Australian Employment Preview: Labor market recovery in doldrums

- Australia’s jobless rate likely ticked higher to 7.2% in October.

- Job losses could reinforce RBA negative rate calls.

- Victoria out of tough restrictions but covid risks persist.

Australia’s labor market recovery is seen slowing in October, the latest employment report, due to be published by the Australian Bureau of Statistics (ABS), will show this Thursday.

Despite the no. 2 most populous state of Victoria out of its tough COVID-19 restrictions, the rise in the unemployment rate is likely to continue, just as job losses accelerate.

Job losses, higher jobless rate

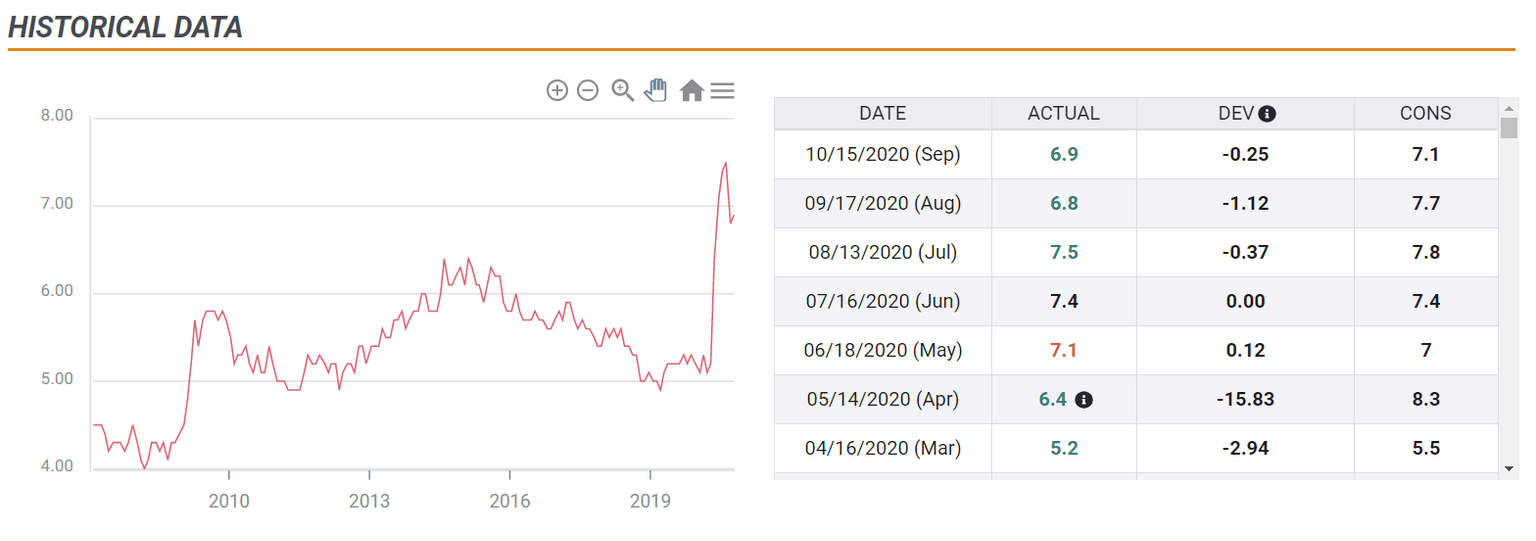

After a modestly upbeat September month employment data, the OZ economy is expected to have lost 30K jobs in October. The Unemployment Rate is foreseen at 7.2% from 6.9% booked in September, the weakest in three months. The Participation Rate is seen a tad lower at 64.7% last month when compared to the previous figure of 64.8%.

Improving signs, not yet

Australia’s economy is on the path of a gradual recovery from the pandemic blow, as consumer spending and confidence surge alongside the advance in the job advertisements and house prices.

However, the recovery is not even, especially looking into the employment sector, as the Australian wages experienced their most sluggish annual growth on record while payroll jobs grew 0.5% nationally over the fortnight to October 31 and by 1% in Victoria.

