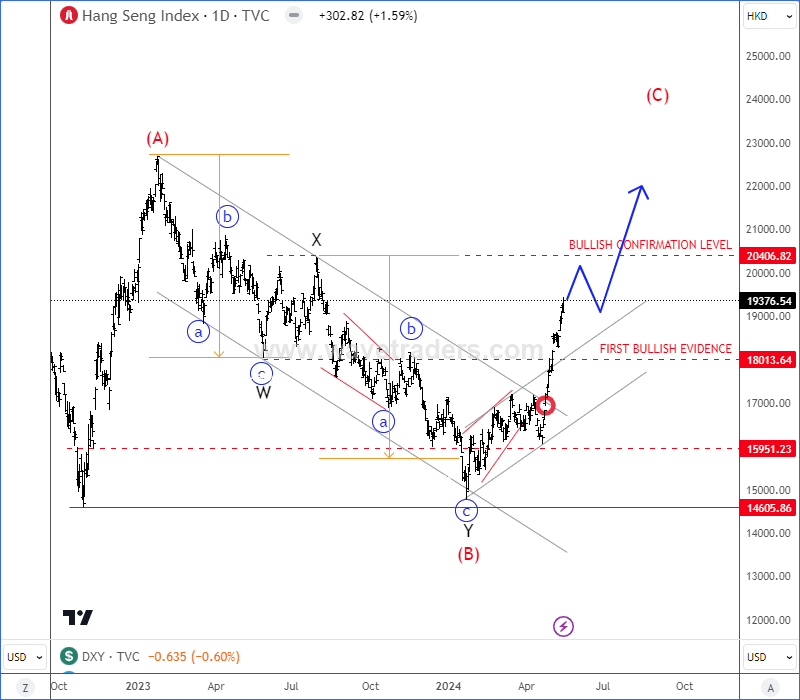

China stocks are extending a recovery as anticipated

China stocks are nicely extending a recovery as expected and there can be space for more upside within that projected wave (C) on HSI - Hang Seng Index as mentioned and highlighted on April 25th. We have been warning about that China may have a global impact on stocks and we can now see even US stocks back to all-time highs as anticipated. At the same time, we can also see Aussie nicely following Chinese stocks with room for more gains, just be aware of short-term pullbacks.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.