AUD/USD Weekly forecast: Lockdowns cause job losses, who knew?

- August Employment Change -146,300, worst since May 2020.

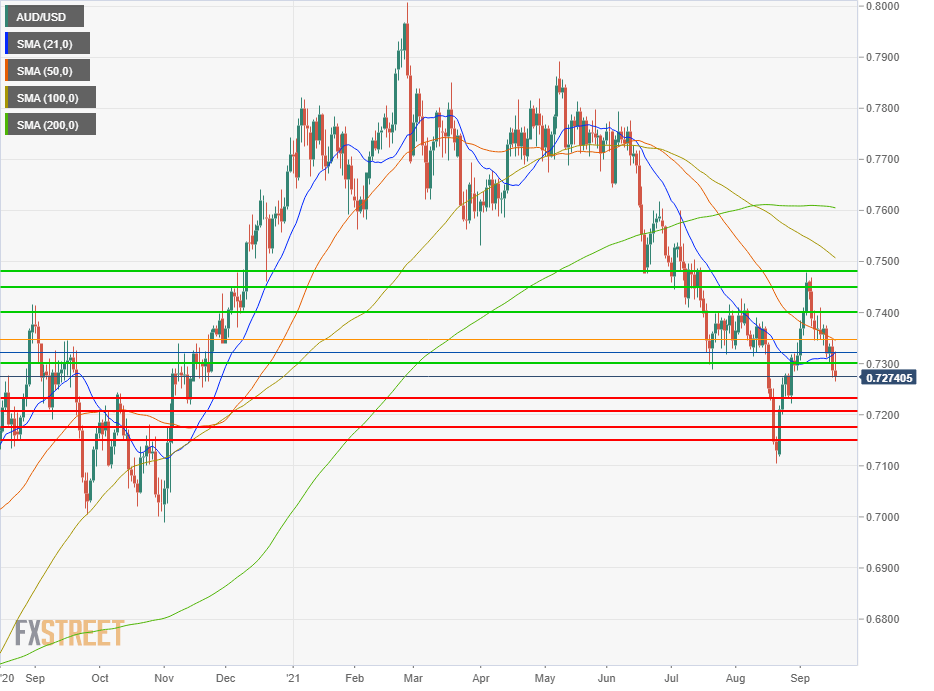

- AUD/USD drops below 0.7300 for the first time in three weeks.

- FXStreet Forecast Poll predicts a rebound from support.

The draconian Australian approach to the Delta variant collapsed the down-under job market in August with the largest loss of employment since May 2020. This data release on Thursday pushed the AUD/USD below 0.7300 for the first time since August 31. But Tuesday’s breach of support at 0.7335 had prepared the market for further losses.

The AUD/USD has been falling for all of September. Markets understand that the extreme measures taken to combat a few relatively minor outbreaks will necessarily damage the economy. There are 18 months of unequivocal global precedent.

Difficulties in the Chinese economy with August’s Retail Sales and Industrial Production falling short of expectations, and Delta closures and restrictions reported in several places, added to the gloom for the aussie. Beijing’s crackdown on the profits of many domestic companies and the potential default of property developer Evergrande multiplied the risks for China, and by extension, her largest resource supplier, Australia.

The AUD/USD is highly sensitive to the global risk environment and the uncertainty in China, the world’s second largest economy, plays to the US dollar’s safety status.

Economic data in the US was mixed for Fed policy. Consumer inflation was slightly lower but Retail Sales in August were much stronger than forecast.

The Federal Reserve’s possible taper announcement at its Wednesday meeting, reinforces the notion that US rates are headed higher, even if the timing remains undecided.

AUD/USD outlook

The AUD/USD has penetrated to the base of its 2021 range and the brief late-August drop to near 0.7100 is the likely next target. The 21-day and 200-day moving averages (MA) were both crossed this week and the support lines from the August decline are weak. But the technical aspects of the AUD/USD will take a back seat until the Fed decision is known.

The odds for a taper schedule announcement are about even and markets are likely to remain quiet until the Fed meeting.

Australian data is limited with the Commonwealth Bank's Purchasing Managers Indexes for September the only releases of note. They will have no market impact.

If the Fed begins its withdrawal of monetary support or establishes a timetable for the reduction the US dollar will gain versus the aussie. Combined with the likely further negative economic impact of Canberra’s covid policies, the bias for the AUD/USD is clearly lower.

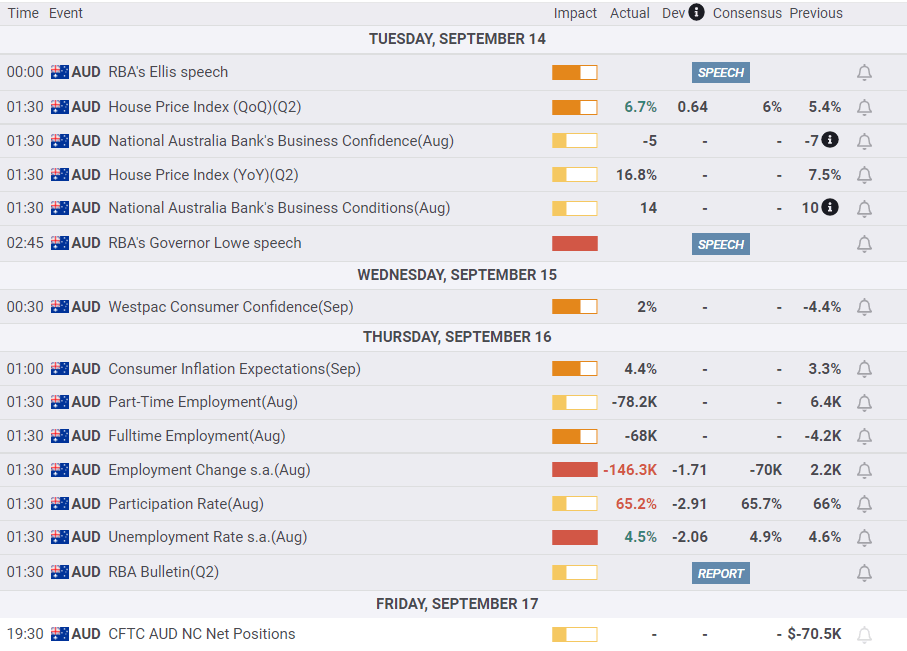

Australia statistics September 13–September 17

US statistics September 13–September 17

Australia statistics September 20–September 24

FXStreet

US statistics September 20–September 24

AUD/USD technical outlook

The break of 0.7300 brought the MACD (Moving Average Convergence Divergence) and the Relative Strength Index (RSI) into weak sales positions but the way had been prepared by the Tuesday crossing of 0.7335 support. True Range moved down from Thursday's peak but is still above all other readings since September 8.

The 50-day moving average (MA) at 0.7345 was crossed on Tuesday and marked the top for Thursday's trading. The 21-day MA at 0.7322 was crossed on Thursday and marked Friday's high. The successive crossing of these two moving averages followed by their translation into resistance is a strong negative indicator.

The resistance/support structure favors a decline in the AUD/USD. Support lines are weak. The most recent are the product of two weeks of trading in late August or date back to the second half of 2020. Resistance lines are better documented and cover trading for a considerably longer period.

Resistance: 0.7300, 0.7322 (21-MA), 0.7345 (50-MA), 0.7400, 0.7450, 0.7480

Support: 0.7235, 0.7210, 0.7175, 0.7150

FXStreet Forecast Poll

The FXStreet Forecast Poll favors the technical rebound from support. It discounts the fundamental factors in the Australian economy and in the United States.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.