Australian Dollar Price Forecast: Looking at the RBA rather than at the Fed

- AUD/USD’s upside impulse seems to have run out of steam near 0.6650.

- The US Dollar faces renewed downside pressure ahead of the Fed’s decision.

- The Australian labour market report will take centre stage on Thursday.

The Australian Dollar (AUD) struggles to extend further its ongoing rally, with AUD/USD coming under some tepid pressure around the 0.6650 region, or multi-week tops.

Meanwhile, spot maintains its bullish stance well in place for the third week in a row while flirting at the same time with its key 200-week SMA around 0.6640. The pair’s inconclusive price action comes despite a decent decline in the Greenback as investors gear up for the imminent interest rate decision by the Federal Reserve (Fed)

A steady economy quietly doing what it needs to do

Australia isn’t firing off huge upside surprises right now, and honestly, that’s kind of the goal. The recovery is moving forward at a comfortable pace, and most of the data looks pretty decent.

The latest PMIs helped calm a few nerves, with Manufacturing back in expansion at 51.6 and Services up to 52.7.

Shoppers are still out there too: Retail Sales rose 4.3% YoY in September, and the trade surplus nudged higher to A$3.938 billion. Business investment did slip in Q3 (-0.9% QoQ), but it feels like more of a wobble than anything worrying.

Growth did undershoot forecasts a bit: Real GDP rose 0.4% QoQ in Q3 vs. 0.7% previously, though the annual pace held at 2.1%. That’s more or less where the Reserve Bank of Australia (RBA) expected things to be by year-end, so resilience isn’t gone.

The labour market is still adding a tailwind. October saw 42.2K jobs created, and the unemployment rate eased to 4.3%. The domestic jobs report on Thursday will be watched closely for extra clues on where policy goes from here.

Where the tension remains is inflation, as October CPI accelerated to 3.8% YoY, a roughly 17-month high, driven by housing, food and recreation. The trimmed mean CPI, the RBA’s favourite, also surprised higher at 3.3% YoY. And with the Australian Bureau of Statistics (ABS) now publishing monthly CPI prints, each release has become a mini-event.

China is still helping, just less dramatically

China continues to act as a safety net for Australia, even if it’s no longer the main engine of excitement.

Indeed, the Q3 GDP grew 4.0% YoY, and Retail Sales rose 2.9% YoY in October. Good numbers, just not the big punch bowl of past years.

But momentum is cooling: November PMIs painted a softer picture as the official NBS Manufacturing PMI edged up to 49.2 (still below 50), while the more export-sensitive RatingDog Manufacturing PMI dipped into contraction at 49.9.

Services aren’t exactly booming either: Non-manufacturing activity slid to 49.5, and RatingDog’s Services PMI eased to 52.1.

Further data saw the trade surplus narrow slightly in September to $90.07B from $90.53B.

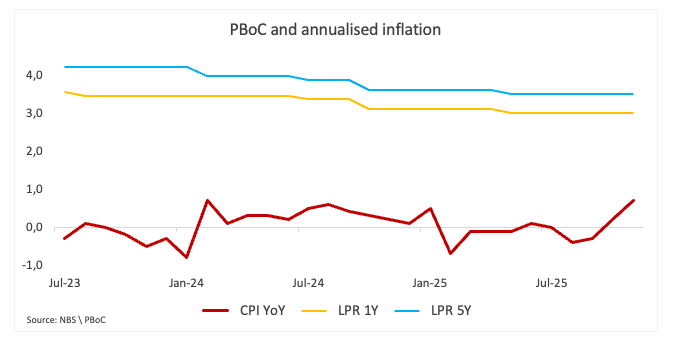

There are some positives, however: Headline CPI turned positive again at 0.7% YoY in November, the highest in almost two years. On a monthly basis, consumer prices dipped 0.1%, while Producer Prices fell 2.2% YoY.

But the People’s Bank of China (PBoC) is taking its time. Loan Prime Rates (LPR) remain unchanged at 3.00% (one-year) and 3.50% (five-year). So China is still helping the Aussie, just not rolling out fireworks.

RBA staying firm on the tiller

The RBA delivered what markets like to call a “hawkish hold” on Tuesday.

That said, the Official Cash Rate (OCR) stayed at 3.60% for a third meeting in a row, but the tone was clear: officials still see capacity constraints and weak productivity as risks, even while the labour market remains fairly tight for now.

In her post-meeting press conference, Governor Michele Bullock pushed back on the idea of cuts anytime soon. She said the Board was essentially weighing a longer pause or the possibility of a rate hike in 2026, with risks for growth and inflation both tilted higher. She also singled out Q4 trimmed mean CPI as crucial, and we won’t get that until late January.

Technical picture

AUD/USD remains focused on the upside, initially targeting the key 0.6700 barrier.

If bulls push harder, spot should face its next resistance of note at the 2025 ceiling of 0.6707 (September 17) ahead of the 2024 peak at 0.6942 (September 30), all preceding the 0.7000 milestone.

On the other hand, there is transitory support around 0.6540, where both the 55-day and 100-day SMAs coincide. Down from here emerges the significant 200-day SMA at 0.6475, seconded by the November base at 0.6421 (November 21) and the October trough at 0.6440 (October 14). The loss of the latter exposes a likely move toward the August valley at 0.6414 (August 21) and the June bottom of 0.6372 (June 23).

The pair’s near-term positive outlook is expected to persist as long as it trades above its 200-day SMA.

Additionally, momentum indicators point to extra gains in the short-term horizon: The Relative Strength Index (RSI) trades above the 67 level, while the Average Directional Index (ADX) near the 24 level indicates quite a firm trend.

-1765386908299-1765386908300.png&w=1536&q=95)

So where does that leave AUD/USD?

No fireworks just yet, but still a gentle upward lean. The Aussie remains very sensitive to global risk appetite and China’s mood. A clean breach below 0.6400 would sour sentiment pretty quickly.

But right now? A softer US Dollar, steady local data, an RBA that isn’t flinching, and modest support from China all point the currency gently higher. It may climb slowly, but the bias is still for gains.

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.