While the Reserve Bank of Australia’s (RBA) concerns about reaching its employment objective persist, Victoria emerging successfully out of the coronavirus resurgence offers a ray of hope for the optimists for October’s employment report.

The November RBA meeting’s minutes emphasized: ''A significant rise in employment and wages growth would be needed to lift inflation back into the RBA's target bank of 2-3%, a distant prospect, given the bank expected the unemployment rate to climb further toward 8% by the end of this year.''

Although the central bank’s next policy action would depend on how the country fared in containing the coronavirus, with its relative success so far and its impact on the labor market.

Heading into the jobs data release, the state of South Australia has announced a six-day circuit-breaker to contain a fresh outbreak of coronavirus infections last week. Its impact is likely to be reflected in the November numbers.

AUD/USD probable scenarios

A positive surprise to the employment numbers could alleviate the pressure off the RBA to do more, in terms of additional asset purchases, in another effort to stimulate the economic recovery.

Though the central bank has downplayed expectations of negative interest rates, a disappointment in the jobs data could likely steer the RBA in that direction. The RBA Governor Philip Lowe said that the central bank would consider negative interest rates if all major central banks took their rates below zero.

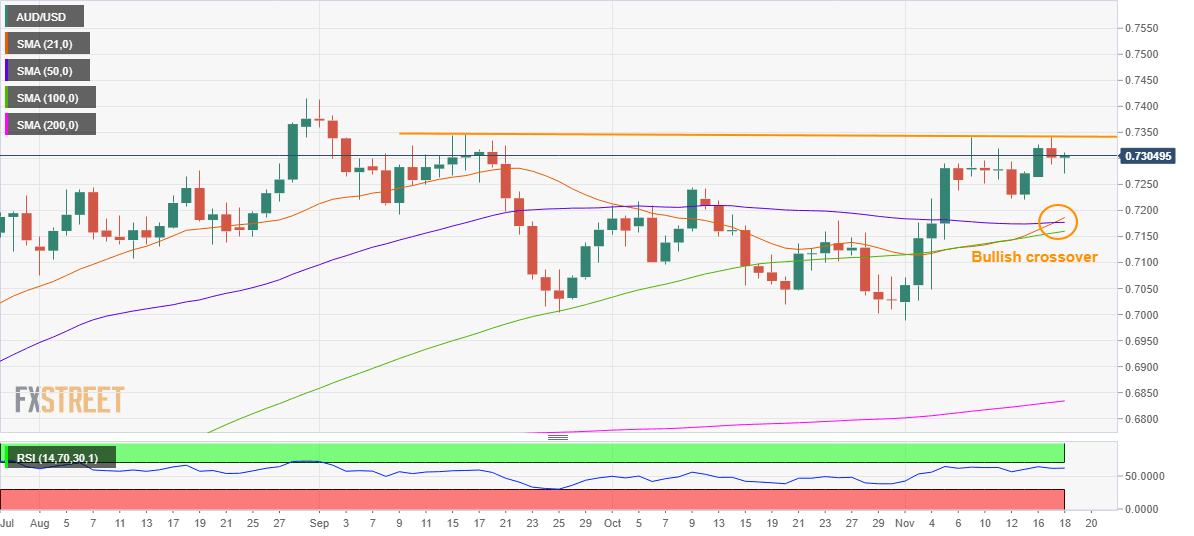

In such a scenario, AUD/USD could drop towards last week’s low of 0.7220, below which the 21-daily moving average (DMA) support at 0.7186 could be put at risk. An upside surprise in the data combined with a favorable risk sentiment could prompt the bulls to takeout the critical horizontal trendline (orange) resistance at 0.7340, opening doors towards 0.7400.

The broader market sentiment, amid rising coronavirus cases and vaccine hopes, could also have an impact on the aussie’s reaction at the time of the data publication. Although, the bullish crossover on the daily chart suggests that the upside appears more compelling in the near-term.

Daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.