Chart Of The Week: USD/JPY moves in on familiar price acceptance area

- Risk-off flows not supporting yen, bulls in control seeking out the 114 handle.

- Symmetrical Triangle breaking down to the upside, eyes on 112.50s.

- Resistance levels to hold in near-term, ahead of low volume nodes.

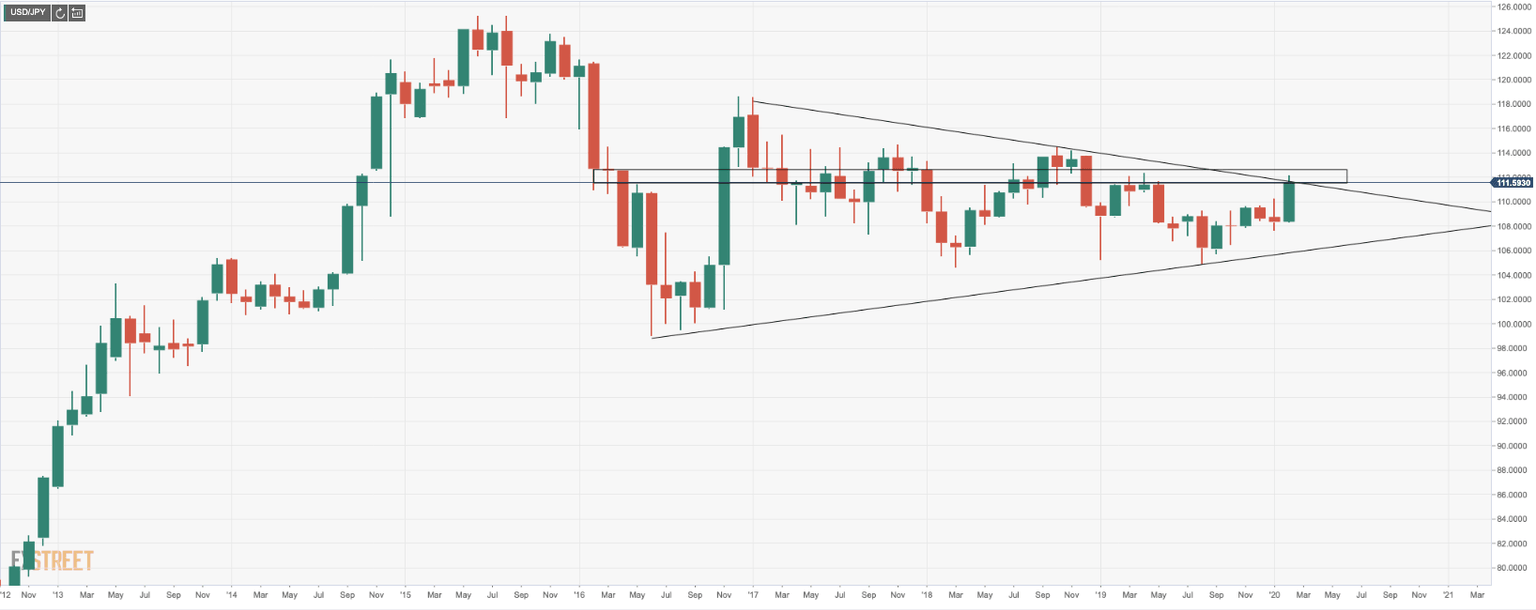

The 2015-2020 downtrend has been taken put and bulls are controlling with a weekly close above 110.31. Bulls can target a run beyond 112.50s for a move towards 114.55, 2018 high.

