AUD/USD rockets as RBA resumes rate hikes

- AUD/USD surges as RBA shifts back to rate hikes.

- Bullish bias intact, break above 0.7070 needed for extension higher.

AUD/USD surged to an intraday high of 0.7043, reversing recent losses after the Reserve Bank of Australia (RBA) raised interest rates to 3.85% as expected, becoming the first major central bank to shift from cuts to hikes since the pandemic. While Governor Bullock struck a cautious tone, markets continue to price in at least one additional hike by year-end amid persistent inflation signals.

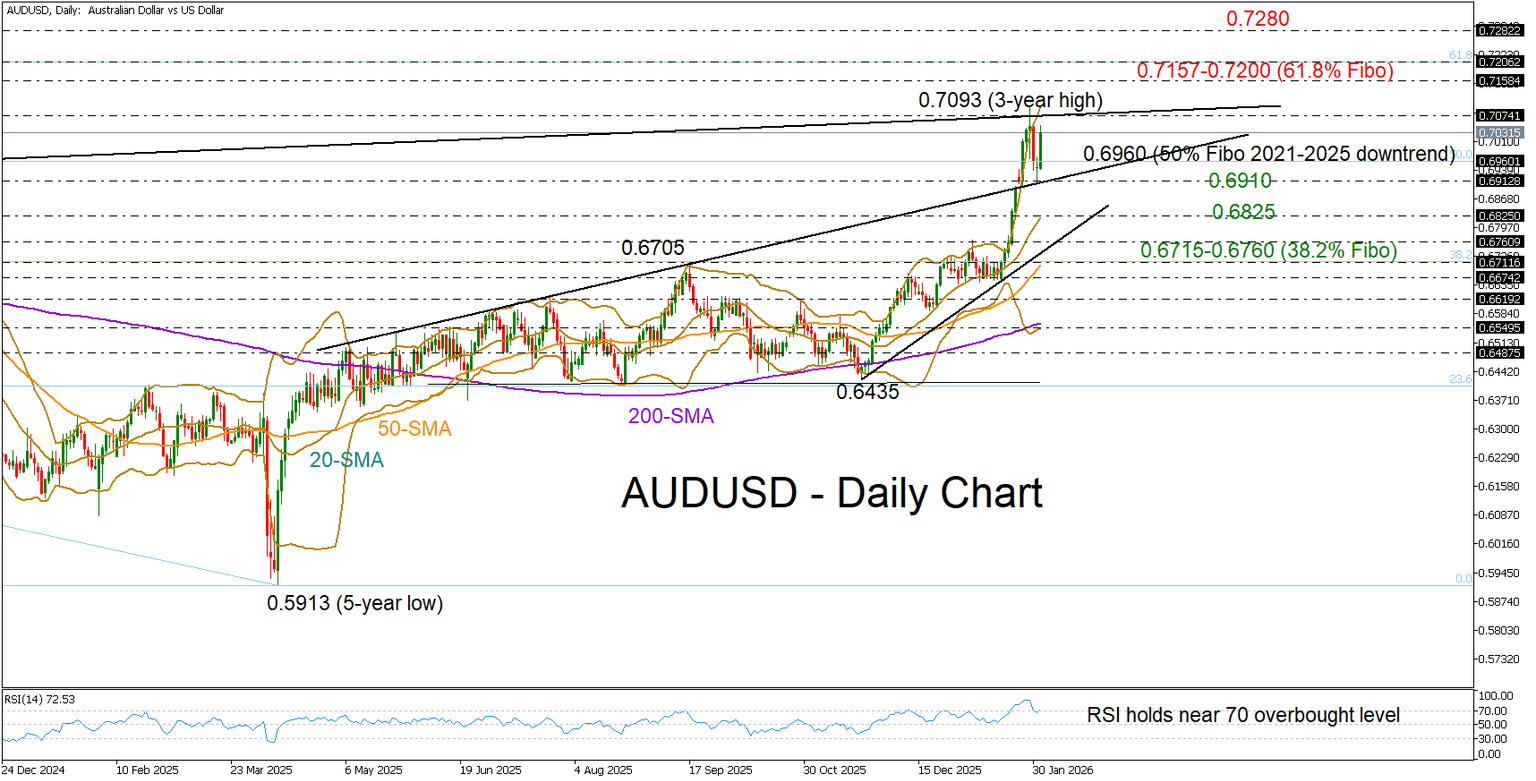

From a technical perspective, the rebound emerged near the 50% Fibonacci retracement of the 2021–2025 downtrend, reinforcing the bullish structure in place since late November. Momentum remains positive, though overbought RSI readings and expanded Bollinger Bands suggest near-term consolidation risks.

A daily close above the 0.7050–0.7070 resistance zone may confirm upside continuation towards 0.7158 and the 61.8% Fibonacci level near 0.7200. Further gains could target 0.7270.

On the downside, initial support lies at 0.6960–0.6915. A break lower may expose the 20-day SMA near 0.6835, with deeper losses potentially stabilizing around 0.6700.

Overall, AUDUSD remains biased to the upside, but a clear break above 0.7070 is needed to unlock fresh buying interest.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.