Chart Of The Week: AUD/USD sold to critical support ahead of RBA

- AUD/USD bears have been relentless and support structures prove fragile.

- Bulls will look for a discount prior to further downside.

The Australian dollar has failed to offer any discounts for bears remaining patient, in anticipation of a pullback since the price continued to fall below prior key support structures.

AUD/USD has dropped almost 5% since the start of the year and has moved to the lowest level since of October 2019, a critical support structure which could be make or break of the pair for weeks ahead. The prior supports have not held up and there have been no long set-ups signalled on the four-hour charts while bears have been in control all the way, bar the occasional correction on glimmers of hope from Australian data ahead of the Reserve Bank of Australia this week.

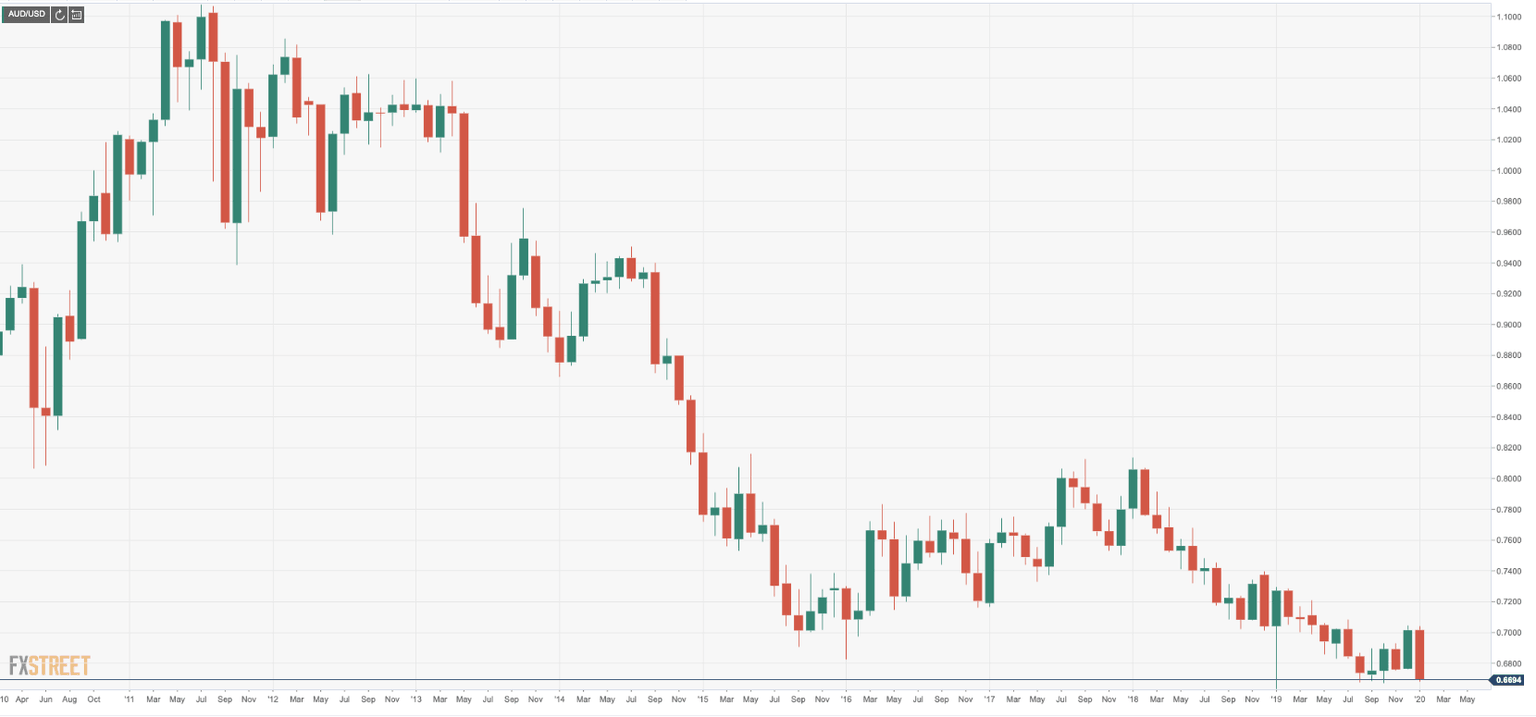

AUD/USD weekly chart

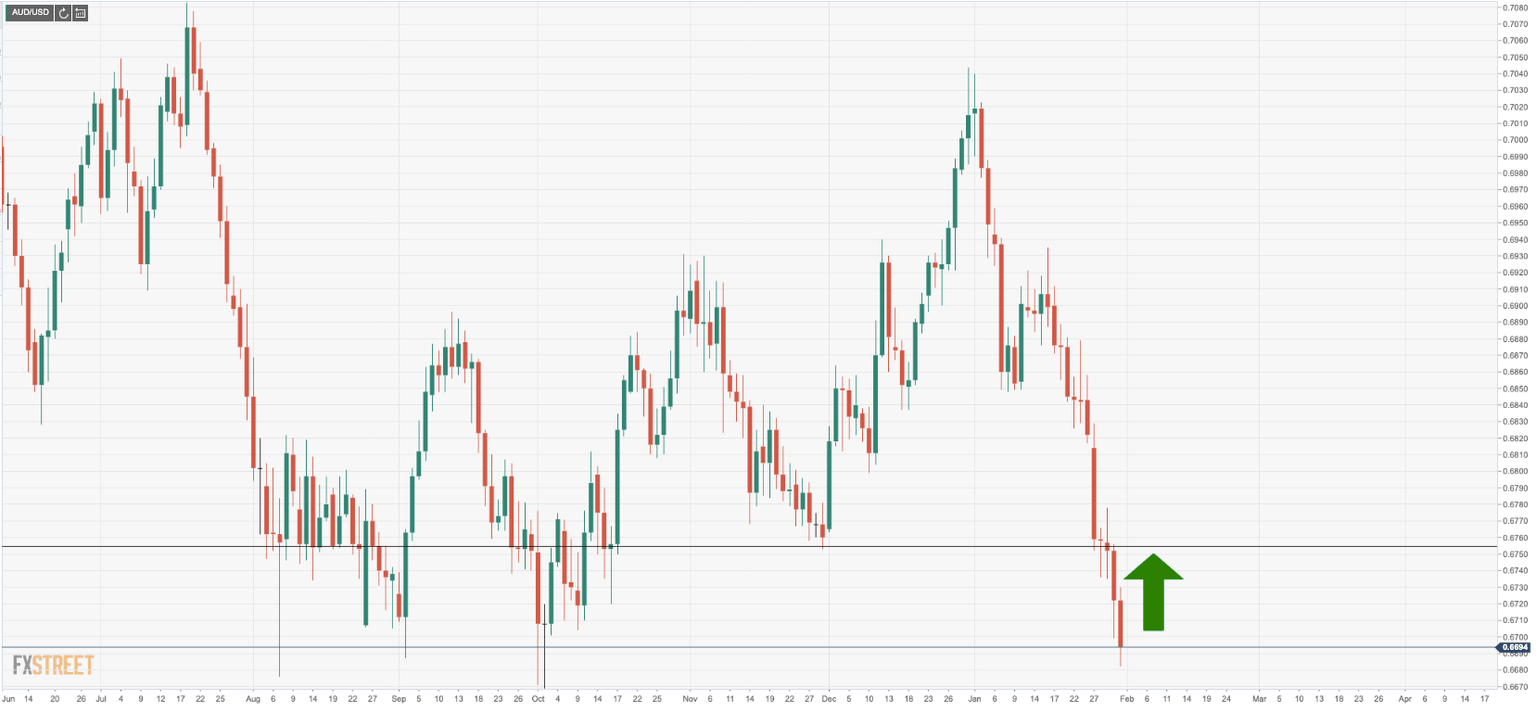

AUD/USD daily chart: Bulls looking for a correction/discount

AUD/USD has been in 12-days of consecutive decline, but that does NOT mean there has to be a sustained correction. It wasn't long ago when the price was in a similar momentum, (-5%) and there was a further 1% to the downside in August 2019. However, a bounce would be expected at this juncture.

