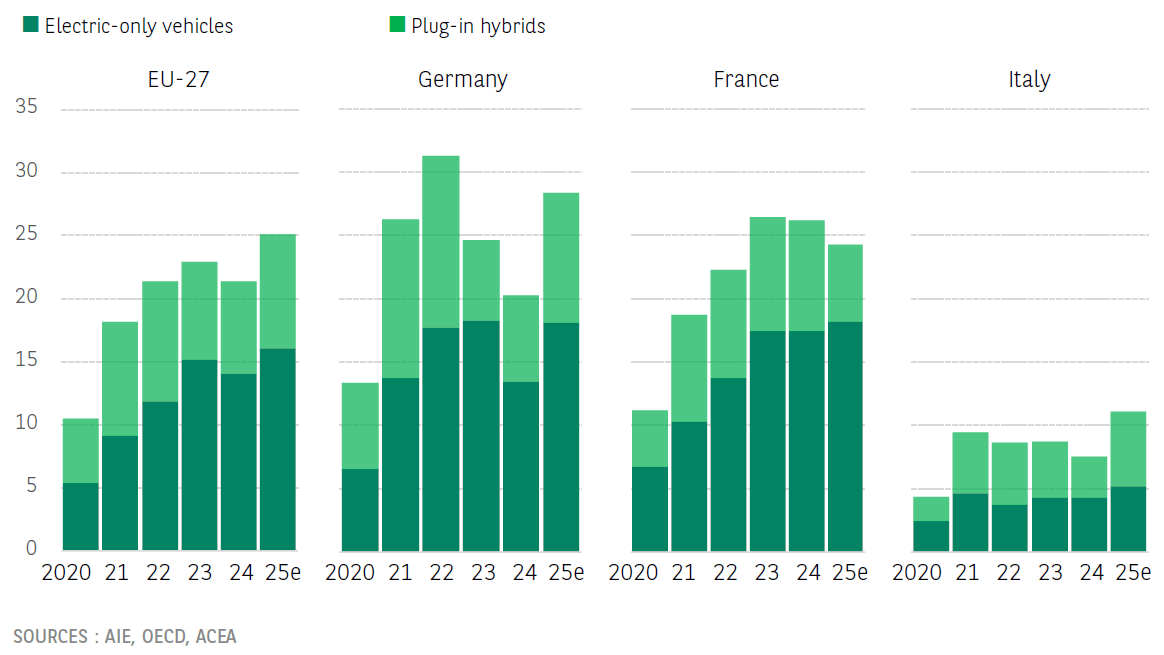

2025: A pivotal year for electric vehicles in Europe

2025 saw a renewed appetite among European consumers for electric cars. This enthusiasm comes after a lacklustre 2024, when registrations stagnated following the late 2023 announcement regarding the reduction of budgetary support in France and the complete withdrawal of such support in Germany. Yet, numerous studies, including the joint report by Pisani-Ferry and Mahfouz, had deemed these subsidies crucial.

Sales development of electric vehicles, as % of total

The post COVID fiscal consolidation eroded the support for electric vehicles. In Germany, the purchase subsidies vanished after the Karlsruhe Court ruled that unspent COVID funds could not be repurposed for electrification without a new parliamentary vote granting an exception to the EU debt brake rule. In France, the subsidies were reduced. Coupled with a European preference rule that increased the cost of manufactured vehicles (including those from China), this resulted in a decrease in the proportion of EVs in new car sales in 2024.

However, that hiatus has now ended. When asking whether a country can tighten its budget deficit and still back electrification, the answer is yes. France exemplifies this by using energy efficiency certificates. These certificates are funded by energy producers – ultimately passed on to energy consumers – with a relatively minor impact on inflation, given that inflation currently hovers around 1% and market electricity prices are on a downward trajectory. This scheme therefore does not put an additional strain on public finances.

Author

Wells Fargo Research Team

Wells Fargo