AUD/USD Weekly Forecast: Bulls take control, 0.8000 at sight

- Optimism resurged at the end of the week as investors assess more potential stimulus.

- RBA´s Assistant Governor Christoper Kent provided an unexpected boost to the aussie.

- AUD/USD trades at its highest in almost three years and could continue rallying.

The AUD/USD pair soared to a fresh almost three-year high of 0.7866 this Friday, holding on to gains as the week ends. The Australian dollar has spent most of the week ranging, accelerating north once stops got triggered above the former year’s high at 0.7819. The move comes as investors get rid of the greenback to move into riskier assets.

Across the FX board, the action was dull for most of the week, with major pairs holding within familiar levels as investors struggled to assess a mixed macroeconomic calendar and the absence of progress in fundamental developments. The slow start to the week was exacerbated by a long holiday in China, which restrained activity during Asian trading hours.

Hopes for a US $1,9 trillion stimulus package played against the greenback, mainly after the Federal Reserve noted slowing economic and employment growth in the last few months while pledging to maintain QE as long as the pandemic continues to hit the economy. Wall Street traded dully throughout the week, but US indexes stand near all-time highs.

Meanwhile, the AUD got an unexpected boost from RBA´s Assistant Governor Christoper Kent, who said that the latest central bank actions put downward pressure on the aussie, which is 5% lower than otherwise in trade-weighted terms. “There has been a general improvement in the outlook for global growth, which has been associated with an appreciation of a range of currencies against the US dollar and a marked increase in many commodity prices,” Kent added.

Australian economy bode well with the pandemic

Data wise, Australian figures were mixed. The country published January employment figures, which showed that the country added 29.1K new jobs in the month, below the 40K expected. The unemployment rate contracted to 6.4%, although the Participation Rate retreated from 66.2% to 66.1%. When compared to other countries, however, it is clear that the Australian labor market continues to bode well in the current context. The Commonwealth PMIs showed that business activity remained in expansion territory in February, according to preliminary estimates. On a down note, Retail Sales in the country rose a modest 0.6% in January vs the 2% expected.

US January Retail Sales surprised to the upside, rising by 5.3% in January, much better than anticipated. The number, however, is tricky as it reflects the latest stimulus checks distributed in December. On the other hand, employment-related figures disappointed, in line with the Fed’s view that the sector is under-performing.

