Australian Employment Preview: Job creation could pick up, but what about inflation?

- Australia is expected to have created 25,000 new jobs in May.

- The Melbourne Institute will release June Consumer Inflation Expectations.

- AUD/USD is technically bearish as long as it develops below the 0.7000 threshold.

Australia will publish its May employment data on Thursday, June 16. The country is expected to have added 25K new job positions after adding a measly 4K in April. At the same time, the Unemployment Rate is expected to decline from the current 3.9% to 3.8%, while the Participation Rate is seen ticking higher to 66.4%.

The report will come after the US Federal Reserve monetary policy announcement, which may come out with a more aggressive quantitative tightening, given that inflation keeps rising to multi-decade highs. The central bank will also release Economic Projections, most likely including growth and inflation reviews. Whatever the Fed announces, it would like to have a significant impact on financial markets and hence, AUD/USD.

As usual, there not be updates on wages, as the country releases the Wage Price Index on a quarterly basis. The Q1 figure showed a modest 0.7% QoQ advance, while the annualized pace surged to 2.4%, still below the desired 3%.

The Melbourne Institute will release June Consumer Inflation Expectations ahead of the aforementioned data, previously at 5%.

A scenario of solid job creation alongside expectations for rising inflation would surely be a boost for the aussie, moreover after the dust settles post-Fed. However, if employment figures disappoint and inflation pressures ease, the aussie could suffer a major setback.

AUD/USD possible scenarios

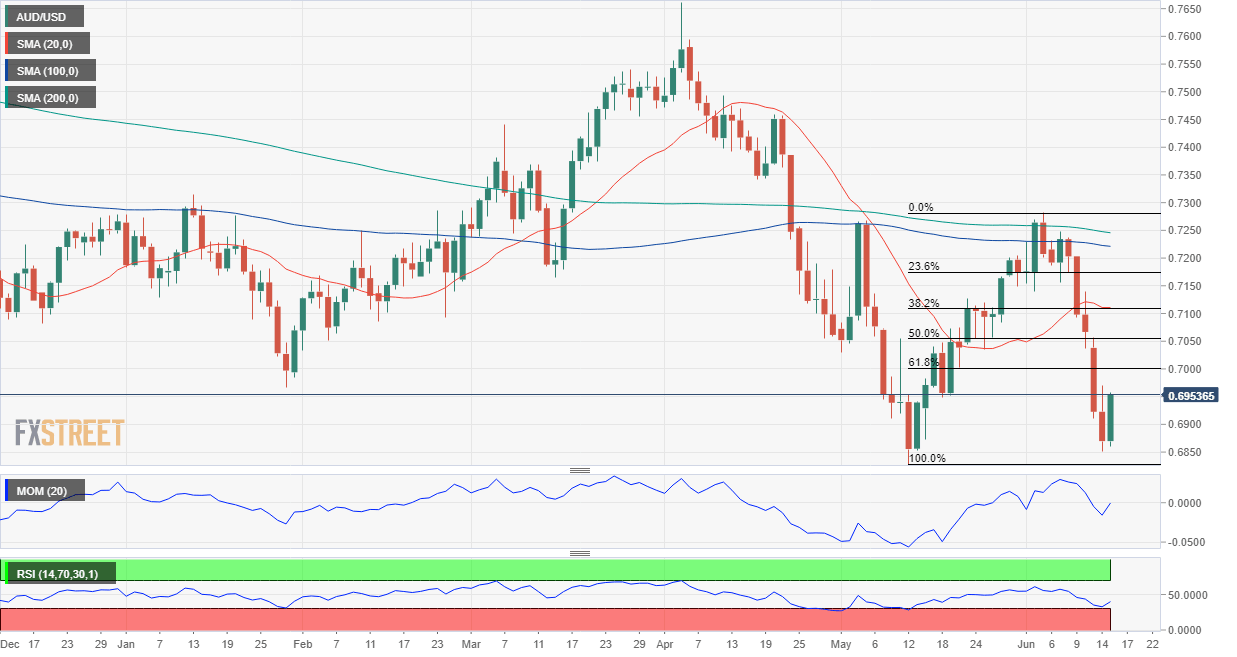

Technically speaking, the daily chart for the AUD/USD pair shows that the risk remains skewed to the downside. The pair is still developing below the 61.8% retracement of its latest daily advance measured between 0.6828 and 0.7282 at 0.7000.

Technical indicators in the mentioned time frame have bounced from near oversold readings but remain well into negative levels, failing to hint at a bullish continuation. The 20 SMA, in the meantime, is flat at around 0.7106.

Beyond 0.7000, the recovery could extend towards the 0.7060 price zone, ahead of the critical Fibonacci level at 0.7106. On the other hand, a slide below 0.6900 should open the door for a slump towards the year low at 0.6828 and even lower, depending on the market’s reaction to the Fed’s decision.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.