AUD/USD Weekly Forecast: Dependent on the kindness of strangers

- US CPI scores a major strike on the AUD/USD.

- Aussie falls more than a big figure on the US inflation report.

- Commodity prices continue to underpin Australian dollar strength.

- Chinese pressure in trade negotiations is a long-term concern.

- The FXStreet Forecast poll expects a nearly stationary AUD/USD.

Currency markets are prepared to believe that the US economy is going to accelerate and that consumer inflation is more than a transitory phenomenon.

When evidence arrives the dollar rises across the board.

Wednesday’s US April Consumer Price Index print at 4.2%, up from 2.6% in March, dropped the AUD/USD more than a figure to just above the 0.7700 support line. The US inflation report had a similar impact in all the major currency pairs except the USD/CAD.

April’s US Retail Sales numbers on Friday were weaker than expected and that reversed about half of the aussie’s Wednesday loss. Monday and Tuesday’s trading was in the upper part of the January to May range but the Wednesday decline brought the AUD/USD back to midpoint.

Annual US consumer inflation has tripled in four months from January’s 1.4%. Further price increases are expected as wage pressures combine with goods shortages and strong consumer demand. The forward-looking Producer Price Index for April was much stronger than suspected at 6.2%, and will keep the focus on price changes.

The Federal Reserve’s assertion that this inflation is a transitory phenomenon has not prevented US interest rates from advancing markedly this year and that has been the dollar’s main support.

CNBC

The Australian dollar has fared much better against the greenback than other currencies because commodity prices have been on a tear in anticipation of a global economic recovery. The Bloomberg Commodity Index (BCOM) has climbed 18% year-to-date, 10% since April 2 and is near its seven-year high.

Australia’s resource assets are closely tied to the Chinese economy and trade negotiations with Beijing have been acrimonious. The dispute is likely to be settled to the mainland’s advantage. Still, global demand should help to mitigate any concessions to China and keep the aussie buoyant.

There were no statistics of note in Australia this week.

AUD/USD outlook

Commodity prices and the prospective global expansion, evident only in the US and China so far, will keep the floor under the aussie intact.

Technical support is strong at 0.7700 and 0.7600 and it would take a rise in US rates to near or above 2% in the 10-year Treasury yield to overcome the commodity advantage.

Nonetheless, US CPI underlined the potential vulnerability of the Australian dollar to a substantial rise in US interest rates.

It should be noted that Treasury yields should not be confused with overt Federal Reserve policy. The governors may be perfectly willing to let the yield curve steepen through rate increases in the longer end of the Treasury market as a hedge against inflation.

In the week ahead, Wednesday’s April Australian employment report looks to document modest improvement to an economy that has already recovered all of the jobs lost in the April and May lockdowns. It should not have a major impact on the currency.

The AUD/USD outlook remains positive but restricted. Support is substantial but until the global economy improves in fact and not just in prospect commodity prices are capped.

The US economic situation is somewhat of a wild-card. There can be no certainty on inflation for several months and every uptick plays to the greenback's advantage.