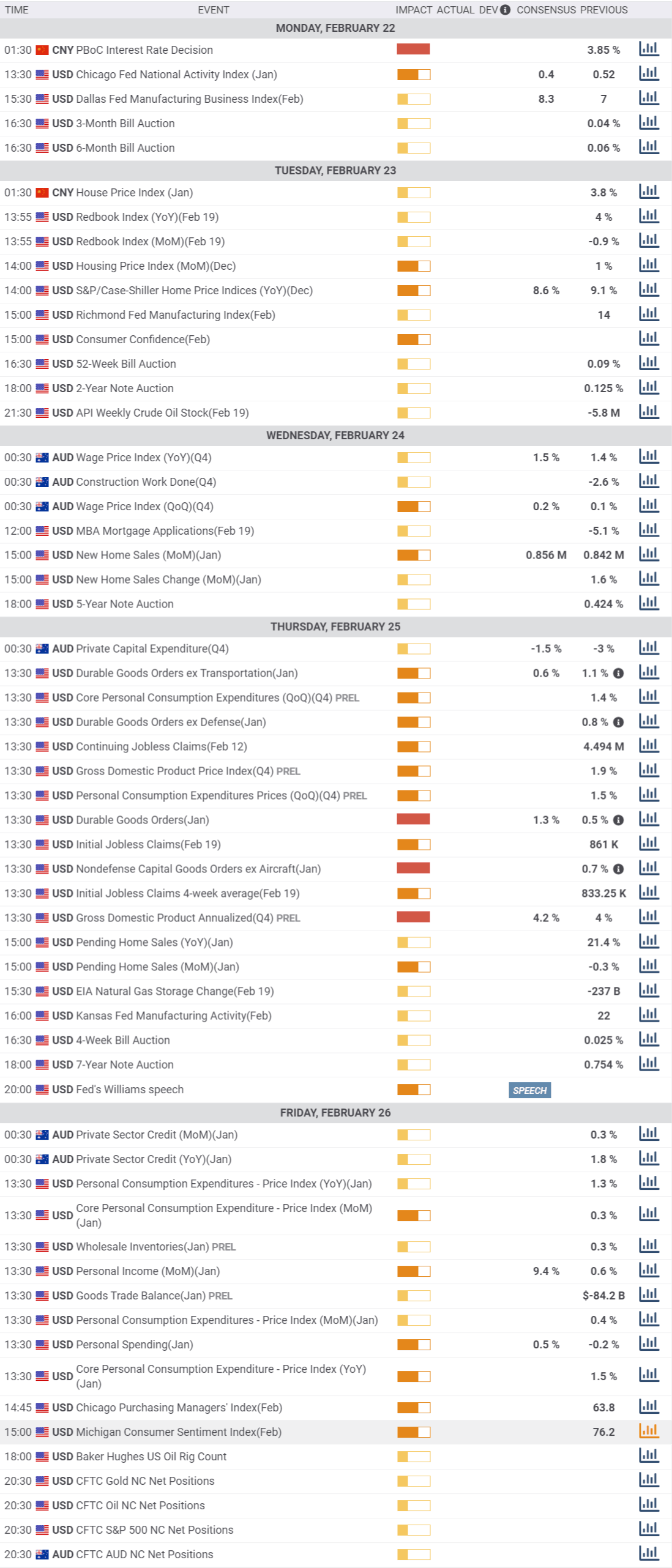

The Australian macroeconomic calendar has little to offer next week, as it will only publish one relevant piece of data, the Q4 Wage Price Index, expected to have ticked higher from Q3 but to remain well below average. The US will release January Durable Goods Orders and the second estimate of Q3 GDP.

AUD/USD technical outlook

The AUD/USD pair has advanced for a third consecutive week and is poised to keep rallying. In the weekly chart, the pair keeps developing above its main moving averages, with the 20 SMA accelerating north above the longer ones. The Momentum indicator turned higher within familiar levels, while the RSI indicator maintains its bullish slope above 70. The daily chart suggests that bulls are in control, as technical indicators head higher almost vertically within positive levels, and the price finally moves away from a flat 20 SMA.

Should the pair manage to advance beyond the mentioned high, the next resistance level is 0.7915, March 2018 monthly high. Above it, AUD/USD has a clear path towards the 0.8000 threshold. Bulls will likely retain control as long as the pair holds above 0.7770, yet once below this last, 0.7700 comes as the next possible bearish target.

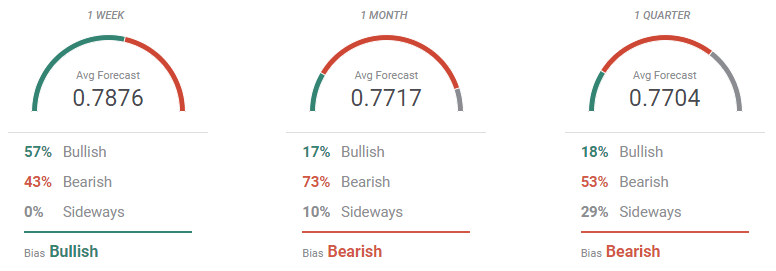

AUD/USD sentiment poll

The FXStreet Forecast Poll shows that the ongoing advance is meant to continue next week, with 57% of the polled experts going long. The average near-term target is 0.7876. Bears are a majority in the monthly and quarterly perspectives, but the pair is seen holding above the 0.7700 threshold.

In the Overview chart, moving averages maintain their bullish slopes, pointing to sustained advance for the next few weeks. When it comes to possible targets, the lower end is being limited by the 0.7400 level, while the upper end continues increasing as the number of those betting for levels above 0.80 continued to increase.

Related Forecasts:

EUR/USD Weekly Forecast: Bulls gearing up for another run towards 1.2350

GBP/USD Weekly Forecast: At critical crossroads, next moves hinge on Boris' reopening, Biden's boost

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.