What the Fed says matters more than it does today

96.5% of the market is positioned in expectation of a 25bps interest rate cut from the Federal Reserve decision today, with the market being over 90% confident since the 1st of this month. That leaves very little room for volatility owing to the decision itself, but as has been the case for much of this year, the market is more focused on what the Fed says rather than what it does.

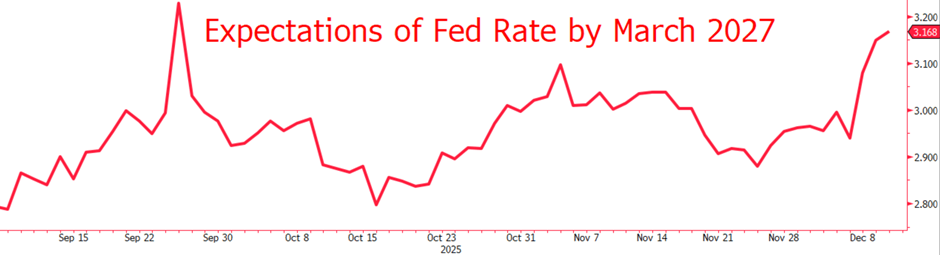

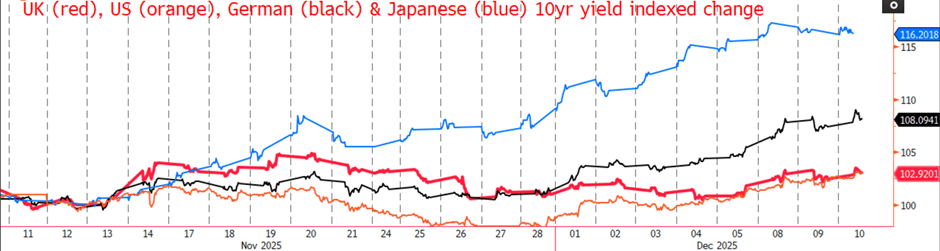

Estimates of the Fed rate in the medium term have been jostling around for much of December, mostly built on anxiety of fewer cuts expected next year and beyond. As a result, the 10yr Treasury yield has risen to its highest since September, in a year where Treasury Scott Bessent said lowering the 10yr yield was a key objective.

Yet, despite this the Dollar remains under pressure, with EURUSD lingering just below its best rate since October and the broader Dollar index pretty muted.

This is likely because the upwards move in US yields is being crowded out by similar shifts globally, with the several major central banks now expected to raise rates in 2026.

More convincingly I suspect that these are mostly end of year jitters, Powell will likely come out strong with a hawkish statement, especially following the recent strong showing in the September jobs report. But Powell is a man on the clock, by the 5th Fed meeting next year he will have been replaced.

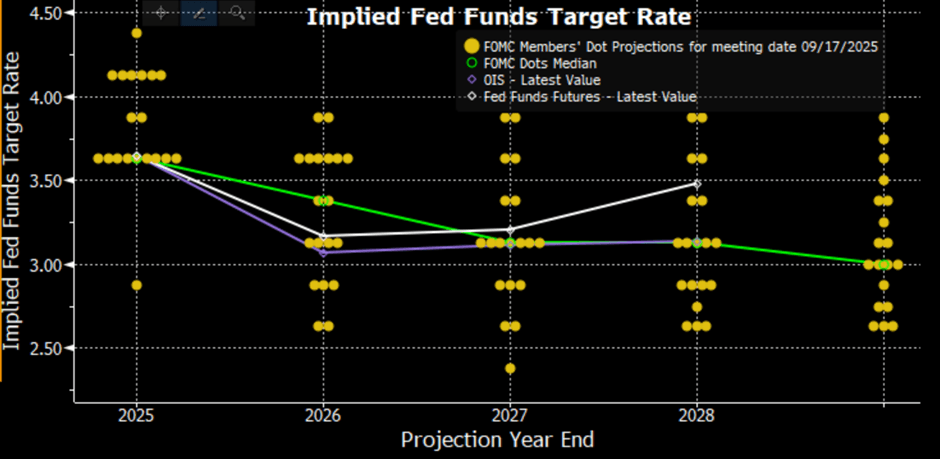

He also is providing over the most split board of Governors for decades and another clear split in the votes seems likely with today’s dot plot projections. Most suggest that there will be a more clearly dovish split in this set of dots,

Indeed, such a move would likely soften USD further, even if it would only suggest 1 more rate cut that initially expected. Regardless, I suspect that the anxiety over high rates next year will only fully fade once the new year commences and Trump names Powell’s successor.

Author

David Stritch

Caxton

Working as an FX Analyst at London-based payments provider Caxton since 2022, David has deftly guided clients through the immediate post-Liz Truss volatility, the 2020 and 2024 US elections and innumerable other crises and events.