CFTC Positioning Report: Japanese yen returns to the negative side

These are the main takeaways from the CFTC Positioning Report for the week ending October 29:

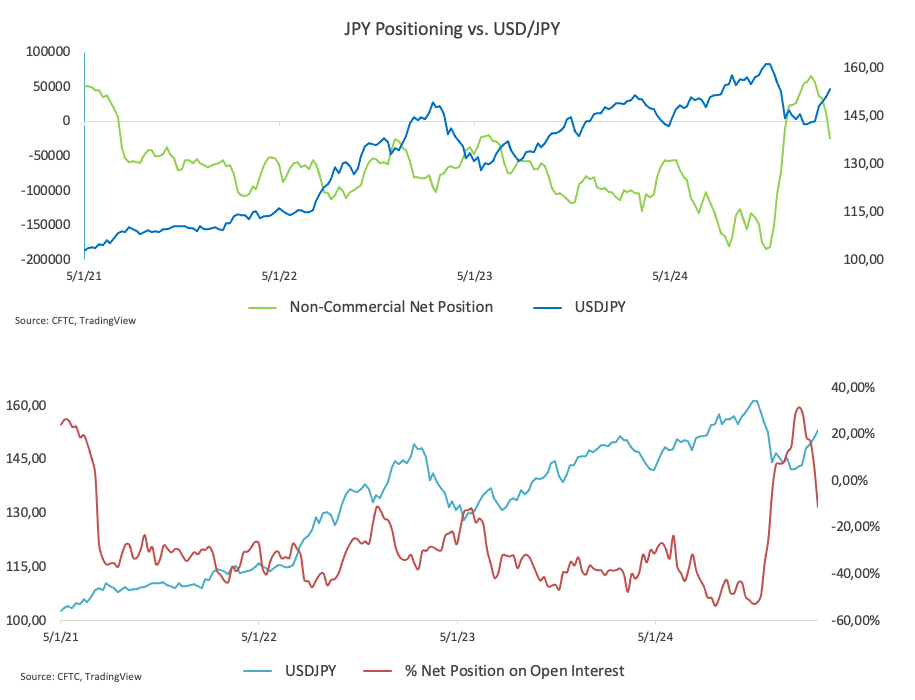

- After eleven weeks, non-commercial players became net sellers of the Japanese yen by nearly 25K contracts. Additionally, commercial traders remained net longs by more than 28K contracts. This scenario was accompanied by the fourth consecutive weekly advance in open interest. Against that, USD/JPY maintained its gradual ascent, reaching fresh highs for the month of October in levels just shy of the 154.00 barrier as investors anticipated the BoJ will keep its interest rate unchanged at the October 31 gathering.

- Speculators remained net sellers of the Euro for the second week in a row, this time increasing their net longs to around 50.3K contracts. Hedge funds, on the other hand, shifted to net buyers for the first time after several consecutive weeks. Open interest rose by around 1.7%, reversing for straight weeks of gains. In that period, EUR/USD kept its choppy performance in place, attempting a move higher after bottoming out around 1.0760 in the previous week. Rising bets for a cautious easing cycle by the Fed vs. prospects for extra rate cuts by the ECB should keep the European currency under pressure in the short-term horizon.

- Speculative net longs in the British pound shrank for the fourth week in a row to around 66.3K contracts as open interest continued to diminish. GBP/USD navigated a bumpy road above the 1.2900 level, always within the broader multi-week bearish trend on the back of the stronger Dollar and some prudence ahead of the publication of the UK Autumn Budget.

- Non-commercial traders remained net buyers of the US Dollar for the second consecutive week, although net longs dropped to around 1.7K contracts. In line with the broad FX world, the US Dollar Index (DXY) kept the choppy trade well in place in the upper end of the range beyond the 104.00 hurdle. The October rally in the Greenback has been underpinned by pre-US election cautiousness, the so-called “Trump trade”, higher US yields, and firm US data from key fundamentals.

- Net longs in Gold retreated to three-week lows around 278.6K contracts. The precious metal remained sidelined during that period, although always with a constructive bias and hitting all-time highs in the proximity of the key $2,800 mark per ounce troy.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.