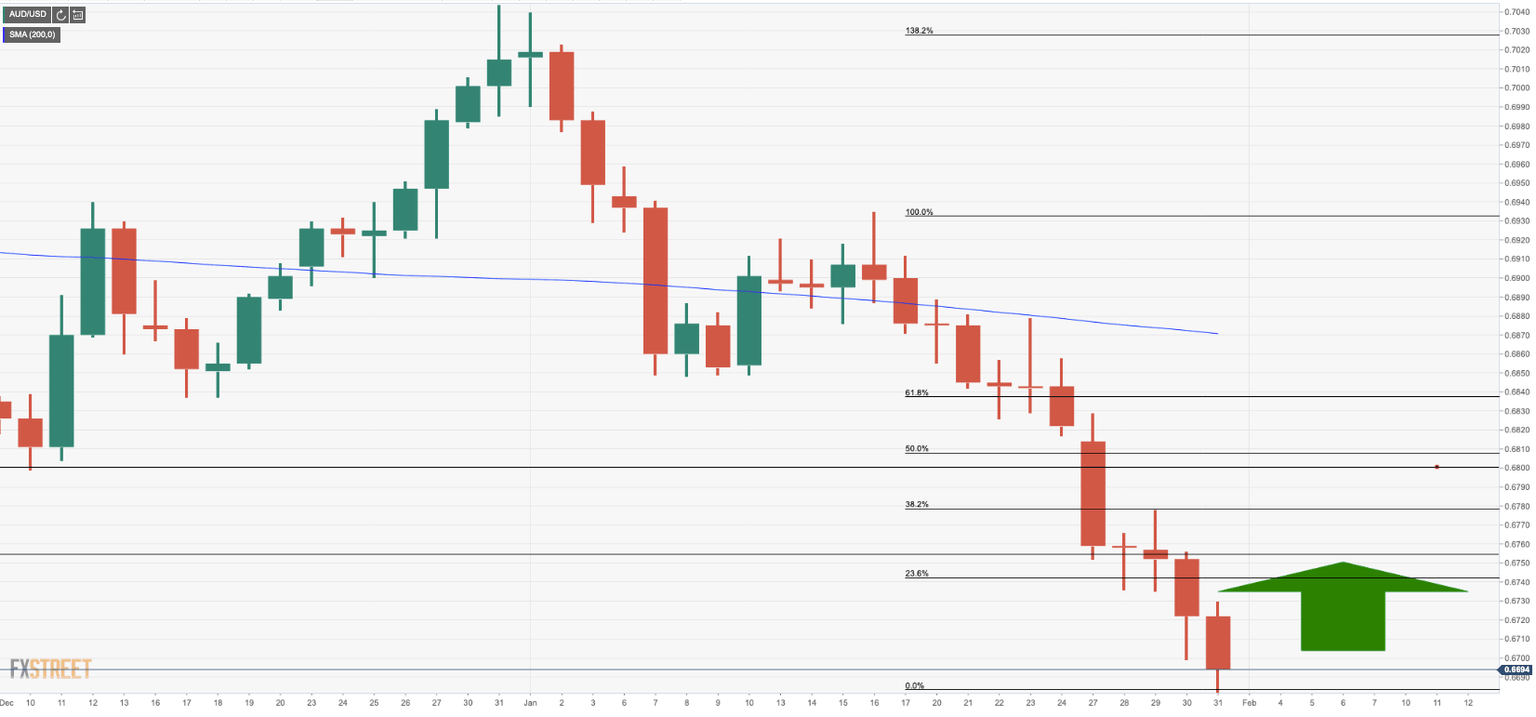

Vicinity of 23.6% Fibo & prior support structure in focus

Meanwhile, should a correction not developt towards prior support structures, the downside below 0.6650 opens risk all the way to the 0.63 handle.

AUD/USD upside targets 0.68 handle

A 50% mean reversion open the 0.68 handle as an upside target. Narrow trading will likely continue until the RBA meeting is out of the way.

RBA preview

RBA Preview: Imminent cut expectations to weigh heavily on AUD

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.