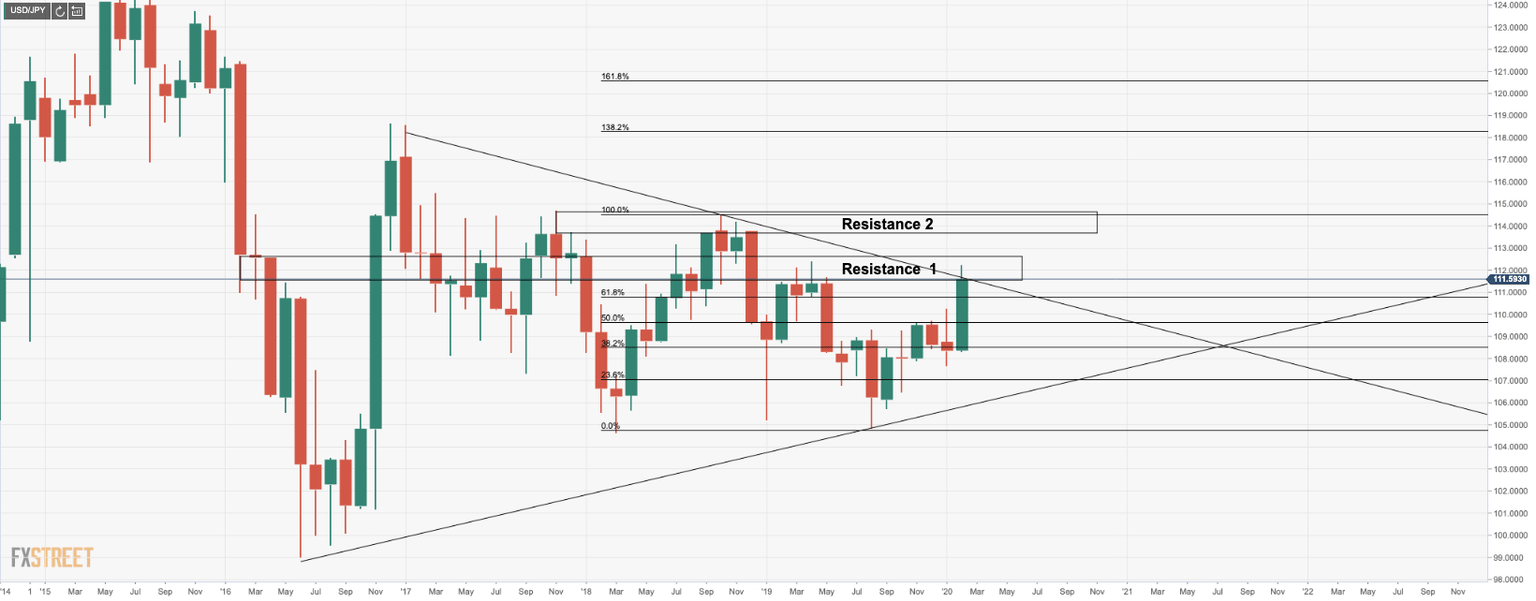

USD/JPY monthly chart: Symmetrical Triangle

Characterized by two converging trend lines connecting a series of sequential peaks and troughs, the symmetrical triangle (ST) could lead to an extensive breakout, one way or the other, although a critical level of resistance at this juncture will need to give in. We have been here before and 112.50/113.00 has been a high area of acceptance by the bulls and bears, so we could see a period of consolidation prior to extensive gains towards the 114 handle.

Break-out may struggle through two key resistance areas

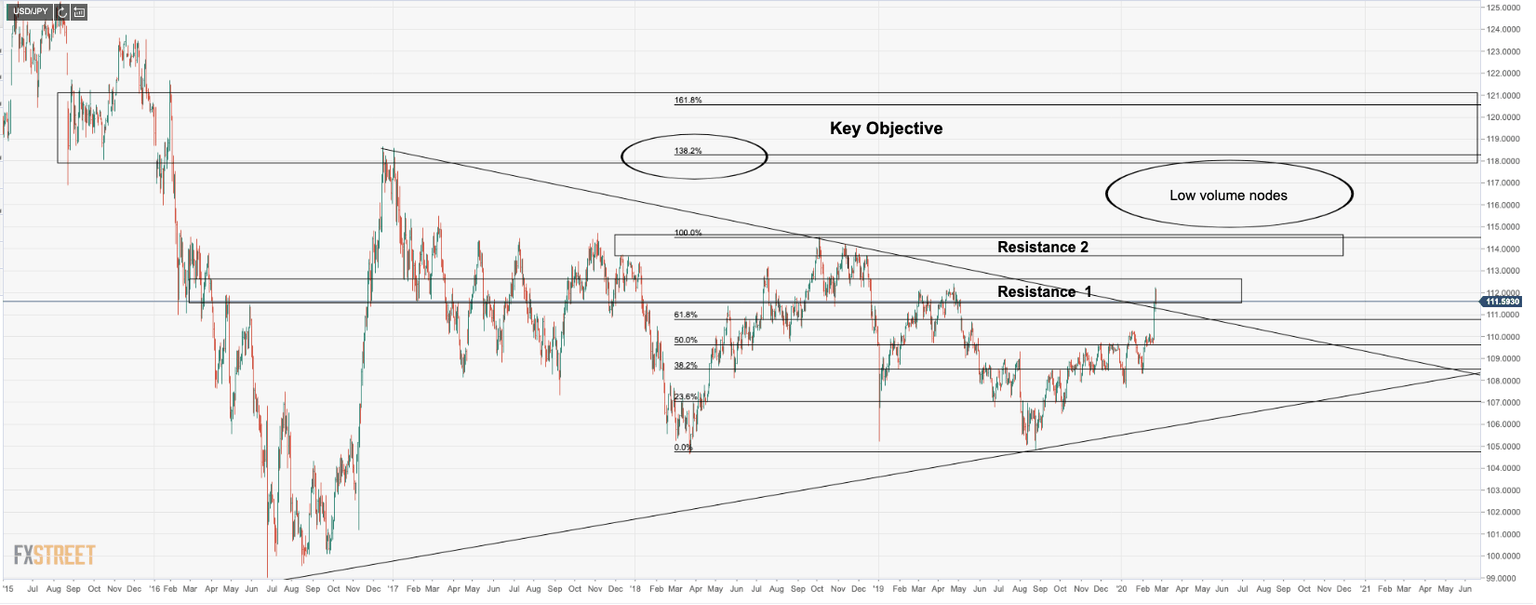

The 61.8% Fibonacci has been priced and the price is now testing the ST's resistance. Resistance 1 on the chart may lead to a head fake on initial attempts beyond the resistance and then the 112 handle. Resistance 2 will likely hold numerous attempts through the 114.55, 2018 high.

Bulls to target low volume nodes

As far fetched as it may seem, the reality is that the yen correlation to risk-off has been dismantled in recent sessions. Gold has rallied some 6.5% vs the US dollar yet the yen has dropped 3.6% in the same time frame. The coronavirus and economic impact it is seen to have in Asia is the likely reason for an exodus from the yen. On such a foundation, it is more feasible to see USD/JPY rally and should it breach the Resistance 2 on the chart above, according to historic price action, there would appear to be little resistance towards a 138.2% and 116.8% levels, the 'Key Objective' area marked out on the chart above.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.