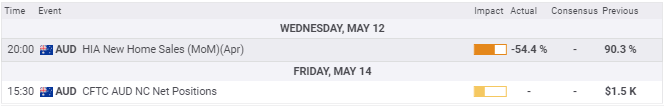

Australia statistics May 10–May 14

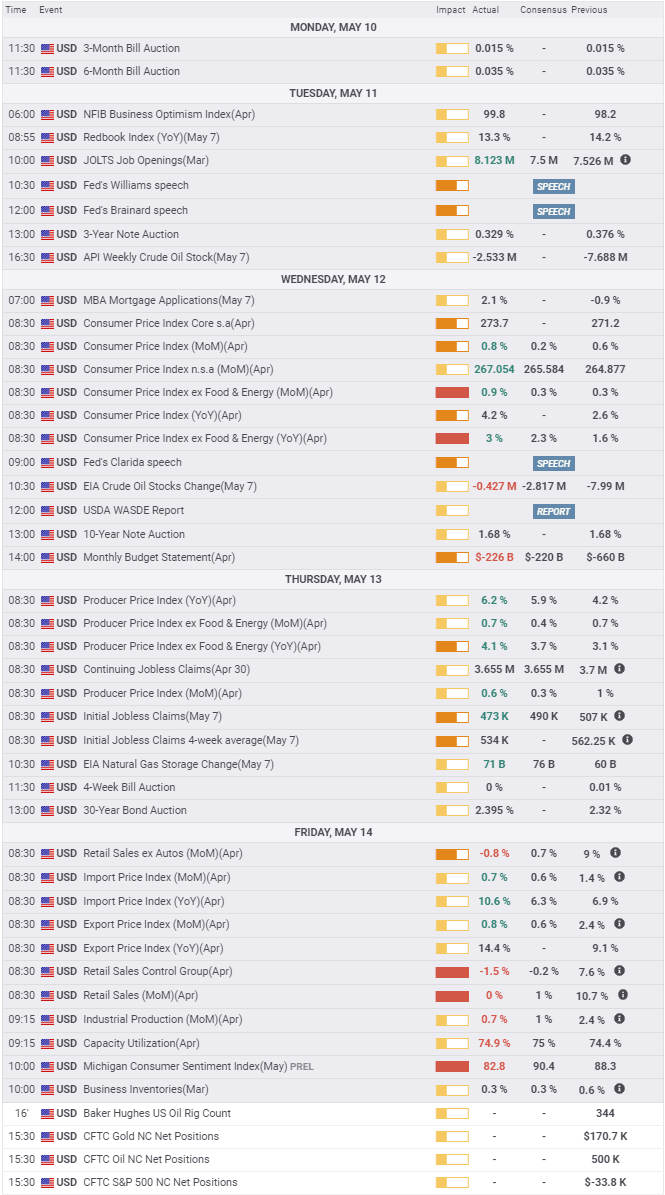

US statistics May 10–May 14

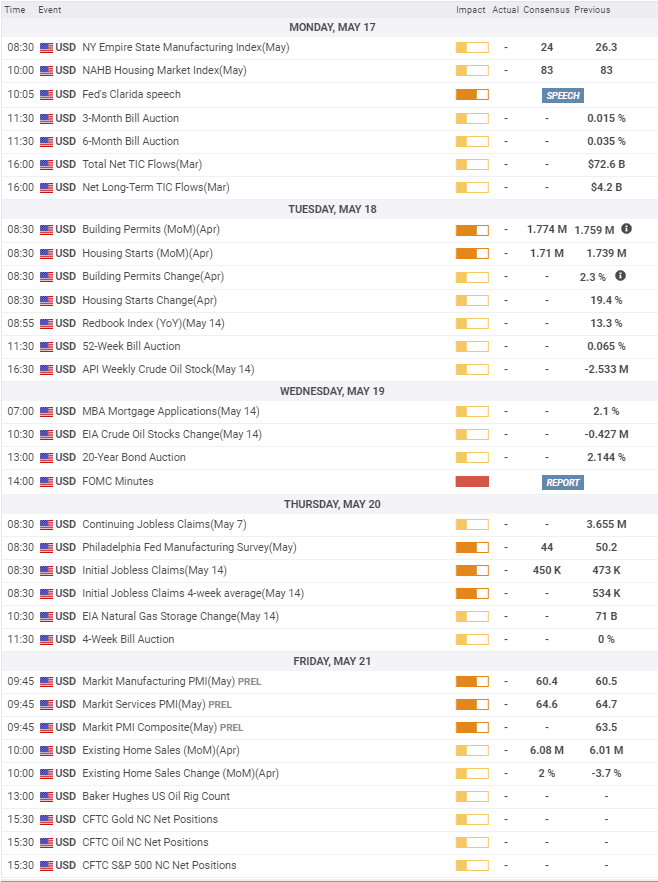

Australia statistics May 17–May 21

Wednesday's labor statistics, even if much better than the forecast will not provide much support to the aussie. Australian dollar fortunes depend on developments in China and the United States.

FXStreet

US statistics May 17–May 21

The US housing market with information on building permits and starts on Tuesday and Existing Home Sales on Friday, should continue red-hot.The scarcity of new homes, especially of lower-cost inventory is a major component of asset price inflation.

AUD/USD technical outlook

The AUD/USD has been penned in a limited 0.7600 to 0.7800 range since January. That is not likely to change this week. Support is strong at the big figures of 0.7700 and 0.7600. If resistance above 0.7800 is ill-defined due to the brief visits this year, it is because the current fundamentals do not support an appreciably stronger aussie. The global economy will have to evince a much more active recovery for the commodity based aussie dollar to rise back to its range above 0.8000 from the first half of the last decade.

The Relative Strength Index (RSI) is a buy signal at 53.55. The most interesting aspect of a limited technical picture is close proximity of the 21-day moving average (MA) at 0.7762 and the 100-day MA at 0.7723, both assisting the strong support between 0.7760 and 0.7700. The 200-day MA at 0.7495 is approaching market relevance.

FXStreet Forecast Poll

The predicted ranges in the FXStreet Forecast Poll are bearish in name only. They anticipate no change in the AUD/USD.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.

%2520tech%25202-637566153056223747.png&w=1536&q=95)

%2520tech-637566152920433339.png&w=1536&q=95)