Market outlook: Dollar, Metals, FX, stocks and crypto key levels [Video]

![Market outlook: Dollar, Metals, FX, stocks and crypto key levels [Video]](https://editorial.fxsstatic.com/images/i/dollar-index-01_XtraLarge.jpg)

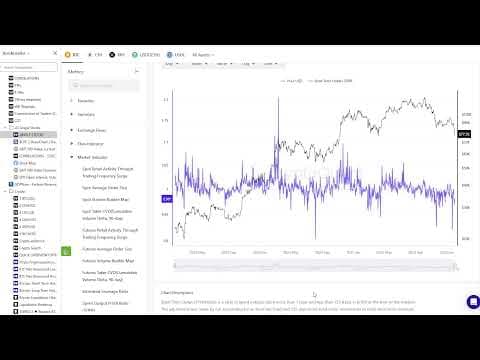

In this video, I walk through the recent surge in market volatility, with a strong focus on metals and the risk that this instability could spread into stocks and the US dollar. I explain my broader dollar index outlook, highlighting extreme positioning, Elliott wave scenarios, and why stabilization or a reversal should not come as a surprise. I cover key FX pairs, including EUR/USD, GBP/USD, USD/JPY, AUD/USD, and NZD/USD, pointing out where trends may be mature and where I prefer to stay patient.

I also discuss why commodity currencies continue to look relatively stronger compared to the euro and pound. On equities, I review the S&P 500 structure, warning about late-stage patterns and the risk of reversals if the dollar starts to strengthen. I spend time on metals, explaining the recent sharp selloffs, liquidations, and why consolidation or short-term rebounds are more likely than a straight continuation higher.

I then move into crypto, covering Bitcoin, Ethereum, and Ripple, outlining key support zones and why the broader correction may not be finished yet. I also touch on MicroStrategy, recent Bitcoin purchases, and upcoming earnings that could drive volatility.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.